Is Estée Lauder Companies (NYSE:EL) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies The Estée Lauder Companies Inc. (NYSE:EL) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Estée Lauder Companies

What Is Estée Lauder Companies's Debt?

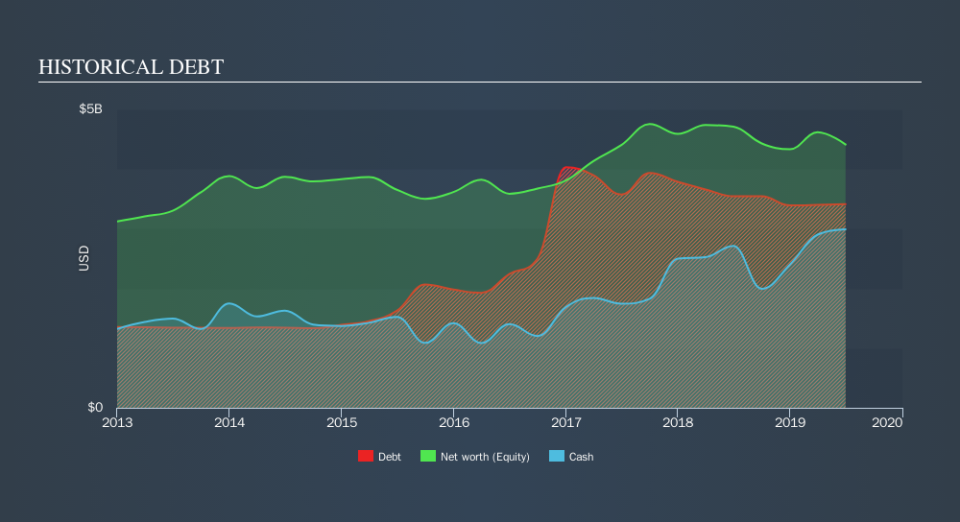

The chart below, which you can click on for greater detail, shows that Estée Lauder Companies had US$3.41b in debt in June 2019; about the same as the year before. However, it does have US$2.99b in cash offsetting this, leading to net debt of about US$422.0m.

A Look At Estée Lauder Companies's Liabilities

Zooming in on the latest balance sheet data, we can see that Estée Lauder Companies had liabilities of US$4.61b due within 12 months and liabilities of US$4.14b due beyond that. On the other hand, it had cash of US$2.99b and US$1.83b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.92b.

Since publicly traded Estée Lauder Companies shares are worth a very impressive total of US$70.0b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, Estée Lauder Companies has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Estée Lauder Companies's net debt is only 0.13 times its EBITDA. And its EBIT easily covers its interest expense, being 34.7 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also good is that Estée Lauder Companies grew its EBIT at 15% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Estée Lauder Companies's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Estée Lauder Companies produced sturdy free cash flow equating to 74% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

The good news is that Estée Lauder Companies's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its net debt to EBITDA is also very heartening. Overall, we don't think Estée Lauder Companies is taking any bad risks, as its debt load seems modest. So we're not worried about the use of a little leverage on the balance sheet. We'd be very excited to see if Estée Lauder Companies insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.