The Estee Lauder Companies (EL) Down Despite Q2 Earnings Beat

The Estee Lauder Companies Inc. EL reported second-quarter fiscal 2023 results, with the top and bottom line surpassing the respective Zacks Consensus Estimate. However, the metrics declined year over year. Shares of the company fell almost 4% during the pre-market session.

COVID-19 continued affecting the company’s operating environment throughout the first half of fiscal 2023, which included curbs in China that weighed on travel retail in Hainan and retail traffic in mainland China. Results were affected by increased inflation, concerns surrounding the recession and unfavorable currency rates.

Management is lowering its fiscal 2023 outlook, thanks to disruption to travel and staffing levels in Hainan during November and December and the recently-unveiled potential roll-back of COVID-associated supportive measures across Korea duty-free. Such factors are causing near-term, transitory pressure on the company’s travel retail business.

Image Source: Zacks Investment Research

Quarter in Detail

The company posted adjusted earnings of $1.54 per share, which surpassed the Zacks Consensus Estimate of $1.29. However, the bottom line slumped 49% (down 44% at constant currency or cc) year over year. This includes an adverse currency impact of 4% on core international travel retail locations.

Net sales of $4,620 million beat the Zacks Consensus Estimate of $4,571.6 million. However, the metric declined 17% (down 12% at cc) from $5,539 million reported in the year-ago quarter. Organic net sales fell 11% in the quarter.

Management highlighted that it battled pandemic-led curbs in mainland China which caused curtailed tourism and product shipments to Hainan along with limited traffic across brick-and-mortar in the rest of China. These factors were somewhat offset by broad-based solid organic net sales growth in developed and emerging markets worldwide. Organic net sales reflect gains from growth across the Fragrance category as well as solid holiday offerings and performance in the 11.11 Global Shopping Festival.

The gross profit came in at $3,401 million, down 21% year over year. The gross margin contracted to 73.6% from 77.9% reported in the year-ago quarter.

The adjusted operating income declined 42% at cc, mainly due to reduced net sales.

Product-Based Segment Results

Skin Care’s sales were down 25% year over year (down 20% at cc) to $2,382 million. Makeup revenues fell 9% year over year (down 3% at cc) to $1,268 million.

In the Fragrance category, revenues were down 3% year over year (up 3% at cc) at $775 million. Hair Care sales totaled $182 million, up 1% (up 4% at cc).

Regional Results

Sales in the Americas tumbled 5% year over year (down 6% at cc) to $1,235 million. Revenues in the EMEA region decreased 22% (down 18% at cc) to $1,816 million. In the Asia-Pacific region, sales declined 17% (down 8% at cc) to $1,570 million.

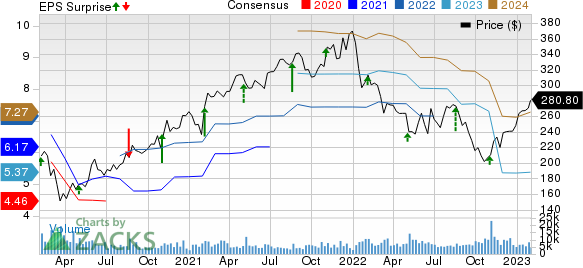

The Estee Lauder Companies Inc. Price, Consensus and EPS Surprise

The Estee Lauder Companies Inc. price-consensus-eps-surprise-chart | The Estee Lauder Companies Inc. Quote

Other Updates

This Zacks Rank #3 (Hold) company exited the quarter with cash and cash equivalents of $3,725 million, long-term debt of $5,111 million and total equity of $5,902 million.

Net cash flow used for operating activities for the six months ended Dec 31, 2022, was $751 million. The company returned $0.71 billion in cash to shareholders through dividend payouts and share repurchases during the quarter.

In a separate press release, the company declared a quarterly dividend of 66 cents per share on Class A and Class B shares. The dividend will be paid out on Mar 15, 2023, to shareholders of record as of Feb 28.

Guidance

Management anticipates the rest of fiscal 2023 to be dynamic, including uncertain consumer recovery in travel retail, evolving COVID-19 situation, inflation, supply chain-related issues along with slowdown risk across some markets worldwide.

That said, The Estee Lauder Companies is optimistic about growth in global prestige beauty and expects to invest in its business despite a tough operating environment. Management plans to invest in its Shanghai innovation center, production unit in Japan along with advertising.

For fiscal 2023, management now projects net sales to decrease in the band of 5-7% year over year, which includes unfavorable currency impact. The view includes a shift in the return to growth across Asia Travel Retail and mainland China as well as the termination of certain license agreements.

Organic net sales growth is now anticipated to be flat to decrease 2% in fiscal 2023. Adjusted earnings per share (EPS) are now expected in the band of $4.87-$5.02, suggesting a 31-33% decline from the year-ago period. The bottom line is expected to decline 27-29% at cc.

For the third quarter of fiscal 2023, management expects net sales to decline in the band of 12-14% year over year. The guidance includes currency headwinds, a shift in return to growth in Asia Travel Retail and mainland China and the termination of certain license agreements.

Organic net sales are anticipated to decrease in the range of 8-10% in the third quarter. The quarterly adjusted EPS is anticipated in the band of 37-47 cents, indicating a 75-81% decrease from the year-ago period. The adjusted EPS is likely to decline 73-79% at cc.

EL shares have gained 44.9% in the past three months compared with the industry’s growth of 40.6%.

Solid Staple Bets

Some better-ranked stocks are Conagra Brands CAG, Lamb Weston LW and Post Holdings POST.

Conagra, a consumer-packaged goods food company, currently sports a Zacks Rank #1 (Strong Buy). CAG has a trailing four-quarter earnings surprise of 8.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Conagra’s current fiscal-year sales and earnings suggests growth of 7.2% and 12.7%, respectively, from the corresponding year-ago reported figures.

Lamb Weston, which is a frozen potato product company, currently sports a Zacks Rank #1. LW has a trailing four-quarter earnings surprise of 52.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and EPS suggests an increase of 19.6% and 90.4%, respectively, from the year-ago reported number.

Post Holdings, which operates as a consumer-packaged goods company, currently sports a Zacks Rank #1. POST has a trailing four-quarter earnings surprise of 9.6%, on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year EPS suggests an increase of 70.8% from the year-ago reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Conagra Brands (CAG) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report