Estee Lauder's China Problem

Shares of The Estee Lauder Companies Inc. (NYSE:EL) are down nearly 40% this year as investors remain concerned about its exposure to the Chinese market.

Estee Lauder stated in its 10-K filing that its largest customer primarily sells products in China and accounted for 13% of its consolidated net sales and 24% of accounts receivable for fiscal 2022. The company has a physical retail presence in over 141 Chinese cities, and roughly one-fourth of Estee Lauder's revenue is generated in the Asia/Pacific region. The stock of companies with significant exposure to the country also took a massive hit following Chinese President Xi Jinping's confirmation of a third term last month.

The Chinese Communist Party held its twice-per-decade summit in October, in which the party selected top leadership positions and Xi secured a third term as the leader of the party and the nation. Investors and market experts believe this will allow him to continue his aggressive and strict regulations, such as the zero-Covid policy, which has had a significant impact on businesses. Companies that rely heavily on the Chinese market have experienced a notable slowdown in growth this year because of new cases in the country that have triggered regional lockdowns. Both retailers and customers alike remain under pressure because of these strict mobility restrictions. These policies, if continued, are very likely to send Chinese stocks listed in the U.S. and American companies reliant on the Chinese market into free fall in the coming quarters.

The Chinese government did not reverse the policies despite the slowing economy and rising geopolitical tensions. Instead, regulators seem to be prioritizing security, self-sufficiency and social stability, focusing on increasing domestic demand and reducing reliance on imports. Few strategists expect a complete decoupling of the world's two largest economiesChina and the U.S.in some critical areas as they focus on national security.

This comes after the United States took steps to limit China's access to critical technologies. Although the restrictions currently apply to tech companies selling sensitive technology, other markets, such as fashion, luxury and food, are not immune to these ongoing tensions. As the relationship between the two countries remains uncertain, it has created a new level of volatility for companies who have invested in China to capitalize on its rapid growth.

Chinas Covid-19 policies are curtailing Estee Lauders growth

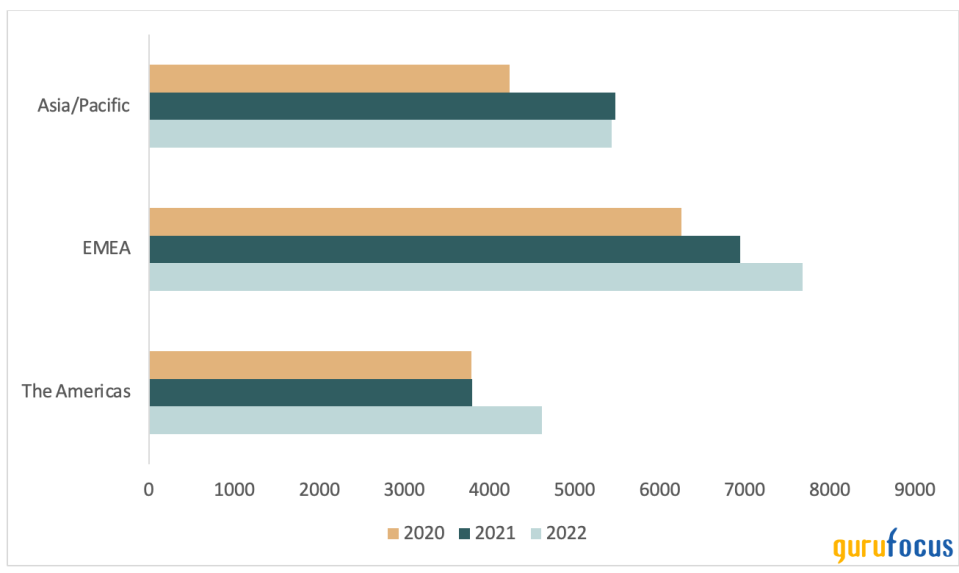

On Aug. 18, Estee Lauder reported full-year 2022 financial results, recording $17.74 billion in net sales, a 9% increase supported by double-digit growth in the Americas and Europe, Middle East and Africa regions. The company saw brick-and-mortar retail stores recover strongly in all regions except China, while also experiencing double-digit growth in global online and travel retail. The resurgence of Covid-19 cases in many Chinese provinces prompted restrictions to prevent the virus from spreading further in February and lasted through August. As a result, the company's distribution facilities in Shanghai operated at reduced capacity until early June, slowing retail traffic.

China continues to impose lockdowns on schools, restaurants and stores, as well as apartment buildings and neighborhoods. In China, 1,321 new Covid cases were reported in the last week of October. The disruptive restrictions caused hundreds of workers to flee Foxconn, the world's largest iPhone factory. According to Bloomberg, experts believe China will stick with the zero -Covid policies, including lockdowns, mass testing and travel restrictions, through the winter. Health experts do not expect any changes until the next National People's Congress, which will be held in March or April of next year. This indicates that businesses can expect sluggish growth in the Asia-Pacific region in the current quarter as well.

Exhibit 1: Estee Lauder net sales by geographic region

Source: Investor presentation.

In addition to pressures in China, a stronger dollar has also hurt net sales in some product categories in EMEA. Skincare net sales increased by 4%, aided by increases in the La Mer, Clinique and Bobbi Brown brands. Estee Lauder partly attributed the single-digit growth to lower-than-expected revenue in the EMEA region after it suspended commercial activities in Russia and Ukraine as well as the negative effects of increased pandemic-related restrictions in China. La Mer and Bobbi Brown, on the other hand, experienced double-digit growth among Chinese consumers in both mainland China and travel retail, as well as in other regions. Makeup sales increased 11% year over year, aided by the continued recovery in Western markets. Net sales in the fragrance product category increased 30% year over year across all regions and fragrance brands, led by Jo Malone London, Tom Ford Beaut, and Le Labo. However, growth may come to a standstill this holiday season as consumer purchasing power is shrinking in many developed markets.

Valuation does not seem attractive unless China turns around

Even on the back of a 40% decline in market value this year, Estee Lauder is still valued at a forward price-earnings ratio of over 40, which suggests Mr. Market is still placing a massive value on the expected growth of the company. At a time when growth companies are getting hammered in the market, Estee Lauder's valuation seems bloated even before accounting for its troubles in China.

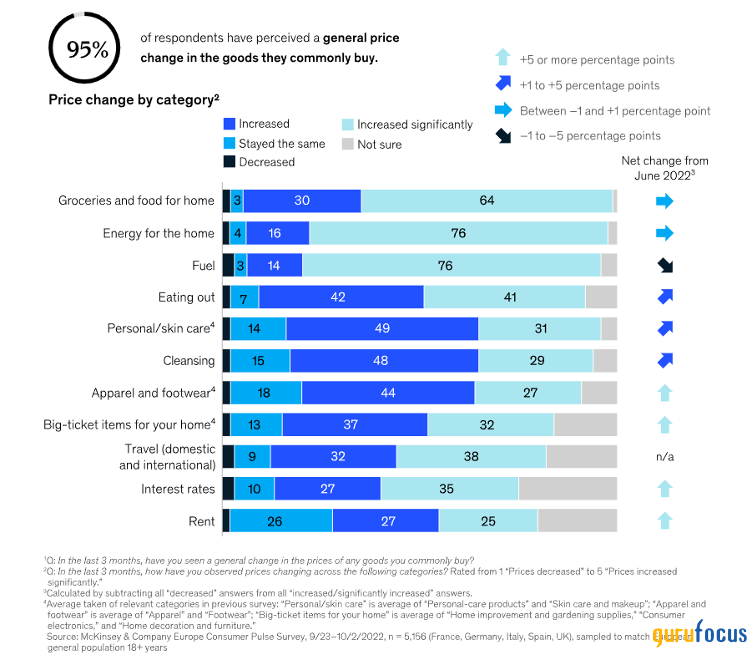

The cosmetics company may be able to make a strong comeback once China lifts its strict lockdown measures. However, it is unclear when the country will fully reopen. In addition, global demand for premium skincare and beauty products is slowing. With the rising cost of living, the lipstick effect the notion that people will continue to buy small luxury items even during recessions - will begin to fade. According to McKinsey, there is an increase in the number Europeans who are reducing their spending on non-food discretionary items, and one in 10 say they plan to shop less or not at all.

Exhibit 2: Price changes observed by respondents in the last three months

Source: McKinsey & Co.

Given these looming challenges, Estee Lauder issued cautious guidance for the current fiscal year. The company expects total revenue growth of only 3% to 5% in fiscal 2023, with organic sales growth of 7% to 9%. The guidance itself is lackluster for a company that is valued at more than 40 times expected earnings for next year. If the company misses this guidance - which is a high-probability scenario because of its exposure to China - the market is likely to punish the stock.

Takeaway

Estee Lauder is one of the most profitable companies in the beauty space and has the strongest brand in premium cosmetics and skincare, with a global customer base. However, disruptions in supply chains, inflationary pressures and China's zero-Covid policies are weighing on the companys growth. The company appears to be fundamentally capable of overcoming its current challenges in the long run, which is why a significant pullback may present a good long-term investment opportunity. However, global consumer sentiment and retail spending are likely to remain low for some time, implying that investors will have to remain patient to make the most of such an investment. At the current market price, the risk-reward profile does not seem to be in favor of investors.

This article first appeared on GuruFocus.