ETF Scorecard: March 22 Edition

To help investors keep up with the markets, we present our ETF Scorecard. The Scorecard takes a step back and looks at how various asset classes across the globe are performing. The weekly performance is from last Friday’s open to this week’s Thursday close.

Brexit is down to the wire, although investors have not shown any signs of angst. British Prime Minister Theresa May won an unconditional small two-week extension to the Brexit date, although she asked for three months. The Europeans signaled they would only agree if the deal is approved in the British Parliament, which already rejected her agreement twice. If the Parliament rejects May’s deal again, the Prime Minister would have to request for a longer extension, to which EU policymakers indicated they would agree if Britain is willing to participate in the upcoming elections for the European Parliament. If she refuses, the no-deal Brexit will be back on the table. The U.S. Federal Reserve has signaled there would be more rate hikes this year, as it sees lower economic growth amid rising trade tensions. The Fed kept interest steady, in a widely expected move. Just in December, the Fed estimated two interest rate hikes this year, but abruptly changed course after yields rose and stocks plunged. The Bank of Japan policymakers were at loggerheads over the central bank’s next steps, as risks to the fragile economic recovery mount. One policymaker noted the BoJ should act decisively and increase its stimulus program if the economy deteriorates, according to the bank’s minutes, although most members agreed to maintain the current program intact. U.S. consumer sentiment rose for the third consecutive month, with the University of Michigan’s index advancing from 93.3 to 97.8 in March. Analysts had expected a figure of 95.5. As Brexit worries mount, U.K. wages growth continues to hover near ten-year highs. Wages rose 3.4% in the three months through January compared with the same period last year, slightly falling from 3.5% in the prior month. Economists forecasted wage growth of 3.2%. U.K. unemployment rate, meanwhile, declined to 3.4% in January from 3.5%. Meanwhile, British inflation came in at 1.9% in February versus 1.8% expected. U.S. unemployment claims of 221,000 for the week ended March 15 signals a strong job market. In the prior week, jobless claims stood at 230,000.

For more ETF news and analysis, subscribe to our free newsletter.

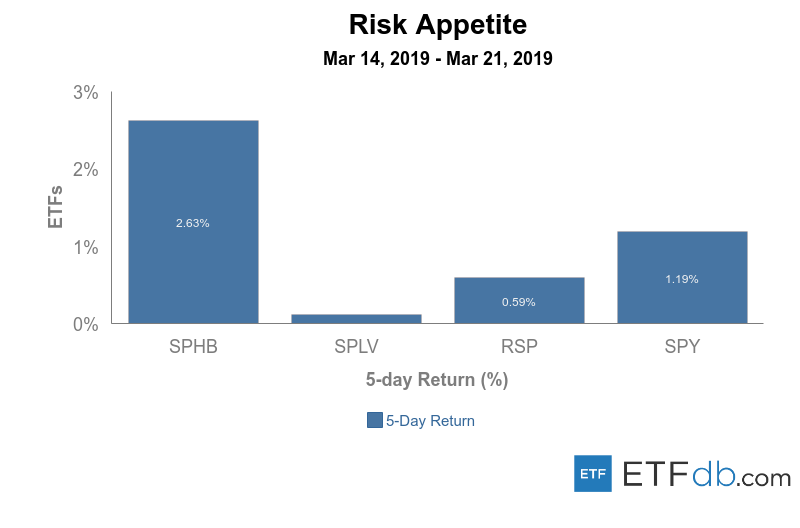

Risk Appetite Review

High risk assets (SPHB B-) advanced 2.63% this week, representing the best performance from the pack by far, as the Federal Reserve signaled that no interest raises will be made this year. The broad market (SPY A) was up 1.19% this week, while low volatility (SPLV A) was the worst performer with a jump of 0.11%.

Sign up for ETFdb.com Pro and get access to real-time ratings on over 1,900 U.S. listed ETFs.

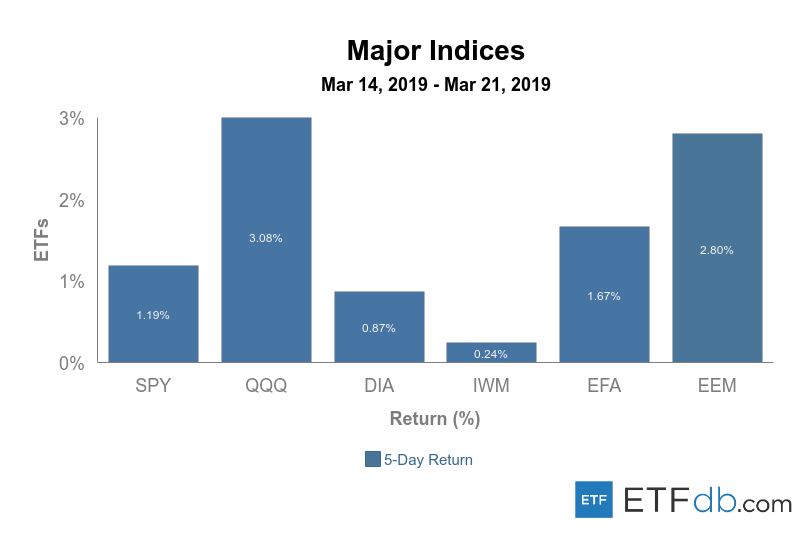

Major Index Review

All major indexes were up.

Technology stocks (QQQ A-) powered ahead this week, staging gains of more than 3%, amid optimism about the Fed’s dovish stance on monetary policy. Emerging markets (EEM A-) also had a strong week, gaining 2.8%.

On the other side of the spectrum were small-cap stocks (EEM A-), which were up just 0.24% and were the only asset to fall for the rolling month.

To see how these indices performed over the past year, check out ““ETF Scorecard: March 15 Edition”":https://etfdb.com/news/2019/03/15/etf-scorecard-march-15-2019-edition/

Sectors Review

Sectors were mixed. Financials, industrials and utilities were hit hard this week, with (XLF A) declining the most, 1.44%, as investors expect low interest rates will hit the banks’ bottom lines. The technology sector (XLK A) was again the best performer from the pack, with an advance of nearly 4%.

Use our “head to head comparison tool”: http://etfdb.com/tool/etf-comparison to compare two ETFs such as (XLI A) and (XLY A) on a variety of criteria such as performance, AUM, trading volume and expenses.

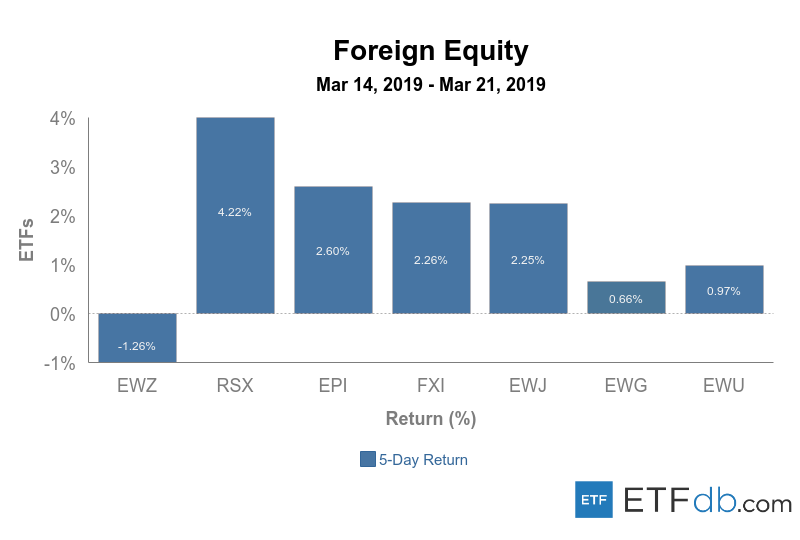

Foreign Equity Review

Foreign equities were mixed. Russian equities (RSX B+) surged 4.22% this week, in part due to a weaker dollar and strong oil prices. Brazilian equities (EWZ B+) corrected some of the gains registered in previous weeks that were rooted in President Jair Bolsonaro’s promised reforms. (EWZ B+) declined 1.26%. The rest of foreign equities posted relatively strong gains.

To find out more about ETFs exposed to particular countries, check our “ETF Country Exposure Tool”: http://etfdb.com/tool/etf-country-exposure-tool/. Select a particular country from a world map and get a list of all ETFs tracking your pick.

Commodities Review

Rarely seen, the agricultural fund (DBA A) was the best performer for the week, edging up 2.56%. Natural gas (UNG B-) was the worst performer with a decline of 0.68%.

Currency Review

Euro (FXE A) lost 2.15% this week, while the British pound (FXB A-) was the second-worst performer. The European economy has been rather weak of late. At the same time, the U.K. economy has been surprisingly strong, with Brexit fears representing the only overhang on the currency’s prospects. Emerging market currencies (CEW A) advanced nearly 1% this week.

For more ETF analysis, make sure to sign up for our free ETF newsletter.

Disclosure: No positions at time of writing.