EU, US Seek Interim Steel Deal to Avoid Return of Trump Tariffs

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- The leaders of the European Union and the US are seeking to announce an interim deal at an Oct. 20 summit on steel and aluminum trade that would avert the re-imposition of Trump-era tariffs on billions of dollars of transatlantic commerce.

Most Read from Bloomberg

Shock Incursion on Weakened Israel Imperils Regional Geopolitics

Biden Says Israel Under Terrorist Attack, Pledges US Support

Top White House and European Commission officials are negotiating a provisional political agreement that would cover the two main planks of the so-called Global Steel and Aluminum Arrangement that the EU and US have been negotiating since 2021: tackling non-market excess capacity and carbon emissions, according to people familiar with the talks.

The deal — which would fall short of a legally binding agreement — seeks to settle a dispute that started when President Donald Trump slapped tariffs on metals imports from Europe, citing risks to national security. Failure to reach an accord by Oct. 31 would mean that levies on $10 billion of exports between the EU and US would automatically come back into force at the start of 2024.

The transatlantic allies are seeking a political accord because they don’t think there’s enough time to reach a formal deal by the deadline and remain distant on some key aspects of the matter such as compatibility with international trade rules, according to the people.

A spokesperson for the commission declined to comment on the GSA talks. A spokesperson from the US national security council didn’t respond to a request for comment.

As part of a possible agreement, the EU and US would aim to coordinate how they measure and tackle excess capacity, said the people, who spoke on the condition of anonymity. The deal would see new steel tariffs aimed at non-market practices of countries such as China, Bloomberg previously reported.

The US has imposed a 25% tariff on steel imports since 2018 and the EU applies about the same level of duties on an array of steel imports under its own safeguard measures. That level of tariff would act as a reference point that can then be adjusted on a case-by-case basis, the people said.

Talks on tackling dirty steel have been more difficult but the EU and US are hoping to commit politically to work together to adopt measures in the coming years, one of the people said. The EU would achieve that through its implementation of its carbon border adjustment mechanism, while the US could adopt its own duties or trade restrictions on dirty steel.

The preliminary deal on sustainable global steel and aluminum will be billed as one of the main deliverables of the first transatlantic summit in two years between President Joe Biden and Commission President Ursula von der Leyen.

The leaders’ summit aims to portray unity among long-time trading partners as both prepare to step up their support for Ukraine against Russia’s invasion in the face of growing skepticism at home. They’re also seeking to align policies to address China’s rising clout on trade and technology.

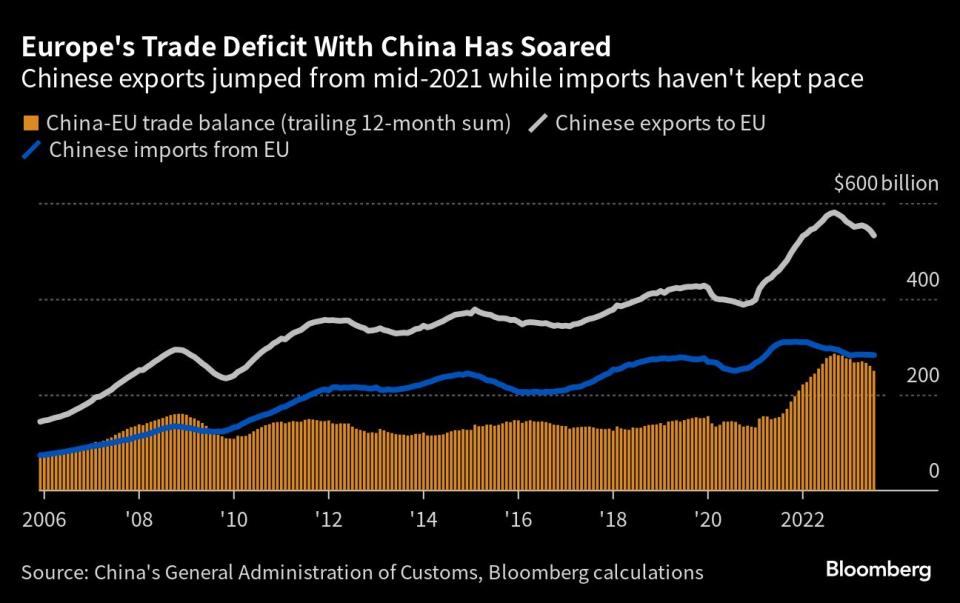

China will be in the crosshairs of the new arrangement because it’s been accused of steel dumping. China accounts for more than half of global crude steel-making, according to data from the Organisation for Economic Cooperation and Development. The depreciation of the yuan has bolstered the attractiveness of Chinese steel exports, putting volumes on track for the highest since 2016.

EU envoys gave the go-ahead on Wednesday to finalize the steel and aluminum agreement with the US, the people said. Germany and France, however, demanded more clarity from the commission on what the final deal would include, given the economic importance of this issue and its geopolitical ramifications.

The EU and the US are also finalizing a critical raw materials deal expected to be announced at the summit that would allow companies based in the EU to benefit from some of the US subsidies for the production of batteries for e-vehicles.

Most Read from Bloomberg Businessweek

Aftermath of an Assassination: Inside the India-Canada Crisis

America’s Factory Boom Brings Billion-Dollar Projects to Tiny Towns

These 10 Graphics Show Just How Broken America’s Child-Care System Is

©2023 Bloomberg L.P.