EU Watches for Red Sea Attacks’ Economic Impact, Gentiloni Says

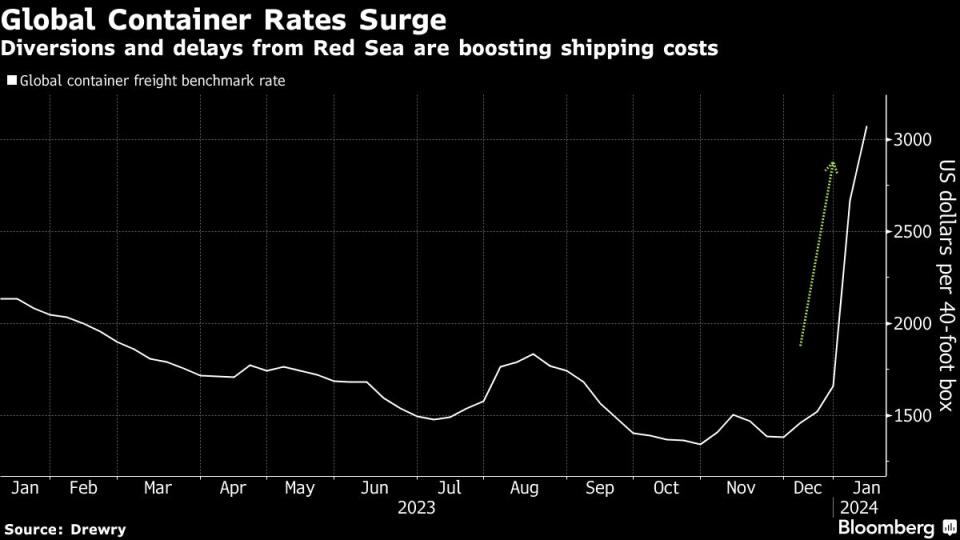

(Bloomberg) -- Tensions in the Red Sea as Houthi militants attack commercial vessels may start to have an impact on energy prices and inflation in the coming weeks, according to the European Union’s economy chief.

Most Read from Bloomberg

Trump Scores Easy Win in Iowa With DeSantis a Distant Second

What Is Disease X? How Scientists Are Preparing for the Next Pandemic

Apple to Pull Blood-Oxygen Tool From Watches to Avoid US Ban If Appeal Fails

“We know that we’re starting this year with subdued growth, some good news on the labor market, but increasing concern on the downside risks caused by geopolitical tensions, and especially what is happening in the Red Sea,” Economy Commissioner Paolo Gentiloni said.

This “is not for the moment apparently creating consequences on energy prices and inflation, but we think that it should be monitored very closely because these consequences could materialize in the coming weeks,” he told reporters ahead of a meeting of euro-area finance ministers in Brussels on Monday.

The US and UK launched airstrikes on Yemen on Friday and Saturday against the Houthis in an attempt to stop the Iran-backed group’s attacks on ships in the Red Sea — ostensibly in support of the militant group Hamas against Israel — that have effectively closed the vital waterway for many major companies.

Read more: Eurogroup Head Expects Euro Area to Grow Around 1% This Year

The disruption in the Red Sea comes at a difficult time for the euro zone as it faces anemic growth in its biggest economy, Germany, which saw output shrink last year.

The bloc will probably expand by around 1% this year as it resists the impact of lingering inflation and the war in Ukraine, according to Paschal Donohoe, president of the Eurogroup, with brings together finance ministers from the 20-nation currency area.

“As I look into 2024, I continue to believe that the euro-area economy is holding up well in the context of such economic challenges,” Donohoe said in Brussels. “While that’s a lower rate of growth than I would otherwise like to see, it’s still growth despite all of the challenges.”

Any impact from the Red Sea disruption on inflation could worsen those forecasts and cause the European Central Bank to postpone any reduction in interest rates. The central bank is currently on hold as it waits to see how the 10 hikes enacted since mid-2022 affect the economy.

--With assistance from Jorge Valero, Kamil Kowalcze and Max Ramsay.

(Updates with Eurogroup president comments starting in sixth paragraph.)

Most Read from Bloomberg Businessweek

Trumponomics 2.0: What to Expect If Trump Wins the 2024 Election

Patti LaBelle Moves From Stage to Stove With a Recipe for Success

Kim Kardashian’s Skims Isn’t the Only Celebrity Brand to Watch

©2024 Bloomberg L.P.