EUR/USD Daily Forecast – Euro Holds Near Month Old Resistance

Last week was quiet for the markets. The economic calendar was light and risk sentiment swayed lightly through the week as optimism of an economic recovery offset a rise in the rate of new virus cases in some parts of the world.

The EUR/USD pair has had a strong relationship to swings in risk sentiment and the equity markets although that could change in the week ahead.

Volatility is likely to pick up this week as the European Central Bank is scheduled to present its latest rate decision and views on monetary policy on Thursday. As well, the US will release inflation data on Tuesday and retail sales figures on Thursday.

The markets appear to be favoring an upside break for the EUR/USD pair which has otherwise traded in a sideways range since the start of June. The latest Commitment of Traders report showed speculative long positions in the euro near highs not seen in two years.

The greenback is the worst performer among the major currencies in the first half of July and the dollar index (DXY) is down nearly 1% for the month thus far.

Technical Analysis

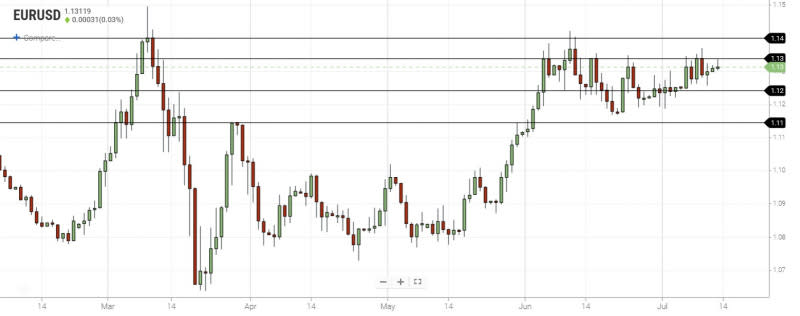

A catalyst might be needed for a range break in EUR/USD, and in the absence of one, the pair may see some selling pressure as it trades near the upper end of a range.

The 1.1340 price point has been an obstacle since the middle of June, and the exchange rate has not been able to close above it on a daily basis since.

Further, sellers have been stepping on rallies for six straight weeks, indicative by the candlestick wicks on a weekly chart.

At the same time, the trend is clearly to the upside, and traders that are selling against resistance here might be quick to take profits on near-term dips.

A sustained break above resistance at 1.1340 targets resistance at 1.1400.

Bottom Line

The range in EUR/USD continues and resistance at 1.1340 is in focus in the early week.

The ECB meeting and economic data from the US later in the week could provide a catalyst for a range break in the currency pair.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire