EUR/USD Mid-Session Technical Analysis for May 11, 2021

The Euro is climbing against the U.S. Dollar on Tuesday, hovering a little below a 2-1/2 month high hit in the previous session, after data showed German investor sentiment surged to its highest level in May since the start of the COVID-19 pandemic.

The ZEW economic research institute said its survey of investors’ economic sentiment rose to 84.4 points from 70.7 the prior month. The last time it hit a higher level was in February 2000. A Reuters poll had forecast a rise to 72.0.

At 12:04 GMT, the EUR/USD is trading 1.2165, up 0.0037 or +0.30%.

The Euro’s gains were also bolstered by widespread dollar weakness as investors waited for comments on U.S. policymaker thinking ahead of inflation data on Wednesday.

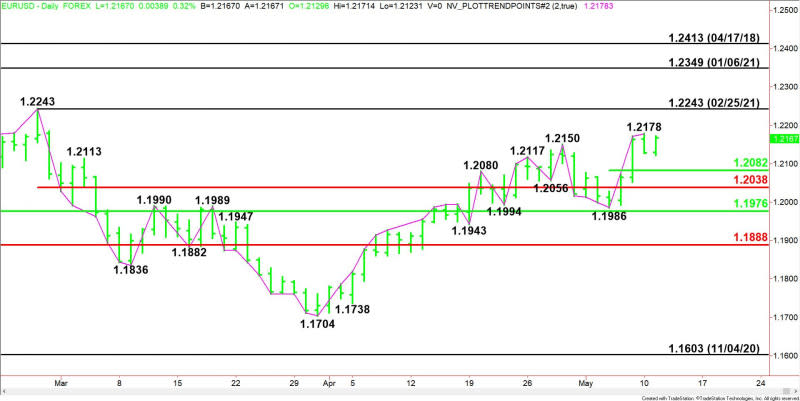

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. However, momentum shifted to the downside with the confirmation of Monday’s closing price reversal top.

A trade through 1.2178 will negate the closing price reversal top and signal a resumption of the uptrend. The main trend will change to down on a move through 1.1986.

The new minor range is 1.1986 to 1.2178. Its 50% level at 1.2082 is the first downside target.

The next potential downside target and possible support is 1.2038 to 1.1976.

Daily Swing Chart Technical Forecast

The chart pattern suggests traders are being indecisive. Early in the session, they confirmed the reversal top, but with little follow-through to the downside.

The direction of the EUR/USD on Tuesday will be determined by trader reaction to 1.2178 and 1.2123.

Bullish Scenario

A sustained move over 1.2178 will indicate the presence of buyers. If this move creates enough upside momentum then look for the rally to possibly extend into the February 25 main top at 1.2243.

Bearish Scenario

A sustained move under 1.2123 will signal the presence of sellers. If this move generates enough downside momentum then look for a break into 1.2082. Since the main trend is up, buyers could come in on the first test of this level. If it fails then look for the selling to possibly extend into 1.2038.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

Silver Price Forecast – Silver Markets Pull Back From Big Figure

Home Depot Could Hit New All-Time High on Strong Q1 Earnings

USD/JPY Price Forecast – US Dollar Pulls Back the 50 Day EMA

Silver Price Daily Forecast – Silver Pulls Back Despite Weaker Dollar

Gold Price Prediction – Prices Continue to Rise as the Dollar Falls