Is Eureka Group Holdings (ASX:EGH) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Eureka Group Holdings Limited (ASX:EGH) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Eureka Group Holdings

What Is Eureka Group Holdings's Debt?

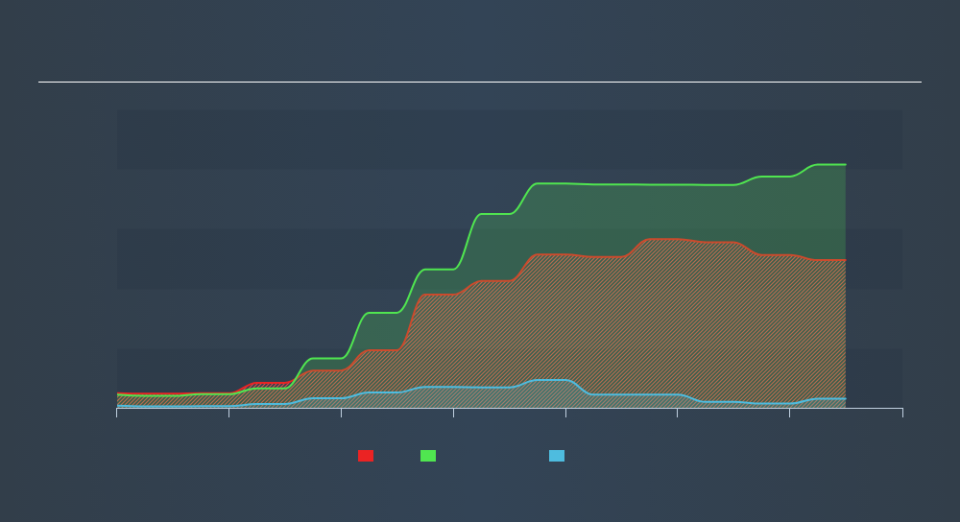

The image below, which you can click on for greater detail, shows that Eureka Group Holdings had debt of AU$49.5m at the end of June 2019, a reduction from AU$55.5m over a year. On the flip side, it has AU$3.06m in cash leading to net debt of about AU$46.4m.

How Healthy Is Eureka Group Holdings's Balance Sheet?

The latest balance sheet data shows that Eureka Group Holdings had liabilities of AU$4.46m due within a year, and liabilities of AU$47.1m falling due after that. On the other hand, it had cash of AU$3.06m and AU$1.09m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$47.4m.

This is a mountain of leverage relative to its market capitalization of AU$75.9m. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Eureka Group Holdings shareholders face the double whammy of a high net debt to EBITDA ratio (6.7), and fairly weak interest coverage, since EBIT is just 2.5 times the interest expense. This means we'd consider it to have a heavy debt load. Looking on the bright side, Eureka Group Holdings boosted its EBIT by a silky 32% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Eureka Group Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Eureka Group Holdings produced sturdy free cash flow equating to 69% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Based on what we've seen Eureka Group Holdings is not finding it easy net debt to EBITDA, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to grow its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Eureka Group Holdings's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Eureka Group Holdings insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.