Europe's Calm FX, Bond Markets Masking Anxiety?

The Eurozone economy stalled in the fourth quarter of 2019 after seven years of recovery, dragged by a contraction in France and Italy, stagnation in Germany and the European Central Bank (ECB) holding firm to negative interest rates at -0.4% even as core inflation hovered just below 1% at the end of last year.

And that was before COVID-19. The region’s economy is now widely expected to shrink by 4% to 8% in 2020 and budgets that were close to being balanced overall in 2019 are widely expected to show deficits of 20% or more of GDP this year as spending surges and tax revenues dwindle. The ECB, meanwhile, has ventured deeper into negative-rate territory, cutting rates to -0.5%.

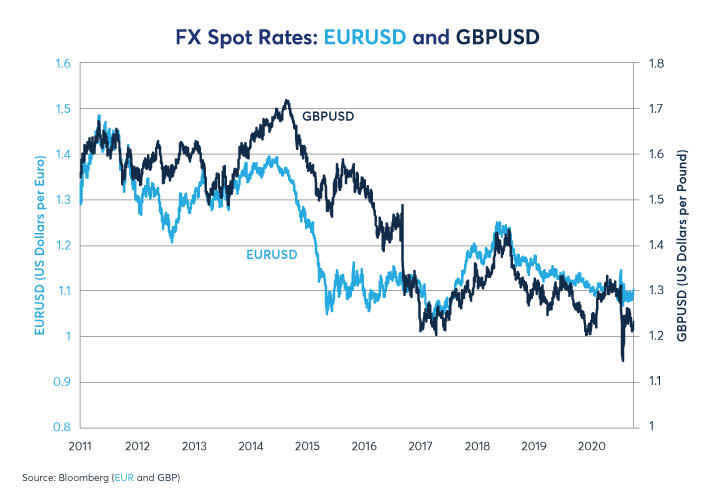

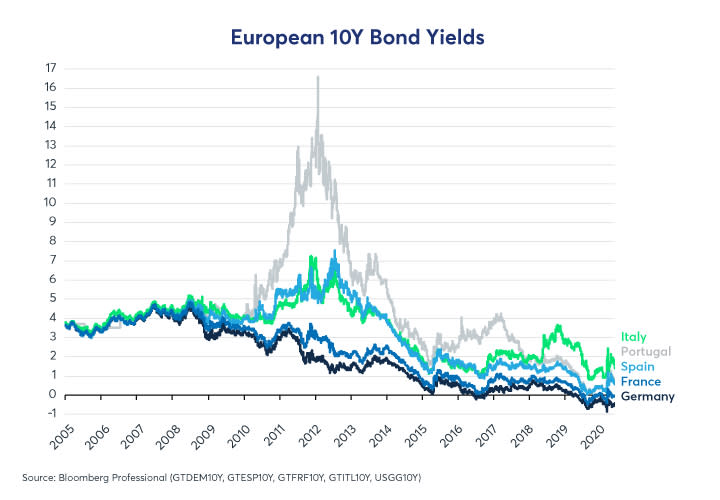

Despite these challenges, European markets have reacted with relative aplomb. European equity markets have risen although somewhat below the performance of their US counterparts, while the euro (EUR) and the European bond market have been remarkably stable (Figures 1 and 2). Italian and Spanish bond spreads have widened but so far nothing akin to the 2009-2012 period has happened.

Figure 1: With the US and Europe in a similar position, EURUSD has shown little reaction to COVID-19

Figure 2: Compared to 2009-12, European bonds have been cool, calm and collected

That Eurozone bonds have been stable is remarkable. Not only have bond holders had to contend with dramatically deteriorating fiscal conditions across the currency zone, but, on May 5, Germany’s Constitutional Court upheld several complaints against the ECB’s Public Sector Purchase Program (PSPP), which is the main vehicle used by ECB to prevent a widening of bond yield spreads between the debt of various Eurozone members. For its part, the ECB responded by saying that it was under the jurisdiction of the European Court of Justice and not national courts.

At the very least, this controversy reminds investors of the Eurozone’s unique set up: it has a common currency but 19 different national fiscal policies. Lacking a common fiscal policy, Eurozone members are supposed to adhere to certain rules including:

Fiscal deficits must not exceed 3% of GDP. In 2019, every Eurozone member met that criteria, but from 2008-2014 many, and in some years, most did not. Following the pandemic, it may take many years for member states to reign in deficit spending to within the 3% range.

Gross government debt must not exceed 60% of GDP. As of Q3 2019, only two Eurozone countries, Finland (59% public debt/GDP) and the Netherlands (49%) met that criteria – although Germany and Ireland were close (61% and 63%, respectively). Meanwhile, Austria’s public sector debt was 71% of GDP; Belgium, France and Spain were close to 100%, Portugal was at 120%, Italy just below 140% and Greece nearly 180%.

It’s largely the ECB bond-buying program, the result of former ECB President Mario Draghi’s promise in 2012 to do “whatever it takes” to keep the eurozone together, that has prevented a substantial expansion of intra-country spreads. Nevertheless, the European bond investors shrugged off the German court’s ruling. For the moment, the ECB appears likely to continue absorbing a large portion of the debt issuance of the Eurozone’s member states.

Even so, at some level investors must be worried. In the US or UK, for example, there is one sovereign debt issuer and one central bank to manage the currency and the debt markets. In the Eurozone, there are 19 separate government debt issues and one supranational central bank. In this regard, the Eurozone doesn’t really have a sovereign debt market at all but rather a public debt market that looks more like the municipal debt market in the US. However, unlike US States and municipalities, which normally have to balance their budget, Eurozone nations usually run deficits and can accumulate enormous debt relative to the size of their economies. Indeed, this is why the ECB’s bond-buying program sometimes raises opposition from inflation and budget deficit hawks: they see ECB buying of individual country debt as being a backdoor path to debt mutualization and a common fiscal policy.

Despite the hit to the economy and political controversies in Europe, on the surface, EURUSD options markets, like the Eurozone government bond market, are also relatively calm. Implied volatility on EURUSD at-the-money (ATM) options spiked from 4% to 15% in March during an incipient dollar-funding crisis at the nadir of the equity market selloff. However, after the Federal Reserve stepped in, providing dollar liquidity and swap lines, currency option volatility returned to its 2012-2019 average levels. Moreover, at the peak of volatility in March, EURUSD 30-Day ATM implied volatility was only halfway to where it peaked in 2008 and 2009 (Figure 3).

Figure 3: On the surface, the EURUSD options market looks relatively calm.

Below the relatively calm surface in the EURUSD options ATM price, currency option traders are clearly anxious. This nervousness becomes apparent when one takes a deeper dive into the EURUSD options market’s pricing, examining two other aspects of the options market:

Skewness: how implied volatility of out-of-the-money (OTM) put and call options varies across different strike prices.

Volumes: how much of each option is trading across different strike prices.

Rather than a traditional normal-distribution-like peak in the possible outcomes for EURUSD, we see a flat, broad top with a bump on the left-hand side. This reflects substantial buying of both put and call options away from the money with some traders especially nervous about extreme downside for EUR. This doesn’t mean that extreme downside (or upside) moves will materialize in real life, but investors apparently see the Eurozone as being under a great deal of stress and, to a greater-than-usual extent, they are buying a lot of downside put protection and some upside call protection as well (Figure 4).

Figure 4: Taking protection on the downside, and upside too.

See more from Benzinga

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.