EV sales are are up across GA, but Muscogee County is falling behind. Here’s why

You could say Robert Vasquez is very enthusiastic about Electric Vehicles.

The Columbus dentist has had four EVs over the past 10 years. He’s tried out Teslas and a Mercedez Benz. His most recent trade-in and current EV is a Ford F-150 Lightning that he bought in 2023.

You could also say necessity was the mother of invention or at least conversion in his case. His 80-mile daily, round trip commute from home in Harris County to his dentist office in Muscogee County, had much to do with switching from an internal combustion engine to an EV.

He hasn’t looked back. Yet, he is only one of hundreds of EV drivers in Muscogee and Harris County that are getting aboard the EV train.

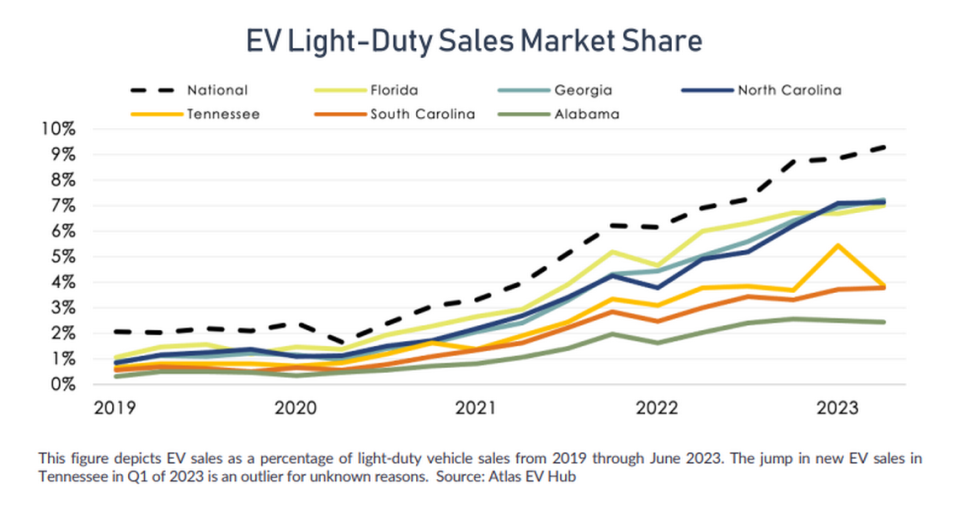

The Columbus area hasn’t seen the spike in EV adoption rates that urban counterparts like Savannah - at 1,560 registered EVs in Chatham County - have seen. And this in a state that is leading the EV transition in the southeast. Georgia makes up 7% of the market share in the U.S., according to a report done by Southern Alliance for Clean Energy (SACE).

There are numerous factors for EV growth or stagnation:

Incentives include federal funding enabling charging deployment and vehicle affordability.

more EV models are becoming available from manufacturers.

pressures from gas prices that deter the use of combustion engines

and for some, the desire to move to an emission-free vehicle to combat public health issues and climate change.

For those where climate is top of mind, transitioning to EV’s and decarbonizing roads is a powerful climate action, since Muscogee County’s highest source of carbon emissions comes from transportation, according to Drawdown Georgia, Georgia’s biggest climate solution nonprofit.

While climate change concerns were not the primary reasons (though it was one of them) for Vasquez to buy the F-150 Lightning, the savings from the cost of gas and the price of the vehicle from federal tax credits from the Inflation Reduction Act (IRA) sold him. Plus, he’s tall and it’s roomier than the Tesla.

Financially speaking, “Every bit helps,” Vasquez said. His high-end premium “Platinum model” clocked out at about $75,000. (The starting rate for the F-150 is $55,000).

This year when he files his taxes, he will receive a $7,500 tax credit thanks to the IRA which has to meet certain criteria like being manufactured in the U.S. and under a certain cost ($80,000) all after Jan 1, 2023.

Georgia Power is enabling the cost to charge EVs with its “Super Off Peak” hours program, which lowers rates from 11 pm-to 7am.

“You could “fill up” the tank [battery] for $5 at home.” Plus, Vasquez went on, “There’s no maintenance, no oil changes, none of that stuff.”

The F-150 Lightning comes with a charger, and as long as you have a 40-80 amp plug “like something you’d use for a washer/dryer,” Vasquez said, you can plug in and charge from home.

Why Sales are Sluggish

Steve Greco sold the F-150 Lightning to Vasquez at Rivertown Ford. In the 15 years Greco has been selling at Rivertown, he’s only sold 10 EVs. But, six of those were all in 2023 and one was to Vaquez.

The other, and more popular EV, the all-electric Mustang Mach-E starts at $42,000.

“I had a Mach-E repeat customer last year,” Greco said.

Greco believes there are several reasons Muscogee County is lagging.

“One reason it is political in nature,” he said. “Some don’t think the transition is possible. Some people are resistant because of tax dollars going towards this.”

The American-made, Mach-E reached its sales milestone (created by Ford for the IRA) and according to IRA rules, is no longer eligible for the $7,500.

“Once the F-150 Lightning reaches its sales milestone it will no longer be eligible for the credit,” Greco said.

Many experts in the electrification space acknowledge that the IRA rules are complicated, potentially deterring people from taking advantage of the tax credits.

“It’s created confusion for some consumers,” Anne Blair Vice President of the Electrification Coalition said.

For example, the all-electric Nissan Ariya, for sale just down the block from Rivertown Ford at Headquarter Nissan of Columbus, only qualifies for $3,750 in tax credits because its final assembly isn’t in the U.S. Nevertheless, Ethan Sargent, sold four of them last year. He even has one himself.

“It’s a better drive quality,” Sargent, a 19-year-old salesman at the Nissan dealership said. “When I put my foot on the pedal, it’s instant. I’ll be getting the Maxima EV when it comes out at the end of this year.”

Sargent, originally from La Grange said he was against EVs at first but said this is the future and Columbus is slower to transition than Atlanta.

“Even I was against it at first. It’s going to take a bit for Columbus to catch up to Atlanta.”

As of January 2024, there are 65,810 registered EVs within 13 Atlanta counties and outlying suburbs and only 717 in Muscogee and Harris County.

The national trend is rising. Last week Energy Secretary, Jennifer Granholm celebrated a new milestone for EVs.

“In 2023, more than 1.4 million electric vehicles were sold in the United States — a 50% increase in one year,” she said in a press release. And since 2021, “EV sales have more than quadrupled, with more than four million EVs on the road.”

Combating Range Anxiety

“It’s new technology and people are scared of what they don’t know,” Sargent said. Only about 50% of his EV customers know about the existing tax credits, he told the Ledger-Enquirer.

Experts suggest a lack of education about the tax credits is a major barrier to adopting EVs, which could be to blame for Columbus’ low rate of enthusiasm.

“There is education that needs to happen around the tax credit,” Stan Cross, electric transportation director of Southern Alliance for Clean Energy (SACE) said. “It is so critical for consumers to get excited about EV.”

One of the biggest fears that prevent people from switching to EV is range anxiety, a worry that their vehicle will not have enough range to get from one charging station to the next due to the vehicle’s range and the lack of charging stations.

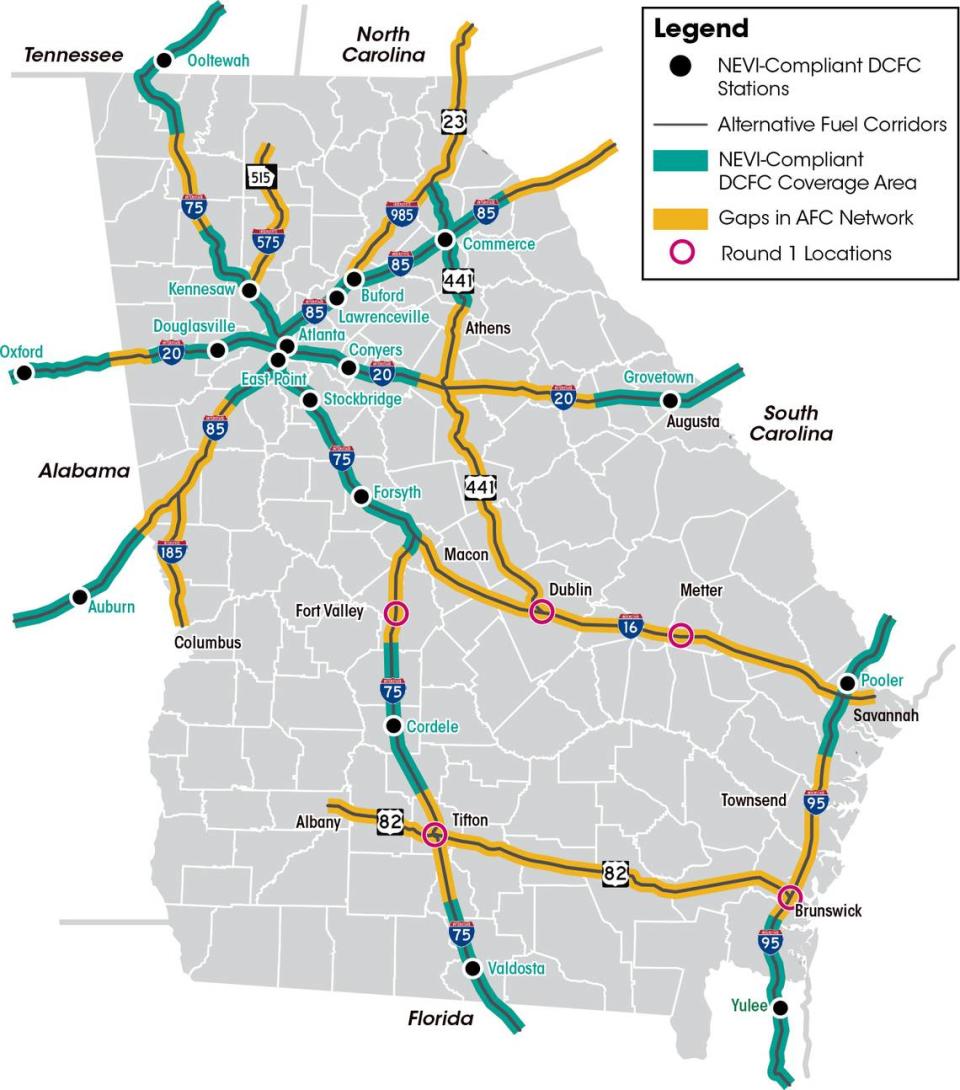

In the next six months, Georgians will start to see fast electric chargers throughout interstates in Georgia, thanks to the Bi-Patisan Infrastructure Law.

The nation has $5 billion dollars to add charging stations across America over five years. Georgia was allotted $135 million of the $5 billion to add DCFC (DC-Fast Chargers) along interstates. The program project is called the Georgia National Electric Vehicle Infrastructure Deployment Program (or NEVI for short).

“There will be two on I-75 south of Macon because that’s where the gaps are,” said John Hibbard, director of operations for the Georgia Department of Transportation.

This first round of five chargers are all in the southern half of Georgia. The second round of 35 chargers will begin to advertise bids at the end of this year and chargers could be installed in the middle of 2025, Hibbard said.

“We’re addressing concerns about range anxiety, the rule states there has to be a charger every 50 miles on the highway and no more than one mile away from the highway,”

Hibbard said these have to be 150 kilowatt, fast chargers, and there needs to be a minimum of four chargers. There are already existing chargers and the NEVI project team at GDOT is “filling in the gaps” where there aren’t any chargers.

Anne Blair of Electrification Coalition told the Ledger-Enquirer that 80% of the charging is done at home, and these charging projects help with long-distance travel.

Stan Cross of SACE said the perception that there needs to be more public chargers in the city could be a reason that adoption rates haven’t quite taken off in the Columbus area.

“Range anxiety is mostly perceptual,” Cross said. “Once you own an EV you learn how to charge at home and you get comfortable coming home empty.”

More EV and Used Models

When Cross bought his 2013 Nissan Leaf 10 years ago, there were only a few other EV options. Today there are more than 40 models on the market.

“People were hungry for alternatives [back then],” Blair said. “The increase in model availability in the last few years like the iD4, AUDI, KIA, Hyundai has helped with EV sales.”

Time and more models mean a larger used car market, which is so important because that is the majority of what Americans buy.

“Two-thirds of consumers buy used cars, not new cars,” Cross said. “EV’s are predominantly new cars but now we’re starting to see a used EV market begin to take shape. ”

The Inflation Reduction Act has a $4,000 tax credit for used cars that began last year on January 1, 2023. Used vehicles must be at least two years old and cost $25,000 or less. There are also income limitations.

EVHybridNoire is a nonprofit based in Atlanta that works to amplify and increase awareness of EV adoption. Part of that work for the Co-Founder of EVHybridNoire Dr. Shelley Francis is to make sure more communities know the benefits.

“A lot of people think EVs cost $100,000 and they are for people in the suburbs,” Francis said. “The average cost of a new vehicle (gas-powered and all-electric) is $50,000 and for used is $30,000. There are a lot of EVs much less than $50,000.”

Francis points to the the BMW i3, Chevy Bolt, KIA, Ford’s Mach-E as used cars that are all under $30,000.

This week, Rodney Crawford, who sells used cars at Budget on Veterans Parkway sold a 2020 Tesla for $25,000.

There have only been a few that come on the lot over the past years, but now, “they are starting to trickle in”, Crawford said. “The $4,000 rebate is possible for the customer.”

He just got another 2020 Tesla on his lot when the Ledger-Enquirer spoke to him on Wednesday.

The latest updates as of January 1, 2024, to the IRA are what experts call the “point of sale change”, meaning you can get the rebate money at the dealership.

“Thanks to the IRA for the first time a tax credit that can be discount on the price of vehicle at purchase,” Cross said.

However, there remains a $210 registration fee for EV’s in Georgia. This is a policy Francis is hoping to change. She’s working with United States Congressman Sanford Bishop to support the removal of this fee.

“We’ve engaged with congressman and team down there [Muscogee County]to garner support,” she said. “Sanford Bishop is a big supporter of our project.”

Ensuring the transition is equitable means effort across sectors.

“We need to recognize that as a nation we’ve never successfully deployed new technology equitably. We’re trying to do the right thing for the first time. That will take effort across the ecosystem from manufacturers to state agencies to advocates,” Cross said.