Exelixis (EXEL) Q2 Earnings Beat, Cabometyx Maintains Growth

Exelixis, Inc. EXEL reported earnings of 22 cents in the second quarter of 2022, beating the Zacks Consensus Estimate of 20 cents. In the year-ago quarter, EXEL reported earnings of 30 cents per share.

Excluding stock-based compensation expense, earnings per share came in at 28 cents, down from 37 cents in the year-ago quarter. The year-over-year decline in earnings was mainly due to higher operating expenses.

Net revenues came in at $419.4 million, which surpassed the Zacks Consensus Estimate of $391 and increased from $385.2 million reported in the year-ago quarter.

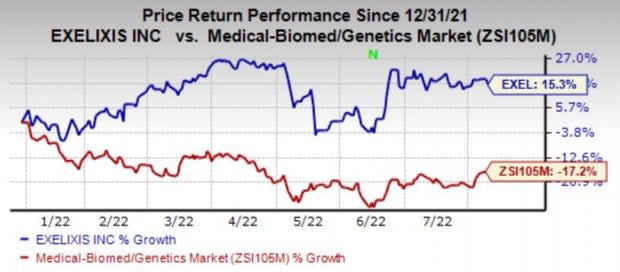

Exelixis’ shares have gained 15.3% in the year so far against the industry’s decline of 17.2%.

Image Source: Zacks Investment Research

Quarter in Detail

Net product revenues came in at $347 million, up from $284.2 million in the year-ago quarter. The upside was primarily led by higher sales volume.

Cabometyx generated revenues of $339.2 million. It is approved for advanced renal cell carcinoma (RCC) and previously treated hepatocellular carcinoma (HCC). Cometriq (cabozantinib capsules) for the treatment of medullary thyroid cancer generated $7.9 million of net product revenues. EXEL earned $30.2 million of royalty revenues.

Collaboration revenues, comprising license revenues and collaboration services revenues, were $72.4 million in the quarter compared with $100.9 million in the year-ago quarter. The decrease in collaboration revenues was primarily related to a decline in development cost reimbursements earned.

In the reported quarter, research and development expenses were $199.5 million, up from $148.8 million in the year-ago quarter. The increases in research and development expenses were primarily related to the rise in personnel expenses, clinical trial costs, license and other collaboration costs, and consulting and outside services expenses. Selling, general and administrative expenses were $122.8 million, up from $98.5 million in the year-ago quarter.

Exelixis, Inc. Price, Consensus and EPS Surprise

Exelixis, Inc. price-consensus-eps-surprise-chart | Exelixis, Inc. Quote

Pipeline Update

In May 2022, Exelixis’ partner Ipsen secured approval from the European Commission for Cabometyx as a monotherapy to treat adult patients with locally advanced or metastatic differentiated thyroid cancer (DTC), refractory or not eligible to radioactive iodine (RAI) and who progressed during or after prior systemic therapy. Exelixis is entitled to receive $27.0 million in milestone payments from Ipsen, of which $25.7 million was recognized in license revenues and collaboration services revenues in the reported quarter.

COSMIC-313, a phase III study evaluating cabozantinib in combination with Bristol Myers’ BMY Opdivo (nivolumab) and Yervoy (ipilimumab) in previously untreated advanced RCC, met its primary endpoint, demonstrating significant improvement in progression-free survival (PFS) at the primary analysis. However, at a prespecified interim analysis for the secondary endpoint of overall survival (OS), the combination of cabozantinib, nivolumab and ipilimumab did not demonstrate a significant benefit versus the combination of nivolumab and ipilimumab. Exelixis intends to discuss the results with the FDA to determine the next steps toward a potential regulatory submission for the combination regimen for patients with previously untreated advanced intermediate- or poor-risk RCC.

In April 2022, Exelixis initiated the dose-escalation stage of the first-in-human phase I trial of XL114, a novel anti-cancer compound that inhibits the CARD11-BCL10-MALT1 complex as a monotherapy in patients with non-Hodgkin’s lymphoma (NHL) who received prior standard therapies.

2022 Guidance Reiterated

Revenues are projected within $1.525-$1.625 billion, while product revenues are estimated in the range of $1.325-$1.425 billion.

Our Take

Exelixis’ second-quarter results were strong, with a beat on both counts. The approval of Cabometyx combined with the immuno-oncology drug Opdivo for advanced RCC boosted sales. However, competition is stiff in this space and capturing additional market share might become tough.

Bristol-Myers’ Opdivo, one of its leading revenue generators, is approved for various oncology indications.

Merck’s MRK Keytruda, in combination with Pfizer’s PFE Inlyta, is also indicated for the first-line treatment of patients with advanced RCC.

MRK’s Keytruda, an anti-PD-1 therapy, is approved for the adjuvant treatment of patients with RCC at intermediate-high or high risk of recurrence following nephrectomy or nephrectomy and resection of metastatic lesions.

PFE’s Inlyta showed a strong performance, boosted by a continued adoption in the United States and Europe. Pfizer’s older drug Sutent is also approved for advanced RCC.

Exelixis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research