Exxon Mobil Shares Sink Despite Earnings Beat

- By Sydnee Gatewood

As low oil demand related to the Covid-19 pandemic continues to weigh on operations, Exxon Mobil Corp. (NYSE:XOM) reported its third straight quarter of losses before the opening bell on Friday.

The Irving, Texas-based oil and gas giant posted a $680 million loss for the three months ended Sept. 30, though the company noted it was an improvement from the previous quarter as the industry began to witness "early stages of demand recovery."

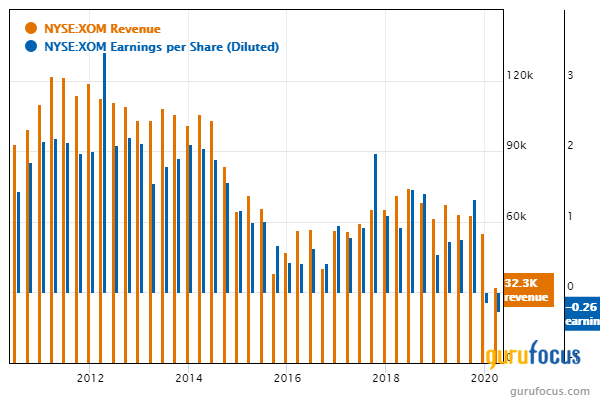

On an adjusted basis, Exxon Mobil recorded a loss of 18 cents per share, which was ahead of Refinitiv's estimated loss of 25 cents. Revenue of $46.2 billion also edged past expectations of $46.01 billion, but was down nearly 30% from the $65.05 billion in sales it reported in the prior-year quarter.

In spite of the difficult environment and the stock being removed from the Dow Jones Industrial Average in August, Chairman and CEO Darren Woods said Exxon Mobil "remain[s] confident in our long-term strategy and the fundamentals of our business, and are taking the necessary actions to preserve value while protecting the balance sheet and dividend."

"We are on pace to achieve our 2020 cost-reduction targets and are progressing additional savings next year as we manage through this unprecedented down cycle," he added.

Exxon Mobil noted the previously announced reduction in its capital spending program, which was cut from $33 billion to $23 billion, is ahead of schedule due to increased efficiency and a slower project pace. For 2021, the company is projecting capital spending between $16 billion and $19 billion. It is also dedicated to maintaining its dividend. On Wednesday, Exxon declared a fourth-quarter distribution of 87 cents per share, which will be paid on Dec. 10.

As a result of the pandemic, however, the oil major announced on Thursday it will reduce its U.S. workforce by around 1,900 employees, while global workforce reductions could potentially increase to as much as 15%.

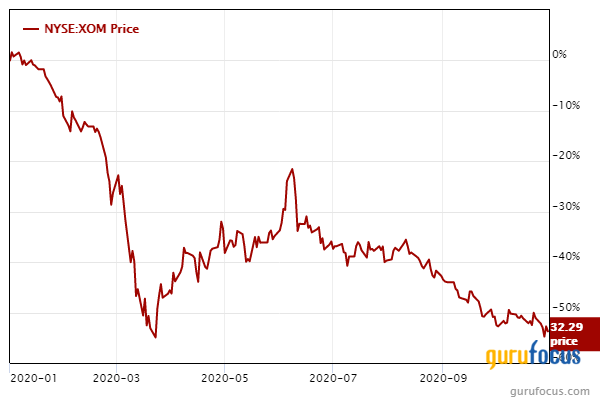

With a market cap of $140.04 billion, shares of Exxon Mobil were down 1.17% on Friday morning at $32.59. GuruFocus data shows the stock has tumbled over 50% year to date.

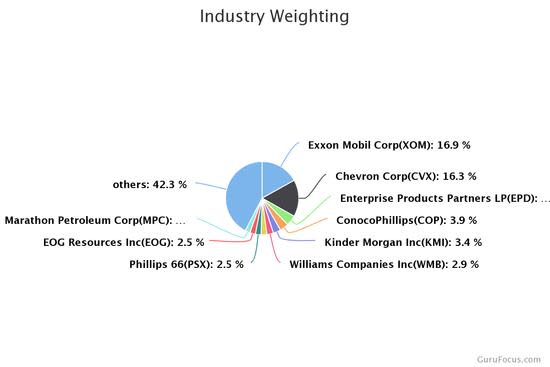

Regardless of these developments, the GuruFocus Industry Overview shows Exxon Mobil remains one of the largest players in the oil and gas sector, along with Chevron Corp. (NYSE:CVX).

Disclosure: No positions.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.