EY warned NMC Health over bank account discrepancies

Auditors at EY raised red flags about shortcomings in NMC Health’s financial controls a year before the company went bust after more than $4bn (£3.2bn) in debt was uncovered.

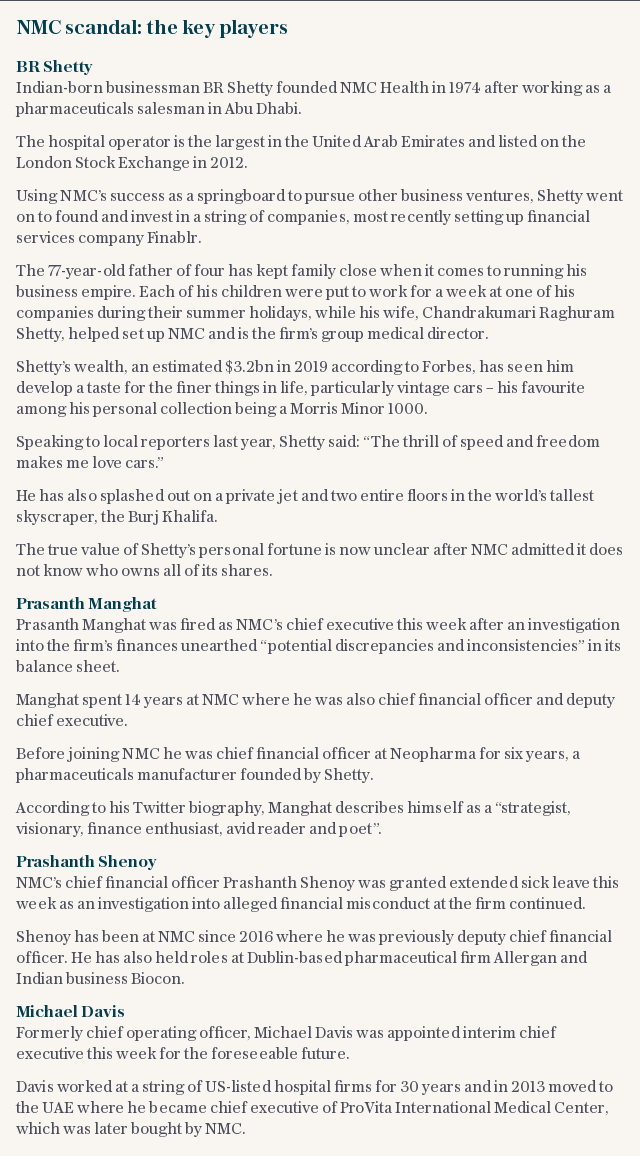

EY initially believed that £220m worth of loans and overdrafts had been omitted from the balance sheet before it discovered that Bank of Baroda, one of India’s largest banks, had confused bank accounts belonging to the hospital operator with those of its founder BR Shetty, the Financial Times reported.

In talks with NMC’s management, its audit committee and the bank, EY was told the discrepancy was the result of bank accounts being incorrectly tagged in the name of an NMC subsidiary instead of Mr Shetty, a memo showed.

EY signed off on the accounts after the discrepancy, which was raised in March 2019, was clarified but warned NMC’s audit committee of deficiencies in its controls relating to bank balances. The auditor said these should be addressed as a “high priority”.

NMC was a FTSE 100 company when its shares were suspended in February as details of previously undisclosed borrowings began to emerge.

The Abu Dhabi-based firm was placed into administration in April amid allegations of fraud.

Insolvency experts Alvarez & Marsal are quizzing directors, shareholders and staff to establish the firm’s true financial position and salvage assets for creditors. NMC’s hospitals are still operating.

Bank of Baroda had to scramble to clarify the ownership of the accounts in the days before EY signed off on NMC’s financial statements, it was reported.

In a memo, EY called on NMC to strengthen its internal controls for dealing with banks and suggested management periodically obtain independent confirmations from all its banks.

EY has faced intense scrutiny in recent weeks after Wirecard, which was audited by its German division, filed for insolvency after a major accounting scandal and suspected fraud.

NMC Health and EY both declined to comment.