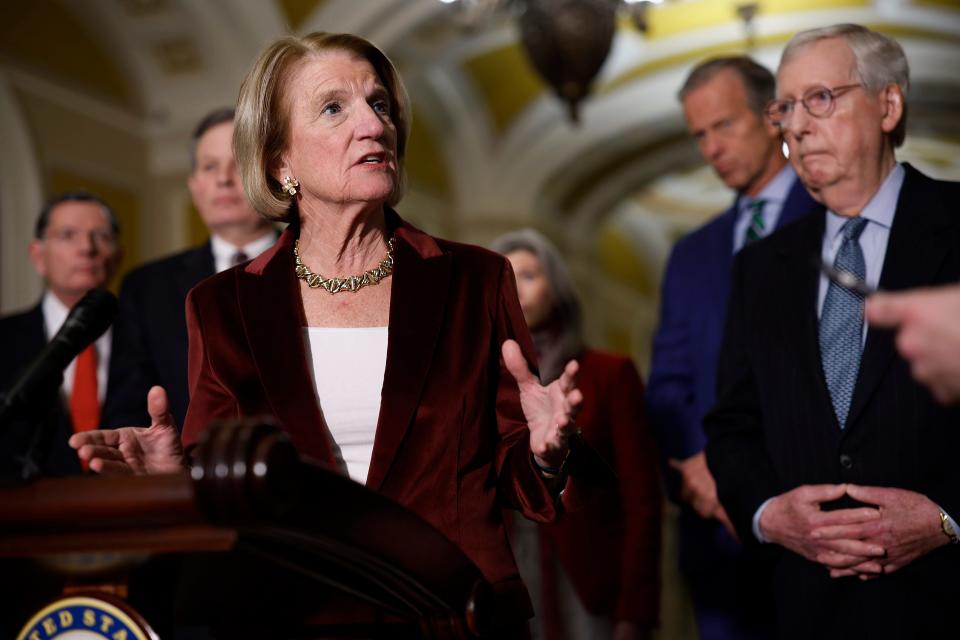

Fact-checking Shelley Moore Capito on high mortgage rates and their causes

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Shelley Moore Capito

Statement: “#Bidenomics has led to mortgage rates hitting a 21-year high → over 7%.”

In a social media post, Sen. Shelley Moore Capito, R-W.Va., noted a recent rise in mortgage interest rates and blamed President Joe Biden for it.

"#Bidenomics has led to mortgage rates hitting a 21-year high → over 7%," Capito posted Aug. 23 on X, the social media platform formerly known as Twitter. "The hope of buying a home continues to shrink under this administration."

Capito added in a subsequent X post, “ ‘Bidenomics’ is certainly not a science and certainly not something to celebrate. West Virginians are getting less, while spending more because of this administration’s reckless economic policies."

We found that Capito is correct about mortgage rates hitting a 21-year high. However, economists cautioned that Biden’s policies are not the only factor pushing mortgage rates higher.

As evidence, Capito’s post linked to an Aug. 17 New York Times article headlined, "U.S. mortgage rates jump to highest level since 2002." The article reported that the 30-year fixed-rate mortgage average had just hit 7.09%.

The average 30-year mortgage rate hadn’t been that high since April 2002, when it reached 7.13%. Since Capito shared her post, the average 30-year mortgage rate has continued to rise, hitting 7.49% Oct. 5. (The record was set in October 1981, when mortgage rates exceeded 18%.)

So Capito is on track with the numbers. What about the cause? That’s more complicated.

Economists generally agree that some of Biden’s policies — notably the enactment of his coronavirus relief bill, the American Rescue Plan, in early 2021 — probably added to the pressures that pushed prices up.

The American Rescue Plan (which passed with exclusively Democratic support in Congress) put more money in Americans’ hands when supply chains, still hampered by the pandemic, couldn’t produce enough goods to fulfill consumer demand. This worsened the rise of prices, which were already increasing because of the supply chain disruptions that preceded the law’s passage.

To curb this inflation, the Federal Reserve in March 2022 began raising interest rates. Fed interest rate hikes are considered the most effective economic tools for curbing inflation, because they tend to cool the economy, which eases demand and lowers prices.

The Fed’s rate increases have helped reduce inflation by two-thirds. However, a side effect of these rate hikes is that they also push up other types of interest rates — including for mortgages.

"Most of the increase (in mortgage rates) is due to the Fed’s anti-inflation policy that they have been pursuing since early last year," said John Deskins, director of the West Virginia University Bureau of Business and Economic Research.

However, blaming these events entirely on Biden’s policies is an exaggeration, economists say.

"The drivers of this inflation go back to COVID — issues like supply chain constraints, workforce shortages and other factors," Deskins said. "That is much larger than any particular Biden policy."

Gary Burtless, an economist with the Brookings Institution, a Washington-based think tank, said Biden should "assume some responsibility, but so should members of Congress who voted in favor of stimulus payments, tax cuts, generous unemployment benefits, aid to states and private businesses during and after the COVID-19 pandemic recession."

Although the American Rescue Plan got no Republican support in Congress, earlier pandemic relief bills passed on an overwhelmingly bipartisan basis.

Burtless added that from the perspective of Biden’s first month in office, when the pandemic was still a major danger to the economy and health, it’s understandable why he sought passage of the American Rescue Plan.

"The federal fiscal stimulus and the Fed’s low-interest rate policy in 2020-2021 were necessary measures to protect households and boost the economy," Burtless said. "But those excellent policies in 2020-2021 in turn helped produce higher inflation and higher interest rates in 2022-2023."

In a statement to PolitiFact West Virginia. Capito’s office dialed down the rhetoric. The office called Biden’s policies "a major contributing factor" to inflation.

Biden’s increases in federal spending, Capito’s office said in the statement, have proved "to be a major contributing factor to high inflation. Inflation is causing high interest rates, and in turn, causing mortgage rates to hit a 21-year high."

Our ruling

Capito said, "#Bidenomics has led to mortgage rates hitting a 21-year high — over 7%."

Numerically, Capito is on target: Mortgage rates hit a 21-year high in August, reaching 7.09%. Rates have risen this high because the Federal Reserve has been raising interest rates in a bid to cool inflation, which reached a 40-year high in 2022.

However, economists say that Capito’s post oversimplifies the role of Biden’s policies. Some legislation, including the American Rescue Plan, probably helped worsen the inflation that prompted the Fed’s rate hikes, they said, but the conditions for surging inflation were already in place before the law was enacted.

We rate the statement Mostly True.

This article originally appeared on Austin American-Statesman: Fact-checking Sen. Capito on high mortgage rates and their causes