Federal money, improving efficiency pushing solar energy in Montana

As recently as a decade ago, a common public perception of solar energy was that it was inefficient, unreliable and expensive. To actively generate electricity using photovoltaic panels on your roof or from a ground-mounted array was something that might appeal to environmentalists or homeowners in the desert southwest but made little sense on the high plains of Montana, where the pale winter sun can remain obscured by clouds for weeks at a time.

Yet a growing number of Montanans are taking another look at solar, and not just because it’s a renewable energy source that can make you feel good about reducing greenhouse gas emissions. Modern solar panels are twice as efficient and about one-quarter the price of what they were just 15 years ago.

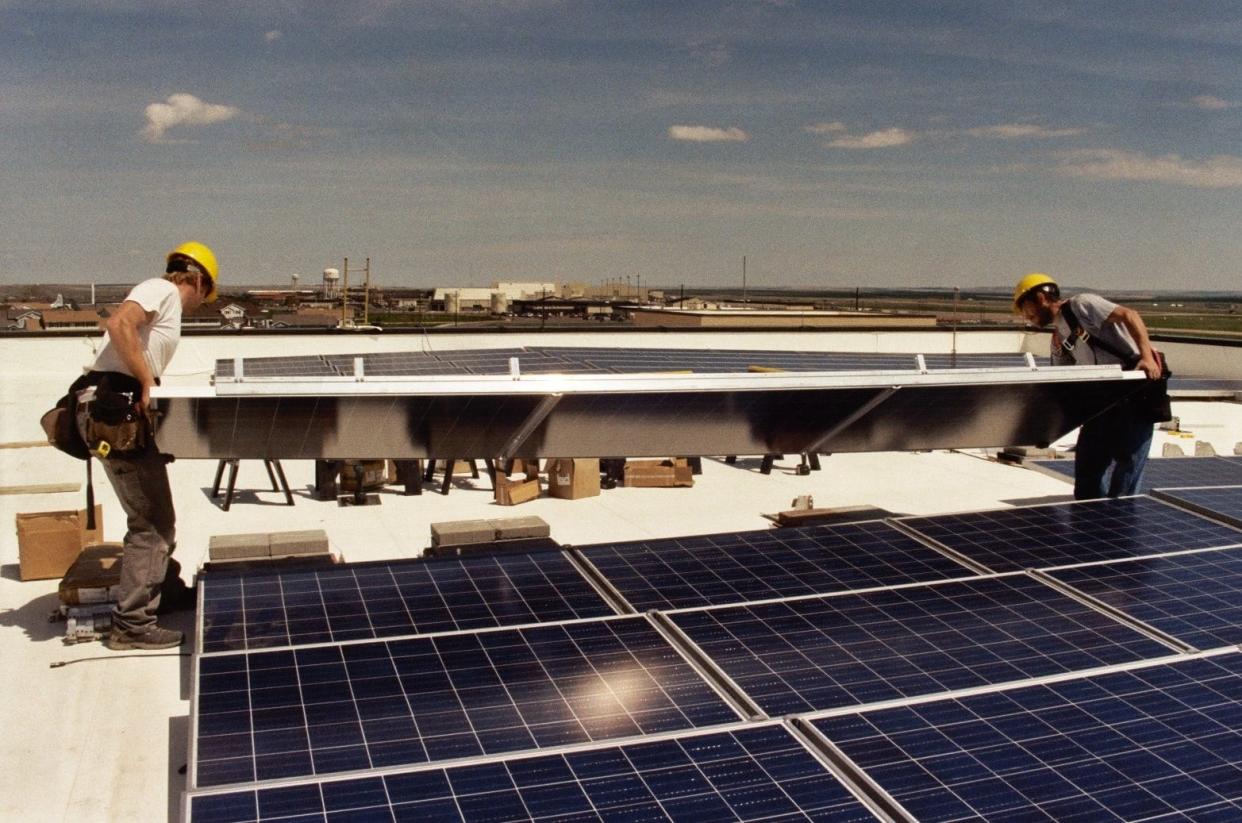

A moderately sized commercial building easily be fitted with a solar energy system capable of producing 50kW of electricity, enough to power two modern homes when operating at peak capacity.

But the factor that’s really driving even tight-fisted conservatives to take a more generous view of solar is the current schedule of federal grants and tax credits that combined can lower the cost of installing a photovoltaic solar system by as much as 65%.

“Statewide, the increase in solar installations has been huge,” said John Palm, CEO of Bozeman Green Build, a renewable energy systems company that’s been operating in Montana for more than 30 years.

He said that there is a segment of his customers who are most interested in solar’s environmental benefits: those who have a cabin in the woods they want to electrify or who value self-reliance and want to be less reliant on big utility companies. However, the biggest single motivation is always financial – seeing a net return on investment.

“There is no single political leaning of our customers one way or the other,” Palm said. “We have what I would call extreme leftists and extreme conservatives, both. Saving money makes all of them feel good.”

“I’m going to get 30% of my investment back as a tax credit that will reduce my tax burden,” said Olaf Stimac, a retired pipe fitter who recently had a large solar array attached to the roof of his shop north of Great Falls. “That was a big part of it, and I’m doing a good thing for the environment.”

Stimac has worked in heavy industrial settings throughout his career and generally supports fossil fuel industries as a valuable and necessary component of the economy.

“I’m not a radical environmentalist,” he said matter-of-factly. “I’m just an ordinary, middle-class working guy.”

“Oil and coal are going to be part of our economy for some time,” Stimac added. “Even though solar’s not the ultimate answer to everything, it is a part of it. It makes you feel good that you are doing something - and my electricity bill is less, which makes me happy.”

The federal government has long funded grants and tax credits to encourage renewable energy production. Rural Energy for America Program (REAP) grants for up to 25% of the total cost of a solar project have been available since 2014, and a 21% federal tax credit on the remaining cost has been around since the George W. Bush administration.

What’s changed is the implementation of the Inflation Reduction Act of 2022 (IRA). The Biden Administration legislation included $369 billion for energy security and climate change programs over the next 10 years, with more than $2 billion dedicated to fund grants for private alternative energy generation systems. The extra funding has made installing a private solar energy system its most affordable ever.

“Forever, REAP grants were 25% of the full cost of the project,” Palm noted. “Then the Inflation Reduction Act bumped it up to 50%. “The IRA also increased the tax credit from 22% … then on Jan.1, 2023 they bumped it back up to 30% for the next 10 years. “That’s basically for anybody, residential, business it doesn’t matter. That made quite a difference.”

“Really the only thing between more solar and the people who want it is education,” he added. “I think folks just don’t know how it works, they don’t understand the benefits and they just need the opportunity to dig into it a little bit.”

Leading the campaign to educate the public about the current opportunities for solar power installation is the Northern Plains Resource Council (NPRC). Founded by Montana ranchers in the early 1970s to oppose coal company efforts to strip mine the Powder River Basin, the non-profit foundation now includes 13 affiliated local groups dedicated to conserving family farms and ranches.

Included among these is the NPRC’s newest affiliate, the Golden Triangle Resource Council (GTRC) serving Cascade, Teton, Chouteau and Pondera Counties. The GTRC has launched an educational program they call “Solarize Golden Triangle.” The council’s motto for their program is “If you’ve got a roof, you're eligible.”

“We created ‘Solarize’ to give folks in our four-county area the information, community support, and motivation they might need to take the leap and start generating solar energy at their home, farm, ranch, or business,” said Lori Benjamin, Chair of GTRC. “Already, we’ve had 78 folks sign up to have their property assessed for solar. People are clearly interested in reducing their power bills and helping their communities achieve more resilience and energy-independence.”

Solar energy in the U.S. still only accounts for about 3% of all utility-scale electricity production, a far smaller share than natural gas (38%) or coal (22%). However, the rate of solar energy expansion has taken off over the last few years, having doubled since 2016.

“Residential solar power installations rose by 34% from 2.9 gigawatts in 2020 to 3.9 gigawatts in 2021,” data from the U.S. Energy Information Administration (EIA) states. In the second quarter of 2022, residential solar set its fifth consecutive quarterly growth record, according to the Solar Energy Industries Association.

A large portion of the growing interest in solar panels is fueled by Chinese investment in the industry. China is home to the largest solar panel production in the world and has ramped up to make photovoltaic cells vastly more affordable.

”Thank the Chinese,” Palm said with a hint of irony. “Without their buckling down and having decided to increase the production in the way that they did, who knows where we’d be right now in pricing. They set the pricing for the entire world market.”

“I would guess that the average panel you would have purchased in 2008 … was somewhere in 175W to 200W class (enough to power a laptop computer) and now the residential panels were installing are 400W, and the commercial panels are as much as 540W (enough to run a small refrigerator). So, they’ve increased in efficiency quite a bit. Hand-in-hand with that is that the cost has come down quite a bit, somewhere in the neighborhood of 25% of what it was 15-years ago.”

Today a moderately sized business typically has enough roof space to power a 50kW solar energy system, enough to run two modern homes during a solar system’s peak energy production period.

An important consideration when assessing a solar energy system is the potential for ‘Net Metering.’ Montana law mandates that regional energy suppliers like NorthWestern Energy buy the excess energy produced by renewable energy systems linked to their metering system. NorthWestern does not issue checks for the excess but records the excess as energy credits that can be used during winter months when the solar systems are not as productive.

Installing a new solar energy production is still expensive. Many different factors apply to the cost of any given system, but on average, Palm estimates the cost for an average 700W system typical to a private home at between $24,000 and $28,000. However, with the federal incentives, a reasonable expectation is for the system to pay for itself in reduced energy costs within six to 12 years depending upon which plan you qualify for.

“You have a positive cash flow from these systems as soon as they reach their payback period,” Palm explained. “With the REAP grant at 50% plus the federal tax of 30% you're looking at a 65% reduction in cost, and the payback time on those systems is at about six years. That’s an incredibly short period.”

“I had enough room for all the panels,” Stimac said, noting that he was not personally eligible for a REAP grant. “It looks like an 11-year payback on the investment, with a system that has a 25-year lifespan. That’s a really good deal for me.”

For more information on the availability of solar energy for your home or business, contact the Golden Triangle Resource Council at www.northernplains.org or through the Northern Plains Resource Council at www,northernplain.org

This article originally appeared on Great Falls Tribune: Solar energy growing in Montana due to cost, tax credits