Fentura Financial, Inc. Announces Third Quarter 2020 Earnings

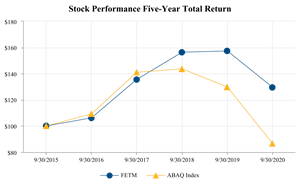

Stock Performance Five-Year Total Return

Stock Performance Five-Year Total Return

Dollars in thousands except per share amounts. Certain items in the prior period financial statements have been reclassified to conform with the September 30, 2020 presentation.

FENTON, Mich., Oct. 29, 2020 (GLOBE NEWSWIRE) -- Fentura Financial, Inc. (OTCQX: FETM) announces quarterly results of net income of $5,336 and $12,731 for the three and nine month periods ended September 30, 2020.

Ronald Justice, President and CEO, stated I remain extremely proud of our team. Throughout the COVID-19 pandemic, they have remained committed to safely serving the needs of our customers and communities. While the virus has presented many health and economic challenges, we are focused on enhancing long term shareholder value through consistent financial performance.

Following is a discussion of the Corporation's financial performance as of, and for the three and nine month periods ended September 30, 2020. At the end of this document is a list of abbreviations and acronyms.

Results of Operations

The following table outlines the Corporation's QTD results of operations and provides certain performance measures as of, and for the three month periods ended:

|

| 9/30/2020 |

| 6/30/2020 |

| 3/31/2020 |

| 12/31/2019 |

| 9/30/2019 | ||||||||||

INCOME STATEMENT DATA |

|

|

|

|

|

|

|

|

|

| ||||||||||

Interest income |

| $ | 12,070 |

|

| $ | 11,215 |

|

| $ | 11,070 |

|

| $ | 11,076 |

|

| $ | 11,240 |

|

Interest expense |

| 1,189 |

|

| 1,618 |

|

| 2,145 |

|

| 2,158 |

|

| 2,184 |

| |||||

Net interest income |

| 10,881 |

|

| 9,597 |

|

| 8,925 |

|

| 8,918 |

|

| 9,056 |

| |||||

Provision for loan losses |

| 1,109 |

|

| 2,001 |

|

| 1,542 |

|

| 436 |

|

| 422 |

| |||||

Noninterest income |

| 5,159 |

|

| 5,292 |

|

| 4,513 |

|

| 2,129 |

|

| 2,262 |

| |||||

Noninterest expenses |

| 8,218 |

|

| 7,809 |

|

| 7,686 |

|

| 7,415 |

|

| 6,608 |

| |||||

Federal income tax expense |

| 1,377 |

|

| 1,036 |

|

| 858 |

|

| 644 |

|

| 873 |

| |||||

Net income |

| $ | 5,336 |

|

| $ | 4,043 |

|

| $ | 3,352 |

|

| $ | 2,552 |

|

| $ | 3,415 |

|

PER SHARE |

|

|

|

|

|

|

|

|

|

| ||||||||||

Earnings |

| $ | 1.14 |

|

| $ | 0.87 |

|

| $ | 0.72 |

|

| $ | 0.55 |

|

| $ | 0.73 |

|

Dividends |

| $ | 0.075 |

|

| $ | 0.075 |

|

| $ | 0.075 |

|

| $ | 0.07 |

|

| $ | 0.07 |

|

Tangible book value (1) |

| $ | 23.50 |

|

| $ | 22.44 |

|

| $ | 21.56 |

|

| $ | 20.87 |

|

| $ | 20.37 |

|

Quoted market value |

|

|

|

|

|

|

|

|

|

| ||||||||||

High |

| $ | 17.99 |

|

| $ | 18.95 |

|

| $ | 26.00 |

|

| $ | 25.50 |

|

| $ | 21.00 |

|

Low |

| $ | 16.80 |

|

| $ | 14.90 |

|

| $ | 12.55 |

|

| $ | 20.60 |

|

| $ | 20.45 |

|

Close (1) |

| $ | 16.93 |

|

| $ | 17.35 |

|

| $ | 15.50 |

|

| $ | 25.23 |

|

| $ | 21.00 |

|

PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

| ||||||||||

Return on average assets |

| 1.68 | % |

| 1.35 | % |

| 1.28 | % |

| 1.02 | % |

| 1.40 | % | |||||

Return on average shareholders' equity |

| 18.86 | % |

| 15.20 | % |

| 13.01 | % |

| 10.03 | % |

| 13.83 | % | |||||

Return on average tangible shareholders' equity |

| 19.54 | % |

| 15.79 | % |

| 13.54 | % |

| 10.46 | % |

| 14.47 | % | |||||

Efficiency ratio |

| 51.23 | % |

| 52.45 | % |

| 57.20 | % |

| 67.12 | % |

| 58.38 | % | |||||

Yield on earning assets (FTE) |

| 3.97 | % |

| 3.94 | % |

| 4.47 | % |

| 4.66 | % |

| 4.85 | % | |||||

Rate on interest bearing liabilities |

| 0.63 | % |

| 0.91 | % |

| 1.28 | % |

| 1.36 | % |

| 1.42 | % | |||||

Net interest margin to earning assets (FTE) |

| 3.58 | % |

| 3.37 | % |

| 3.61 | % |

| 3.75 | % |

| 3.91 | % | |||||

BALANCE SHEET DATA (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Total investment securities |

| $ | 78,179 |

|

| $ | 75,526 |

|

| $ | 76,312 |

|

| $ | 61,621 |

|

| $ | 62,351 |

|

Gross loans |

| $ | 1,060,885 |

|

| $ | 1,044,564 |

|

| $ | 865,577 |

|

| $ | 870,555 |

|

| $ | 826,597 |

|

Total assets |

| $ | 1,284,845 |

|

| $ | 1,237,694 |

|

| $ | 1,071,180 |

|

| $ | 1,034,759 |

|

| $ | 978,046 |

|

Total deposits |

| $ | 1,061,470 |

|

| $ | 1,018,287 |

|

| $ | 883,837 |

|

| $ | 863,102 |

|

| $ | 801,101 |

|

Borrowed funds |

| $ | 96,217 |

|

| $ | 96,217 |

|

| $ | 71,500 |

|

| $ | 61,500 |

|

| $ | 69,000 |

|

Total shareholders' equity |

| $ | 114,081 |

|

| $ | 108,969 |

|

| $ | 104,828 |

|

| $ | 101,444 |

|

| $ | 99,142 |

|

Net loans to total deposits |

| 98.99 | % |

| 101.70 | % |

| 97.11 | % |

| 100.19 | % |

| 102.51 | % | |||||

Common shares outstanding |

| 4,691,142 |

|

| 4,680,920 |

|

| 4,675,499 |

|

| 4,664,369 |

|

| 4,658,722 |

| |||||

QTD BALANCE SHEET AVERAGES |

|

|

|

|

|

|

|

|

|

| ||||||||||

Total assets |

| $ | 1,264,105 |

|

| $ | 1,200,966 |

|

| $ | 1,049,245 |

|

| $ | 994,094 |

|

| $ | 971,074 |

|

Earning assets |

| $ | 1,210,274 |

|

| $ | 1,146,941 |

|

| $ | 997,089 |

|

| $ | 944,692 |

|

| $ | 920,857 |

|

Interest bearing liabilities |

| $ | 750,281 |

|

| $ | 711,500 |

|

| $ | 672,564 |

|

| $ | 629,454 |

|

| $ | 611,804 |

|

Total shareholders' equity |

| $ | 112,565 |

|

| $ | 106,998 |

|

| $ | 103,646 |

|

| $ | 100,991 |

|

| $ | 97,958 |

|

Total tangible shareholders' equity |

| $ | 108,655 |

|

| $ | 102,999 |

|

| $ | 99,558 |

|

| $ | 96,796 |

|

| $ | 93,650 |

|

Earned common shares outstanding |

| 4,673,629 |

|

| 4,664,946 |

|

| 4,659,279 |

|

| 4,652,569 |

|

| 4,646,835 |

| |||||

Unvested stock grants |

| 14,208 |

|

| 14,208 |

|

| 13,481 |

|

| 9,947 |

|

| 9,967 |

| |||||

Total common shares outstanding |

| 4,687,837 |

|

| 4,679,154 |

|

| 4,672,760 |

|

| 4,662,516 |

|

| 4,656,802 |

| |||||

ASSET QUALITY (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Nonperforming loans to gross loans |

| 0.07 | % |

| 0.10 | % |

| 0.10 | % |

| 0.17 | % |

| 0.11 | % | |||||

Nonperforming assets to total assets |

| 0.06 | % |

| 0.08 | % |

| 0.12 | % |

| 0.14 | % |

| 0.09 | % | |||||

Allowance for loan losses to gross loans |

| 0.95 | % |

| 0.86 | % |

| 0.84 | % |

| 0.67 | % |

| 0.65 | % | |||||

CAPITAL RATIOS (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Total capital to risk weighted assets |

| 15.57 | % |

| 15.06 | % |

| 14.42 | % |

| 14.03 | % |

| 14.42 | % | |||||

Tier 1 capital to risk weighted assets |

| 14.40 | % |

| 14.00 | % |

| 13.56 | % |

| 13.33 | % |

| 13.73 | % | |||||

CET1 capital to risk weighted assets |

| 12.77 | % |

| 12.34 | % |

| 11.91 | % |

| 11.64 | % |

| 11.96 | % | |||||

Tier 1 leverage ratio |

| 9.86 | % |

| 9.90 | % |

| 10.97 | % |

| 11.20 | % |

| 11.22 | % | |||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||

(1) At end of period |

|

|

|

|

|

|

|

|

|

| ||||||||||

The following table outlines the Corporation's YTD results of operations and provides certain performance measures as of, and for the nine month periods ended:

|

| 9/30/2020 |

| 9/30/2019 |

| 9/30/2018 |

| 9/30/2017 |

| 9/30/2016 | ||||||||||

INCOME STATEMENT DATA |

|

|

|

|

|

|

|

|

|

| ||||||||||

Interest income |

| $ | 34,355 |

|

| $ | 32,465 |

|

| $ | 26,419 |

|

| $ | 21,246 |

|

| $ | 13,693 |

|

Interest expense |

| 4,952 |

|

| 6,469 |

|

| 3,901 |

|

| 2,181 |

|

| 1,758 |

| |||||

Net interest income |

| 29,403 |

|

| 25,996 |

|

| 22,518 |

|

| 19,065 |

|

| 11,935 |

| |||||

Provision for loan losses |

| 4,652 |

|

| 899 |

|

| 767 |

|

| 261 |

|

|

| ||||||

Noninterest income |

| 14,964 |

|

| 6,034 |

|

| 6,574 |

|

| 6,768 |

|

| 4,880 |

| |||||

Noninterest expenses |

| 23,713 |

|

| 19,808 |

|

| 18,403 |

|

| 16,418 |

|

| 11,960 |

| |||||

Federal income tax expense |

| 3,271 |

|

| 2,297 |

|

| 1,817 |

|

| 2,640 |

|

| 1,657 |

| |||||

Net income |

| $ | 12,731 |

|

| $ | 9,026 |

|

| $ | 8,105 |

|

| $ | 6,514 |

|

| $ | 3,198 |

|

PER SHARE |

|

|

|

|

|

|

|

|

|

| ||||||||||

Earnings |

| $ | 2.73 |

|

| $ | 1.94 |

|

| $ | 2.23 |

|

| $ | 1.80 |

|

| $ | 1.28 |

|

Dividends |

| $ | 0.23 |

|

| $ | 0.21 |

|

| $ | 0.18 |

|

| $ | 0.15 |

|

| $ | 0.35 |

|

Tangible book value (1) |

| $ | 23.50 |

|

| $ | 20.37 |

|

| $ | 16.91 |

|

| $ | 14.29 |

|

| $ | 13.78 |

|

Quoted market value |

|

|

|

|

|

|

|

|

|

| ||||||||||

High |

| $ | 26.00 |

|

| $ | 21.00 |

|

| $ | 23.00 |

|

| $ | 20.65 |

|

| $ | 15.00 |

|

Low |

| $ | 12.55 |

|

| $ | 20.05 |

|

| $ | 18.88 |

|

| $ | 15.10 |

|

| $ | 12.85 |

|

Close (1) |

| $ | 16.93 |

|

| $ | 21.00 |

|

| $ | 21.15 |

|

| $ | 18.45 |

|

| $ | 14.50 |

|

PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

| ||||||||||

Return on average assets |

| 1.45 | % |

| 1.27 | % |

| 1.32 | % |

| 1.22 | % |

| 0.91 | % | |||||

Return on average shareholders' equity |

| 15.79 | % |

| 12.73 | % |

| 17.29 | % |

| 16.24 | % |

| 12.60 | % | |||||

Return on average tangible shareholders' equity |

| 16.40 | % |

| 13.35 | % |

| 18.77 | % |

| 17.52 | % |

| 12.60 | % | |||||

Efficiency ratio |

| 53.45 | % |

| 61.84 | % |

| 63.26 | % |

| 63.55 | % |

| 71.13 | % | |||||

Yield on earning assets (FTE) |

| 4.11 | % |

| 4.81 | % |

| 4.59 | % |

| 4.15 | % |

| 4.38 | % | |||||

Rate on interest bearing liabilities |

| 0.93 | % |

| 1.43 | % |

| 0.98 | % |

| 0.60 | % |

| 0.77 | % | |||||

Net interest margin to earning assets (FTE) |

| 3.52 | % |

| 3.86 | % |

| 3.91 | % |

| 3.72 | % |

| 3.81 | % | |||||

BALANCE SHEET DATA (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Total investment securities |

| $ | 78,179 |

|

| $ | 62,351 |

|

| $ | 79,531 |

|

| $ | 67,155 |

|

| $ | 23,300 |

|

Gross loans |

| $ | 1,060,885 |

|

| $ | 826,597 |

|

| $ | 728,302 |

|

| $ | 628,552 |

|

| $ | 413,622 |

|

Total assets |

| $ | 1,284,845 |

|

| $ | 978,046 |

|

| $ | 909,901 |

|

| $ | 756,967 |

|

| $ | 500,551 |

|

Total deposits |

| $ | 1,061,470 |

|

| $ | 801,101 |

|

| $ | 766,587 |

|

| $ | 625,588 |

|

| $ | 418,849 |

|

Borrowed funds |

| $ | 96,217 |

|

| $ | 69,000 |

|

| $ | 74,000 |

|

| $ | 68,000 |

|

| $ | 44,000 |

|

Total shareholders' equity |

| $ | 114,081 |

|

| $ | 99,142 |

|

| $ | 66,340 |

|

| $ | 57,161 |

|

| $ | 35,048 |

|

Net loans to total deposits |

| 98.99 | % |

| 102.51 | % |

| 94.46 | % |

| 99.95 | % |

| 97.88 | % | |||||

Common shares outstanding |

| 4,691,142 |

|

| 4,658,722 |

|

| 3,645,402 |

|

| 3,631,576 |

|

| 2,543,832 |

| |||||

YTD BALANCE SHEET AVERAGES |

|

|

|

|

|

|

|

|

|

| ||||||||||

Total assets |

| $ | 1,171,415 |

|

| $ | 950,749 |

|

| $ | 820,481 |

|

| $ | 718,335 |

|

| $ | 467,720 |

|

Earning assets |

| $ | 1,118,093 |

|

| $ | 903,192 |

|

| $ | 772,111 |

|

| $ | 687,175 |

|

| $ | 417,673 |

|

Interest bearing liabilities |

| $ | 711,449 |

|

| $ | 606,912 |

|

| $ | 528,165 |

|

| $ | 481,657 |

|

| $ | 283,548 |

|

Total shareholders' equity |

| $ | 107,711 |

|

| $ | 94,815 |

|

| $ | 62,662 |

|

| $ | 53,760 |

|

| $ | 33,891 |

|

Total tangible shareholders' equity |

| $ | 103,712 |

|

| $ | 90,394 |

|

| $ | 57,732 |

|

| $ | 49,838 |

|

| $ | 33,891 |

|

Earned common shares outstanding |

| 4,665,951 |

|

| 4,641,084 |

|

| 3,638,123 |

|

| 3,618,889 |

|

| 2,506,250 |

| |||||

Unvested stock grants |

| 13,966 |

|

| 9,907 |

|

|

|

|

|

|

| ||||||||

Total common shares outstanding |

| 4,679,917 |

|

| 4,650,991 |

|

| 3,638,123 |

|

| 3,618,889 |

|

| 2,506,250 |

| |||||

ASSET QUALITY (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Nonperforming loans to gross loans |

| 0.07 | % |

| 0.11 | % |

| 0.01 | % |

| 0.03 | % |

| % | ||||||

Nonperforming assets to total assets |

| 0.06 | % |

| 0.09 | % |

| 0.03 | % |

| 0.05 | % |

| 0.06 | % | |||||

Allowance for loan losses to gross loans |

| 0.95 | % |

| 0.65 | % |

| 0.57 | % |

| 0.52 | % |

| 0.88 | % | |||||

CAPITAL RATIOS (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Total capital to risk weighted assets |

| 15.57 | % |

| 14.42 | % |

| 11.31 | % |

| 10.92 | % |

| 12.96 | % | |||||

Tier 1 capital to risk weighted assets |

| 14.40 | % |

| 13.73 | % |

| 10.73 | % |

| 10.41 | % |

| 12.06 | % | |||||

CET1 capital to risk weighted assets |

| 12.77 | % |

| 11.96 | % |

| 8.77 | % |

| 8.23 | % |

| 8.61 | % | |||||

Tier 1 leverage ratio |

| 9.86 | % |

| 11.22 | % |

| 8.90 | % |

| 9.26 | % |

| 10.08 | % | |||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||

(1) At end of period |

|

|

|

|

|

|

|

|

|

| ||||||||||

Income Statement Breakdown and Analysis

|

| Quarter to Date | |||||||||||||||||||||||

|

| 9/30/2020 |

| 6/30/2020 |

| 3/31/2020 |

| 12/31/2019 |

| 9/30/2019 | |||||||||||||||

GAAP net income |

| $ | 5,336 |

|

|

| $ | 4,043 |

|

|

| $ | 3,352 |

|

|

| $ | 2,552 |

|

|

| $ | 3,415 |

|

|

Acquisition related items (net of tax) |

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Accretion on purchased loans |

| (144 | ) |

|

| (110 | ) |

|

| (180 | ) |

|

| (126 | ) |

|

| (189 | ) |

| |||||

Amortization of core deposit intangibles |

| 72 |

|

|

| 71 |

|

|

| 71 |

|

|

| 89 |

|

|

| 88 |

|

| |||||

Amortization on acquired time deposits |

| 5 |

|

|

| 5 |

|

|

| 5 |

|

|

| 7 |

|

|

| 7 |

|

| |||||

Amortization on purchased mortgage servicing rights |

|

|

|

|

|

|

|

|

|

| 3 |

|

|

| 3 |

|

| ||||||||

Total acquisition related items (net of tax) |

| (67 | ) |

|

| (34 | ) |

|

| (104 | ) |

|

| (27 | ) |

|

| (91 | ) |

| |||||

Other nonrecurring items (net of tax) |

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net gain from COLI death benefit |

|

|

|

| (173 | ) |

|

|

|

|

|

|

|

|

|

| |||||||||

Prepayment penalties collected |

| (16 | ) |

|

| (12 | ) |

|

| (36 | ) |

|

| (42 | ) |

|

| (284 | ) |

| |||||

Change in fair value of equity investment due to acquisition transaction |

|

|

|

|

|

|

| (578 | ) |

|

|

|

|

|

|

| |||||||||

Change in fair value of mortgage banking instruments |

|

|

|

|

|

|

| (448 | ) |

|

|

|

|

|

|

| |||||||||

Mortgage servicing rights (reduction of) impairment |

| (176 | ) |

|

| 191 |

|

|

| 173 |

|

|

|

|

|

|

|

| |||||||

Total other nonrecurring items (net of tax) |

| (192 | ) |

|

| 6 |

|

|

| (889 | ) |

|

| (42 | ) |

|

| (284 | ) |

| |||||

Adjusted net income from operations |

| $ | 5,077 |

|

|

| $ | 4,015 |

|

|

| $ | 2,359 |

|

|

| $ | 2,483 |

|

|

| $ | 3,040 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

GAAP net interest income |

| $ | 10,881 |

|

|

| $ | 9,597 |

|

|

| $ | 8,925 |

|

|

| $ | 8,918 |

|

|

| $ | 9,056 |

|

|

Accretion on purchased loans |

| (182 | ) |

|

| (139 | ) |

|

| (228 | ) |

|

| (160 | ) |

|

| (239 | ) |

| |||||

Prepayment penalties collected |

| (20 | ) |

|

| (15 | ) |

|

| (46 | ) |

|

| (53 | ) |

|

| (360 | ) |

| |||||

Amortization on acquired time deposits |

| 6 |

|

|

| 6 |

|

|

| 6 |

|

|

| 9 |

|

|

| 9 |

|

| |||||

Adjusted net interest income |

| $ | 10,685 |

|

|

| $ | 9,449 |

|

|

| $ | 8,657 |

|

|

| $ | 8,714 |

|

|

| $ | 8,466 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Based on adjusted net income from operations |

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Earnings per share |

| $ | 1.09 |

|

|

| $ | 0.86 |

|

|

| $ | 0.51 |

|

|

| $ | 0.53 |

|

|

| $ | 0.65 |

|

|

Return on average assets |

| 1.60 |

| % |

| 1.34 |

| % |

| 0.90 |

| % |

| 0.99 |

| % |

| 1.24 |

| % | |||||

Return on average shareholders' equity |

| 17.94 |

| % |

| 15.09 |

| % |

| 9.15 |

| % |

| 9.75 |

| % |

| 12.31 |

| % | |||||

Return on average tangible shareholders' equity |

| 18.59 |

| % |

| 15.68 |

| % |

| 9.53 |

| % |

| 10.18 |

| % |

| 12.88 |

| % | |||||

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Based on adjusted net interest income |

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Yield on earning assets (FTE) |

| 3.90 |

| % |

| 3.89 |

| % |

| 4.36 |

| % |

| 4.57 |

| % |

| 4.59 |

| % | |||||

Rate on interest bearing liabilities |

| 0.63 |

| % |

| 0.91 |

| % |

| 1.28 |

| % |

| 1.37 |

| % |

| 1.43 |

| % | |||||

Net interest margin to earning assets (FTE) |

| 3.52 |

| % |

| 3.32 |

| % |

| 3.50 |

| % |

| 3.66 |

| % |

| 3.66 |

| % | |||||

|

| Year to Date September 30 |

| Variance | |||||||||||||||

|

| 2020 |

| 2019 |

| Amount |

| % | |||||||||||

GAAP net income |

| $ | 12,731 |

|

|

| $ | 9,026 |

|

|

| $ | 3,705 |

|

|

| 41.05 |

| % |

Acquisition related items (net of tax) |

|

|

|

|

|

|

|

| |||||||||||

Accretion on purchased loans |

| (434 | ) |

|

| (509 | ) |

|

| 75 |

|

|

| (14.73 | ) | % | |||

Amortization of core deposit intangibles |

| 214 |

|

|

| 267 |

|

|

| (53 | ) |

|

| (19.85 | ) | % | |||

Amortization on acquired time deposits |

| 15 |

|

|

| 21 |

|

|

| (6 | ) |

|

| (28.57 | ) | % | |||

Amortization on purchased mortgage servicing rights |

|

|

|

| 9 |

|

|

| (9 | ) |

|

| (100.00 | ) | % | ||||

Total acquisition related items (net of tax) |

| (205 | ) |

|

| (212 | ) |

|

| 7 |

|

|

| (3.30 | ) | % | |||

Other nonrecurring items (net of tax) |

|

|

|

|

|

|

|

| |||||||||||

Change in fair value of equity investment due to acquisition transaction |

| (578 | ) |

|

|

|

|

| (578 | ) |

|

| N/M | ||||||

Change in fair value of mortgage banking instruments |

| (448 | ) |

|

|

|

|

| (448 | ) |

|

| N/M | ||||||

Net gain from COLI death benefit |

| (173 | ) |

|

|

|

|

| (173 | ) |

|

| N/M | ||||||

Prepayment penalties collected |

| (64 | ) |

|

| (307 | ) |

|

| 243 |

|

|

| (79.15 | ) | % | |||

Mortgage servicing rights (reduction of) impairment |

| 188 |

|

|

|

|

|

| 188 |

|

|

| N/M | ||||||

Total other nonrecurring items (net of tax) |

| (1,075 | ) |

|

| (307 | ) |

|

| (768 | ) |

|

| 250.16 |

| % | |||

Adjusted net income from operations |

| $ | 11,451 |

|

|

| $ | 8,507 |

|

|

| $ | 2,944 |

|

|

| 34.61 |

| % |

|

|

|

|

|

|

|

|

| |||||||||||

GAAP net interest income |

| $ | 29,403 |

|

|

| $ | 25,996 |

|

|

| $ | 3,407 |

|

|

| 13.11 |

| % |

Accretion on purchased loans |

| (549 | ) |

|

| (644 | ) |

|

| 95 |

|

|

| (14.75 | ) | % | |||

Prepayment penalties collected |

| (81 | ) |

|

| (388 | ) |

|

| 307 |

|

|

| (79.12 | ) | % | |||

Amortization on acquired time deposits |

| 18 |

|

|

| 26 |

|

|

| (8 | ) |

|

| (30.77 | ) | % | |||

Adjusted net interest income |

| $ | 28,791 |

|

|

| $ | 24,990 |

|

|

| $ | 3,801 |

|

|

| 15.21 |

| % |

|

|

|

|

|

|

|

|

| |||||||||||

PERFORMANCE RATIOS |

|

|

|

|

|

|

|

| |||||||||||

Based on adjusted net income from operations |

|

|

|

|

|

|

|

| |||||||||||

Earnings per share |

| $ | 2.45 |

|

|

| $ | 1.83 |

|

|

| $ | 0.62 |

|

|

| 33.88 |

| % |

Return on average assets |

| 1.31 |

| % |

| 1.20 |

| % |

|

|

| 0.11 |

| % | |||||

Return on average shareholders' equity |

| 14.20 |

| % |

| 12.00 |

| % |

|

|

| 2.20 |

| % | |||||

Return on average tangible shareholders' equity |

| 14.75 |

| % |

| 12.58 |

| % |

|

|

| 2.17 |

| % | |||||

|

|

|

|

|

|

|

|

| |||||||||||

Based on adjusted net interest income |

|

|

|

|

|

|

|

| |||||||||||

Yield on earning assets (FTE) |

| 4.03 |

| % |

| 4.66 |

| % |

|

|

| (0.63 | ) | % | |||||

Rate on interest bearing liabilities |

| 0.93 |

| % |

| 1.44 |

| % |

|

|

| (0.51 | ) | % | |||||

Net interest margin to earning assets (FTE) |

| 3.45 |

| % |

| 3.71 |

| % |

|

|

| (0.26 | ) | % | |||||

To effectively compare core operating results from period to period, the impact of acquisition related items and other nonrecurring items have been isolated.

The Corporation adopted Staff Accounting Bulletin No. 109 as of January 1, 2020. This standard required the Corporation to record the servicing assets of interest rate lock commitments and loans held for sale at fair value. Changes in the fair value of these instruments is recognized as a component of noninterest income. As forward loan sales commitments and interest rate lock commitments were previously recorded at fair value, the nonrecurring item impact disclosed above represents the change in fair value of loans held for sale. Subsequent to the adoption of Staff Accounting Bulletin No. 109, changes in fair value related to mortgage banking are recurring in nature.

Average Balances, Interest Rate, and Net Interest Income

The following tables present the daily average amount outstanding for each major category of interest earning assets, nonearning assets, interest bearing liabilities, and noninterest bearing liabilities. These tables also present an analysis of interest income and interest expense for the periods indicated. All interest income is reported on a FTE basis using a federal income tax rate of 21%. Loans in nonaccrual status, for the purpose of the following computations, are included in the average loan balances.

|

| Three Months Ended | |||||||||||||||||||||||||||||||

|

| September 30, 2020 |

| June 30, 2020 |

| September 30, 2019 | |||||||||||||||||||||||||||

|

| Average Balance |

| Tax Equivalent Interest |

| Average Yield / Rate |

| Average Balance |

| Tax Equivalent Interest |

| Average Yield / Rate |

| Average Balance |

| Tax Equivalent Interest |

| Average Yield / Rate | |||||||||||||||

Interest earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total loans |

| $ | 1,086,629 |

|

| $ | 11,701 |

|

| 4.28 | % |

| $ | 1,048,068 |

| ||||||||||||||||||

Nine Months Ended | ||||||||||||||||||||||

September 30, 2020 | September 30, 2019 | |||||||||||||||||||||

Average Balance | Tax Equivalent Interest | Average Yield / Rate | Average Balance | Tax Equivalent Interest | Average Yield / Rate | |||||||||||||||||

Interest earning assets | ||||||||||||||||||||||

Total loans | $ | 1,004,477 | $ | 32,970 | 4.38 | % | $ | 808,159 | $ | 30,521 | 5.05 | % | ||||||||||

Taxable investment securities | 60,760 | 932 | 2.05 | % | 68,219 | 1,396 | 2.74 | % | ||||||||||||||

Nontaxable investment securities | 12,601 | 266 | 2.82 | % | 9,812 | 218 | 2.97 | % | ||||||||||||||

Federal funds sold | 11,196 | 116 | 1.38 | % | 8,928 | 150 | 2.25 | % | ||||||||||||||

Interest earning cash and cash equivalents | 25,753 | 40 | 0.21 | % | 4,924 | 88 | 2.39 | % | ||||||||||||||

Federal Home Loan Bank stock | 3,306 | 87 | 3.52 | % | 3,150 | 138 | 5.86 | % | ||||||||||||||

Total earning assets | 1,118,093 | 34,411 | 4.11 | % | 903,192 | 32,511 | 4.81 | % | ||||||||||||||

Nonearning assets | ||||||||||||||||||||||

Allowance for loan losses | (7,610 | ) | (4,851 | ) | ||||||||||||||||||

Fixed assets | 15,465 | 14,866 | ||||||||||||||||||||

Accrued income and other assets | 45,467 | 37,542 | ||||||||||||||||||||

Total assets | $ | 1,171,415 | $ | 950,749 | ||||||||||||||||||

Interest bearing liabilities | ||||||||||||||||||||||

Interest bearing demand deposits | $ | 194,058 | $ | 868 | 0.60 | % | $ | 82,161 | $ | 445 | 0.72 | % | ||||||||||

Savings deposits | 250,045 | 455 | 0.24 | % | 243,135 | 898 | 0.49 | % | ||||||||||||||

Time deposits | 182,786 | 2,441 | 1.78 | % | 221,903 | 3,746 | 2.26 | % | ||||||||||||||

Borrowed funds | 84,560 | 1,188 | 1.88 | % | 59,713 | 1,380 | 3.09 | % | ||||||||||||||

Total interest bearing liabilities | 711,449 | 4,952 | 0.93 | % | 606,912 | 6,469 | 1.43 | % | ||||||||||||||

Noninterest bearing liabilities | ||||||||||||||||||||||

Noninterest bearing deposits | 341,642 | 243,523 | ||||||||||||||||||||

Accrued interest and other liabilities | 10,613 | 5,499 | ||||||||||||||||||||

Shareholders' equity | 107,711 | 94,815 | ||||||||||||||||||||

Total liabilities and shareholders' equity | $ | 1,171,415 | $ | 950,749 | ||||||||||||||||||

Net interest income (FTE) | $ | 29,459 | $ | 26,042 | ||||||||||||||||||

Net interest margin to earning assets (FTE) | 3.52 | % | 3.86 | % | ||||||||||||||||||

Net Interest Income

Net interest income is the amount by which interest income on earning assets exceeds the interest expenses on interest bearing liabilities. Net interest income, which includes loan fees, is influenced by changes in the balance and mix of assets and liabilities and market interest rates. The Corporation exerts some control over these factors; however, FRB monetary policy and competition have a significant impact. For analytical purposes, net interest income is adjusted to a FTE basis by adding the income tax savings from interest on tax exempt loans, and nontaxable investment securities, thus making year-to-year comparisons more meaningful.

Volume and Rate Variance Analysis

The following table sets forth the effect of volume and rate changes on interest income and expense for the periods indicated. For the purpose of this table, changes in interest due to volume and rate were determined as follows:

Volume - change in volume multiplied by the previous period's rate.

Rate - change in the FTE rate multiplied by the previous period's volume.

The change in interest due to both volume and rate has been allocated to volume and rate changes in proportion to the relationship of the absolute dollar amounts of the change in each.

Three Months Ended | Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||

September 30, 2020 | September 30, 2020 | September 30, 2020 | ||||||||||||||||||||||||||||||||||

Compared To | Compared To | Compared To | ||||||||||||||||||||||||||||||||||

June 30, 2020 | September 30, 2019 | September 30, 2019 | ||||||||||||||||||||||||||||||||||

Increase (Decrease) Due to | Increase (Decrease) Due to | Increase (Decrease) Due to | ||||||||||||||||||||||||||||||||||

Volume | Rate | Net | Volume | Rate | Net | Volume | Rate | Net | ||||||||||||||||||||||||||||

Changes in interest income | ||||||||||||||||||||||||||||||||||||

Total loans | $ | 476 | $ | 437 | $ | 913 | $ | 9,669 | $ | (8,607 | ) | $ | 1,062 | $ | 8,588 | $ | (6,139 | ) | $ | 2,449 | ||||||||||||||||

Taxable investment securities | (2 | ) | (65 | ) | (67 | ) | 166 | (285 | ) | (119 | ) | (140 | ) | (324 | ) | (464 | ) | |||||||||||||||||||

Nontaxable investment securities | 81 | (64 | ) | 17 | 96 | (67 | ) | 29 | 66 | (18 | ) | 48 | ||||||||||||||||||||||||

Federal funds sold | — | — | — | (45 | ) | (44 | ) | (89 | ) | 48 | (82 | ) | (34 | ) | ||||||||||||||||||||||

Interest earning cash and cash equivalents | 4 | — | 4 | 206 | (232 | ) | (26 | ) | 137 | (185 | ) | (48 | ) | |||||||||||||||||||||||

Federal Home Loan Bank stock | 12 | (21 | ) | (9 | ) | 28 | (49 | ) | (21 | ) | 11 | (62 | ) | (51 | ) | |||||||||||||||||||||

Total changes in interest income | 571 | 287 | 858 | 10,120 | (9,284 | ) | 836 | 8,710 | (6,810 | ) | 1,900 | |||||||||||||||||||||||||

Changes in interest expense | ||||||||||||||||||||||||||||||||||||

Interest bearing demand deposits | 227 | (332 | ) | (105 | ) | 838 | (938 | ) | (100 | ) | 553 | (130 | ) | 423 | ||||||||||||||||||||||

Savings deposits | 73 | (97 | ) | (24 | ) | 189 | (355 | ) | (166 | ) | 41 | (484 | ) | (443 | ) | |||||||||||||||||||||

Time deposits | (83 | ) | (171 | ) | (254 | ) | (240 | ) | (400 | ) | (640 | ) | (592 | ) | (713 | ) | (1,305 | ) | ||||||||||||||||||

Borrowed funds | 103 | (149 | ) | (46 | ) | 914 | (1,003 | ) | (89 | ) | 646 | (838 | ) | (192 | ) | |||||||||||||||||||||

Total changes in interest expense | 320 | (749 | ) | (429 | ) | 1,701 | (2,696 | ) | (995 | ) | 648 | (2,165 | ) | (1,517 | ) | |||||||||||||||||||||

Net change in net interest income (FTE) | $ | 251 | $ | 1,036 | $ | 1,287 | $ | 8,419 | $ | (6,588 | ) | $ | 1,831 | $ | 8,062 | $ | (4,645 | ) | $ | 3,417 | ||||||||||||||||

Average Yield/Rate for the Three Month Periods Ended | |||||||||||||||

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | |||||||||||

Total earning assets | 3.97 | % | 3.94 | % | 4.47 | % | 4.66 | % | 4.85 | % | |||||

Total interest bearing liabilities | 0.63 | % | 0.91 | % | 1.28 | % | 1.36 | % | 1.42 | % | |||||

Net interest margin to earning assets (FTE) | 3.58 | % | 3.37 | % | 3.61 | % | 3.75 | % | 3.91 | % | |||||

Quarter to Date Net Interest Income (FTE) | ||||||||||||||||||||

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Interest income | $ | 12,070 | $ | 11,215 | $ | 11,070 | $ | 11,076 | $ | 11,240 | ||||||||||

FTE adjustment | 21 | 18 | 17 | 17 | 15 | |||||||||||||||

Total interest income (FTE) | 12,091 | 11,233 | 11,087 | 11,093 | 11,255 | |||||||||||||||

Total interest expense | 1,189 | 1,618 | 2,145 | 2,158 | 2,184 | |||||||||||||||

Net interest income (FTE) | $ | 10,902 | $ | 9,615 | $ | 8,942 | $ | 8,935 | $ | 9,071 | ||||||||||

Noninterest Income

Quarter to Date | ||||||||||||||||||||

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Net gain on sales of mortgage loans | $ | 3,130 | $ | 2,644 | $ | 970 | $ | 650 | $ | 665 | ||||||||||

Net mortgage servicing rights income | 559 | (163 | ) | (50 | ) | 130 | 142 | |||||||||||||

Trust and investment services | 464 | 321 | 389 | 337 | 395 | |||||||||||||||

ATM and debit card income | 460 | 394 | 355 | 399 | 418 | |||||||||||||||

Mortgage servicing fees | 293 | 270 | 262 | 256 | 243 | |||||||||||||||

Service charges on deposit accounts | 177 | 119 | 219 | 245 | 239 | |||||||||||||||

Change in fair value of equity investments | 2 | 7 | 749 | (5 | ) | 16 | ||||||||||||||

Net gain from corporate owned life insurance death benefit | — | 173 | — | — | — | |||||||||||||||

Net gain on sales of commercial loans | — | — | 668 | — | — | |||||||||||||||

Change in fair value of mortgage banking instruments | (66 | ) | 1,225 | 833 | — | — | ||||||||||||||

Other income and fees | 140 | 302 | 118 | 117 | 144 | |||||||||||||||

Total noninterest income | $ | 5,159 | $ | 5,292 | $ | 4,513 | $ | 2,129 | $ | 2,262 | ||||||||||

Year to Date September 30 | Variance | |||||||||||||||

2020 | 2019 | Amount | % | |||||||||||||

Net gain on sales of mortgage loans | $ | 6,744 | $ | 1,282 | $ | 5,462 | 426.05 | % | ||||||||

Net mortgage servicing rights income | 346 | 493 | (147 | ) | (29.82 | ) | % | |||||||||

Trust and investment services | 1,174 | 1,182 | (8 | ) | (0.68 | ) | % | |||||||||

ATM and debit card income | 1,209 | 1,182 | 27 | 2.28 | % | |||||||||||

Mortgage servicing fees | 825 | 684 | 141 | 20.61 | % | |||||||||||

Service charges on deposit accounts | 515 | 695 | (180 | ) | (25.90 | ) | % | |||||||||

Change in fair value of equity investments | 758 | 51 | 707 | 1386.27 | % | |||||||||||

Net gain from corporate owned life insurance death benefit | 173 | — | 173 | N/M | ||||||||||||

Net gain on sales of commercial loans | 668 | — | 668 | N/M | ||||||||||||

Change in fair value of mortgage banking instruments | 1,992 | — | 1,992 | N/M | ||||||||||||

Other income and fees | 560 | 465 | 95 | 20.43 | % | |||||||||||

Total noninterest income | $ | 14,964 | $ | 6,034 | $ | 8,930 | 147.99 | % | ||||||||

Net gain on sales of mortgage loans represents the income earned on the sale of residential mortgage loans into the secondary market. During 2019, and throughout 2020, the interest rate environment was very advantageous for residential mortgage originations and refinancing. While the interest rate environment is historically attractive for residential mortgage origination, the uncertainty that many consumers are facing due to the COVID-19 global pandemic is expected to reduce residential mortgage originations. As such, gains from the sales of mortgage loans are expected to decline in future periods.

Net mortgage servicing rights income represents income generated from the capitalization of mortgage servicing rights, net of amortization and impairment. For the quarter ended September 30, 2020, the Corporation recognized a reduction in MSR impairment of $222 as mortgage rates stabilized.

Trust and investment services includes income the Corporation earned from contracts with customers to manage assets for investment and/or to transact on their accounts. The wealth management component is strongly correlated to changes in the stock market and as such, can vary from period to period. Trust and investment services income is expected to approximate current levels throughout the remainder of the year.

ATM and debit card income represents fees earned on ATM and debit card transactions. The Corporation expects these fees to increase modestly throughout the remainder of 2020.

Mortgage servicing fees includes the fees earned for servicing loans that have been sold into the secondary market. The increase in mortgage servicing fees is directly related to the increase in the size of the serviced portfolio. Mortgage servicing fees are expected to continue to increase throughout the year.

Service charges on deposit accounts includes fees earned from deposit customers for transaction-based, account maintenance and overdraft services. The year-over-year decrease in service charges on deposit accounts is primarily due to a shift of customer demand toward deposit accounts with no or reduced service charges, as well as a temporary reduction in fees charged due to the COVID-19 global pandemic.

Change in fair value of equity investments represents the income earned on equities held in the Corporation's investment portfolio. During the first quarter of 2020, an equity position held by the Corporation was bought out through an acquisition, resulting in a recognized gain of $732. The Corporation does not anticipate any significant changes in fair value from equity sales throughout the remainder of 2020.

Net gain from corporate owned life insurance death benefit is recognized in the event of the death of an insured individual. The death of an insured individual occurred in the second quarter of 2020. The Corporation does not expect to receive any gains from COLI death benefits for the remainder of 2020.

Net gain on sales of commercial loans represents the income earned from the sale of commercial loans into the secondary market. During the first quarter of 2020, the Corporation sold the guaranteed portion of one SBA loan and one USDA loan. The Corporation continually analyzes its commercial loan portfolio for opportunistic sales strategies.

On January 1, 2020, the Corporation adopted SAB 109. The Corporation now recognizes the value of servicing at the time of commitment, which resulted in an increase in retained earnings of $78 at January 1, 2020. The Corporation also elected the fair value option for its residential mortgage loans HFS on January 1, 2020, which resulted in an increase in retained earnings of $436. Pursuant to this adoption, changes in the fair value of mortgage banking instruments and loans held for sale are included in noninterest income. Change in fair value of mortgage banking instruments will fluctuate with the Corporation's residential mortgage loan originations and interest rate fluctuations. As mortgage loan originations are expected to decline, the change in fair value of mortgage banking instruments is expected to decrease throughout the remainder of 2020.

Other income and fees includes miscellaneous other income items, none of which are individually significant. Other income and fees are expected to approximate current levels throughout 2020.

Noninterest Expenses

Quarter to Date | ||||||||||||||||||||

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Total compensation | $ | 4,531 | $ | 4,252 | $ | 4,248 | $ | 4,037 | $ | 3,530 | ||||||||||

Furniture and equipment | 614 | 618 | 610 | 575 | 497 | |||||||||||||||

Professional services | 524 | 571 | 522 | 582 | 494 | |||||||||||||||

Data processing | 503 | 535 | 442 | 362 | 405 | |||||||||||||||

Occupancy | 491 | 435 | 476 | 467 | 444 | |||||||||||||||

Loan and collection | 292 | 229 | 162 | 203 | 120 | |||||||||||||||

Advertising and promotional | 284 | 255 | 252 | 232 | 222 | |||||||||||||||

ATM and debit card | 109 | 92 | 108 | 98 | 109 | |||||||||||||||

Amortization of core deposit intangibles | 91 | 90 | 90 | 113 | 112 | |||||||||||||||

Telephone and communication | 91 | 86 | 96 | 115 | 110 | |||||||||||||||

FDIC insurance premiums | 55 | 59 | 55 | 6 | 20 | |||||||||||||||

Other general and administrative | 633 | 587 | 625 | 625 | 545 | |||||||||||||||

Total noninterest expenses | $ | 8,218 | $ | 7,809 | $ | 7,686 | $ | 7,415 | $ | 6,608 | ||||||||||

Year to Date September 30 | Variance | |||||||||||||||

2020 | 2019 | Amount | % | |||||||||||||

Total compensation | $ | 13,031 | $ | 10,909 | $ | 2,122 | 19.45 | % | ||||||||

Furniture and equipment | 1,842 | 1,423 | 419 | 29.44 | % | |||||||||||

Professional services | 1,617 | 1,378 | 239 | 17.34 | % | |||||||||||

Data processing | 1,480 | 1,054 | 426 | 40.42 | % | |||||||||||

Occupancy | 1,402 | 1,307 | 95 | 7.27 | % | |||||||||||

Loan and collection | 683 | 349 | 334 | 95.70 | % | |||||||||||

Advertising and promotional | 791 | 676 | 115 | 17.01 | % | |||||||||||

ATM and debit card | 309 | 304 | 5 | 1.64 | % | |||||||||||

Amortization of core deposit intangibles | 271 | 338 | (67 | ) | (19.82 | ) | % | |||||||||

Telephone and communication | 273 | 329 | (56 | ) | (17.02 | ) | % | |||||||||

FDIC insurance premiums | 169 | 138 | 31 | 22.46 | % | |||||||||||

Other general and administrative | 1,845 | 1,603 | 242 | 15.10 | % | |||||||||||

Total noninterest expenses | $ | 23,713 | $ | 19,808 | $ | 3,905 | 19.71 | % | ||||||||

Total compensation includes salaries, commissions and incentives, employee benefits, and payroll taxes. Total compensation has increased due to annual merit increases and an increase in commissions and incentives paid. Fluctuations in commissions and incentives are primarily driven by residential mortgage originations, which can vary significantly from period to period.

Furniture and equipment and occupancy expenses primarily consist of depreciation, repairs and maintenance, property taxes, utilities, insurance, certain service contracts, and other related items. These expenses are expected to increase with the size and complexity of the Corporation.

Professional services include expenses relating to third-party professional services. These services include, but are not limited to, regulatory, auditing, consulting, and legal. These expenses are expected to increase in future periods to ensure compliance with audit and regulatory requirements.

Data processing primarily includes the expenses relating to the Corporation's core data processor. These expenses are expected to increase throughout the remainder of 2020 with the size and complexity of the Corporation.

Loan and collection includes expenses related to the origination and collection of loans, as well as expenses related to OREO. The increase in expenses is a direct result of increased loan volume, as the current low interest rate environment has been attractive for borrowers. The Corporation may experience an increase in these expenses throughout the remainder of 2020 and into 2021.

Advertising and promotional includes the Corporation's media costs and any donations or sponsorships made on behalf of the Corporation. The increase in expenses is a direct result of the Corporation enhancing its marketing efforts to attract new and expand existing customer loans and deposit accounts. These expenses are expected to approximate current levels for the remainder of 2020 as a result of the Corporation's re-branding strategy.

ATM and debit card expenses fluctuate based on customer and non-customer utilization of ATMs and customer debit card volumes. The Corporation expects these fees to increase modestly throughout the remainder of 2020.

Amortization of core deposit intangibles relates to the core deposits acquired from Community Bancorp, Inc. on December 31, 2016 and is expected to approximate current levels throughout the remainder of 2020.

Telephone and communication includes expenses relating to the Corporation's communication systems. These expenses are expected to maintain current levels for the remainder of 2020.

FDIC insurance premiums typically fluctuate based on the size of the Corporation's balance sheet, capital position, overall risk profile, and examination ratings. FDIC insurance premiums decreased significantly in 2019 due to a Small Bank Assessment Credit issued by the FDIC in the second quarter of 2019. The credit was fully applied during the first quarter of 2020. The Corporation expects FDIC insurance premiums to approximate current levels throughout the remainder of 2020.

Other general and administrative includes miscellaneous other expense items, none of which are individually significant. These expenses are expected to approximate current levels into the foreseeable future.

Balance Sheet Breakdown and Analysis

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

ASSETS | ||||||||||||||||||||

Cash and cash equivalents | $ | 75,032 | $ | 35,190 | $ | 71,140 | $ | 46,803 | $ | 37,572 | ||||||||||

Total investment securities | 78,179 | 75,526 | 76,312 | 61,621 | 62,351 | |||||||||||||||

Loans held-for-sale | 34,833 | 46,354 | 21,154 | 19,491 | 15,111 | |||||||||||||||

Gross loans | 1,060,885 | 1,044,564 | 865,577 | 870,555 | 826,597 | |||||||||||||||

Less allowance for loan losses | 10,100 | 8,991 | 7,250 | 5,813 | 5,413 | |||||||||||||||

Net loans | 1,050,785 | 1,035,573 | 858,327 | 864,742 | 821,184 | |||||||||||||||

All other assets | 46,016 | 45,051 | 44,247 | 42,102 | 41,828 | |||||||||||||||

Total assets | $ | 1,284,845 | $ | 1,237,694 | $ | 1,071,180 | $ | 1,034,759 | $ | 978,046 | ||||||||||

LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||||||||||

Total deposits | $ | 1,061,470 | $ | 1,018,287 | $ | 883,837 | $ | 863,102 | $ | 801,101 | ||||||||||

Total borrowed funds | 96,217 | 96,217 | 71,500 | 61,500 | 69,000 | |||||||||||||||

Accrued interest payable and other liabilities | 13,077 | 14,221 | 11,015 | 8,713 | 8,803 | |||||||||||||||

Total liabilities | 1,170,764 | 1,128,725 | 966,352 | 933,315 | 878,904 | |||||||||||||||

Total shareholders' equity | 114,081 | 108,969 | 104,828 | 101,444 | 99,142 | |||||||||||||||

Total liabilities and shareholders' equity | $ | 1,284,845 | $ | 1,237,694 | $ | 1,071,180 | $ | 1,034,759 | $ | 978,046 | ||||||||||

9/30/2020 vs 6/30/2020 | 9/30/2020 vs 9/30/2019 | ||||||||||||||

Variance | Variance | ||||||||||||||

Amount | % | Amount | % | ||||||||||||

ASSETS | |||||||||||||||

Cash and cash equivalents | $ | 39,842 | 113.22 | % | $ | 37,460 | 99.70 | % | |||||||

Total investment securities | 2,653 | 3.51 | % | 15,828 | 25.39 | % | |||||||||

Loans held-for-sale | (11,521 | ) | (24.85 | ) | % | 19,722 | 130.51 | % | |||||||

Gross loans | 16,321 | 1.56 | % | 234,288 | 28.34 | % | |||||||||

Less allowance for loan losses | 1,109 | 12.33 | % | 4,687 | 86.59 | % | |||||||||

Net loans | 15,212 | 1.47 | % | 229,601 | 27.96 | % | |||||||||

All other assets | 965 | 2.14 | % | 4,188 | 10.01 | % | |||||||||

Total assets | $ | 47,151 | 3.81 | % | $ | 306,799 | 31.37 | % | |||||||

LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||

Total deposits | $ | 43,183 | 4.24 | % | $ | 260,369 | 32.50 | % | |||||||

Total borrowed funds | — | — | % | 27,217 | 39.44 | % | |||||||||

Accrued interest payable and other liabilities | (1,144 | ) | (8.04 | ) | % | 4,274 | 48.55 | % | |||||||

Total liabilities | 42,039 | 1.96 | % | 291,860 | 17.37 | % | |||||||||

Total shareholders' equity | 5,112 | 4.69 | % | 14,939 | 15.07 | % | |||||||||

Total liabilities and shareholders' equity | $ | 47,151 | 3.81 | % | $ | 306,799 | 31.37 | % | |||||||

Cash and cash equivalents

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||||

Cash and cash equivalents | ||||||||||||||||||||||

Noninterest bearing | $ | 22,108 | $ | 20,369 | $ | 33,312 | $ | 17,754 | $ | 21,808 | ||||||||||||

Interest bearing | 52,924 | 14,821 | 37,828 | 6,049 | 6,764 | |||||||||||||||||

Federal funds sold | — | — | — | 23,000 | 9,000 | |||||||||||||||||

Cash and cash equivalents | $ | 75,032 | $ | 35,190 | $ | 71,140 | $ | 46,803 | $ | 37,572 | ||||||||||||

9/30/2020 vs 6/30/2020 | 9/30/2020 vs 9/30/2019 | |||||||||||||||||||||

Variance | Variance | |||||||||||||||||||||

Amount | % | Amount | % | |||||||||||||||||||

Cash and cash equivalents | ||||||||||||||||||||||

Noninterest bearing | $ | 1,739 | 8.54 | % | $ | 300 | 1.38 | % | ||||||||||||||

Interest bearing | 38,103 | 257.09 | % | 46,160 | 682.44 | % | ||||||||||||||||

Federal funds sold | — | N/M | (9,000 | ) | (100.00 | ) | % | |||||||||||||||

Cash and cash equivalents | $ | 39,842 | 113.22 | % | $ | 37,460 | 99.70 | % | ||||||||||||||

Cash and cash equivalents, which is comprised of cash and due from banks and federal funds sold, fluctuate from period to period based on loan demand and variances in deposit accounts.

Primary and secondary liquidity sources

While the Corporation continues to maintain a strong liquidity position, it is important to monitor all liquidity sources. The following table outlines the Corporation's primary and secondary sources of liquidity as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Cash and cash equivalents | $ | 75,032 | $ | 35,190 | $ | 71,140 | $ | 46,803 | $ | 37,572 | ||||||||||

Unpledged investment securities | 58,739 | 52,647 | 51,889 | 40,094 | 40,675 | |||||||||||||||

FHLB borrowing availability | 97,500 | 97,500 | 42,500 | 52,500 | 45,000 | |||||||||||||||

Federal funds purchased lines of credit | 21,500 | 21,500 | 17,500 | 17,500 | 17,500 | |||||||||||||||

Funds available through the Fed Discount Window | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | |||||||||||||||

PPPLF | 206,343 | 202,184 | — | — | — | |||||||||||||||

Total liquidity sources | $ | 469,114 | $ | 419,021 | $ | 193,029 | $ | 166,897 | $ | 150,747 | ||||||||||

Total investment securities

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||||

Available-for-sale | ||||||||||||||||||||||

U.S. Government and federal agency | $ | 19,311 | $ | 21,339 | $ | 23,610 | $ | 18,867 | $ | 22,854 | ||||||||||||

State and municipal | 15,729 | 14,115 | 10,657 | 10,691 | 10,194 | |||||||||||||||||

Mortgage backed residential | 20,886 | 12,335 | 10,176 | 10,748 | 6,227 | |||||||||||||||||

Certificates of deposit | 5,921 | 6,665 | 8,644 | 6,659 | 7,155 | |||||||||||||||||

Collateralized mortgage obligations - agencies | 11,141 | 15,736 | 18,288 | 9,527 | 10,826 | |||||||||||||||||

Unrealized gain/(loss) on available-for-sale securities | 2,099 | 2,242 | 1,735 | 1,092 | 1,048 | |||||||||||||||||

Total available-for-sale | 75,087 | 72,432 | 73,110 | 57,584 | 58,304 | |||||||||||||||||

Held-to-maturity state and municipal | 1,977 | 1,981 | 2,091 | 2,096 | 2,100 | |||||||||||||||||

Equity securities | 1,115 | 1,113 | 1,111 | 1,941 | 1,947 | |||||||||||||||||

Total investment securities | $ | 78,179 | $ | 75,526 | $ | 76,312 | $ | 61,621 | $ | 62,351 | ||||||||||||

9/30/2020 vs 6/30/2020 | 9/30/2020 vs 9/30/2019 | |||||||||||||||||||||

Variance | Variance | |||||||||||||||||||||

Amount | % | Amount | % | |||||||||||||||||||

Available-for-sale | ||||||||||||||||||||||

U.S. Government and federal agency | $ | (2,028 | ) | (9.50 | ) | % | $ | (3,543 | ) | (15.50 | ) | % | ||||||||||

State and municipal | 1,614 | 11.43 | % | 5,535 | 54.30 | % | ||||||||||||||||

Mortgage backed residential | 8,551 | 69.32 | % | 14,659 | 235.41 | % | ||||||||||||||||

Certificates of deposit | (744 | ) | (11.16 | ) | % | (1,234 | ) | (17.25 | ) | % | ||||||||||||

Collateralized mortgage obligations - agencies | (4,595 | ) | (29.20 | ) | % | 315 | 2.91 | % | ||||||||||||||

Unrealized gain/(loss) on available-for-sale securities | (143 | ) | (6.38 | ) | % | 1,051 | 100.29 | % | ||||||||||||||

Total available-for-sale | 2,655 | 3.67 | % | 16,783 | 28.79 | % | ||||||||||||||||

Held-to-maturity state and municipal | (4 | ) | (0.20 | ) | % | (123 | ) | (5.86 | ) | % | ||||||||||||

Equity securities | 2 | 0.18 | % | (832 | ) | (42.73 | ) | % | ||||||||||||||

Total investment securities | $ | 2,653 | 3.51 | % | $ | 15,828 | 25.39 | % | ||||||||||||||

The amortized cost and fair value of AFS investment securities as of September 30, 2020 were as follows:

Maturing | ||||||||||||||||||||||||

Due in One Year or Less | After One Year But Within Five Years | After Five Years But Within Ten Years | After Ten Years | Securities with Variable Monthly Payments or Noncontractual Maturities | Total | |||||||||||||||||||

U.S. Government and federal agency | $ | 16,380 | $ | 2,931 | $ | — | $ | — | $ | — | $ | 19,311 | ||||||||||||

State and municipal | 2,509 | 6,049 | 5,089 | 2,082 | — | 15,729 | ||||||||||||||||||

Mortgage backed residential | — | — | — | — | 20,886 | 20,886 | ||||||||||||||||||

Certificates of deposit | 1,731 | 4,190 | — | — | — | 5,921 | ||||||||||||||||||

Collateralized mortgage obligations - agencies | — | — | — | — | 11,141 | 11,141 | ||||||||||||||||||

Total amortized cost | $ | 20,620 | $ | 13,170 | $ | 5,089 | $ | 2,082 | $ | 32,027 | $ | 72,988 | ||||||||||||

Fair value | $ | 20,757 | $ | 14,024 | $ | 5,308 | $ | 2,375 | $ | 32,623 | $ | 75,087 | ||||||||||||

The amortized cost and fair value of HTM investment securities as of September 30, 2020 were as follows:

Maturing | ||||||||||||||||||||||||

Due in One Year or Less | After One Year But Within Five Years | After Five Years But Within Ten Years | After Ten Years | Securities with Variable Monthly Payments or Noncontractual Maturities | Total | |||||||||||||||||||

State and municipal | $ | 414 | $ | 1,113 | $ | 370 | $ | 80 | $ | — | $ | 1,977 | ||||||||||||

Fair value | $ | 419 | $ | 1,160 | $ | 398 | $ | 86 | $ | — | $ | 2,063 | ||||||||||||

Throughout 2019, yields on bonds that met the Corporation's investment standards declined significantly. As such, the Corporation did not replace the majority of maturing investments in 2019. However, an influx of liquidity in late 2019 and into 2020 led the Corporation to make investment security purchases in order to stabilize net interest margin and generate additional net interest income. Total investment securities are expected to grow with overall balance sheet growth as it is an important source of liquidity and consistent earnings. The following table summarizes information as of September 30, 2020 for investment securities purchased YTD:

Book Value | Fully Taxable Equivalent Weighted Average Yield | ||||||

U.S. Government and federal agency | $ | 10,388 | 0.46 | % | |||

State and municipal | 6,274 | 1.72 | % | ||||

Collateralized mortgage obligations - agencies | 7,103 | 1.59 | % | ||||

Certificates of deposit | 496 | 1.01 | % | ||||

Mortgage backed residential | 13,176 | 1.26 | % | ||||

Held-to-maturity state and municipal | — | — | % | ||||

Total | $ | 37,437 | 1.17 | % | |||

Loans held-for-sale

Loans HFS represent the balance of loans that have been committed to be sold to the secondary market, but have not yet been delivered. The level of loans HFS fluctuates based on loan demand as well as the timing of loan deliveries to the secondary market. As residential mortgage activity is likely to decrease throughout the remainder of 2020, the balance of loans HFS will also likely decline.

During the first quarter of 2020, the Corporation opted to recognize loans HFS at fair value which represents the price at which the loans could be sold in the principal market at the measurement date.

Loans and allowance for loan losses

The following tables outline the composition and changes in the loan portfolio as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||||

Commercial | $ | 271,113 | $ | 260,440 | $ | 67,731 | $ | 71,689 | $ | 63,747 | ||||||||||||

Commercial real estate | 483,275 | 469,039 | 462,561 | 455,289 | 420,127 | |||||||||||||||||

Total commercial loans | 754,388 | 729,479 | 530,292 | 526,978 | 483,874 | |||||||||||||||||

Residential mortgage | 261,375 | 268,295 | 285,392 | 292,946 | 291,401 | |||||||||||||||||

Home equity | 39,456 | 40,114 | 43,222 | 41,987 | 43,061 | |||||||||||||||||

Total residential real estate loans | 300,831 | 308,409 | 328,614 | 334,933 | 334,462 | |||||||||||||||||

Consumer | 5,666 | 6,676 | 6,671 | 8,644 | 8,261 | |||||||||||||||||

Gross loans | 1,060,885 | 1,044,564 | 865,577 | 870,555 | 826,597 | |||||||||||||||||

Allowance for loan losses | (10,100 | ) | (8,991 | ) | (7,250 | ) | (5,813 | ) | (5,413 | ) | ||||||||||||

Loans, net | $ | 1,050,785 | $ | 1,035,573 | $ | 858,327 | $ | 864,742 | $ | 821,184 | ||||||||||||

9/30/2020 vs 6/30/2020 | 9/30/2020 vs 9/30/2019 | |||||||||||||||||||||

Variance | Variance | |||||||||||||||||||||

Amount | % | Amount | % | |||||||||||||||||||

Commercial | $ | 10,673 | 4.10 | % | $ | 207,366 | 325.30 | % | ||||||||||||||

Commercial real estate | 14,236 | 3.04 | % | 63,148 | 15.03 | % | ||||||||||||||||

Total commercial loans | 24,909 | 3.41 | % | 270,514 | 55.91 | % | ||||||||||||||||

Residential mortgage | (6,920 | ) | (2.58 | ) | % | (30,026 | ) | (10.30 | ) | % | ||||||||||||

Home equity | (658 | ) | (1.64 | ) | % | (3,605 | ) | (8.37 | ) | % | ||||||||||||

Total residential real estate loans | (7,578 | ) | (2.46 | ) | % | (33,631 | ) | (10.06 | ) | % | ||||||||||||

Consumer | (1,010 | ) | (15.13 | ) | % | (2,595 | ) | (31.41 | ) | % | ||||||||||||

Gross loans | 16,321 | 1.56 | % | 234,288 | 28.34 | % | ||||||||||||||||

Allowance for loan losses | (1,109 | ) | 12.33 | % | (4,687 | ) | 86.59 | % | ||||||||||||||

Loans, net | $ | 15,212 | 1.47 | % | $ | 229,601 | 27.96 | % | ||||||||||||||

The following table presents historical loan balances by portfolio segment and impairment evaluation as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Originated loans collectively evaluated for impairment | ||||||||||||||||||||

Commercial | $ | 270,174 | $ | 259,384 | $ | 66,524 | $ | 70,322 | $ | 61,970 | ||||||||||

Commercial real estate | 469,353 | 452,084 | 446,713 | 436,626 | 400,470 | |||||||||||||||

Residential mortgage | 257,395 | 263,997 | 280,265 | 286,635 | 285,499 | |||||||||||||||

Home equity | 37,022 | 37,663 | 40,459 | 39,023 | 39,586 | |||||||||||||||

Consumer | 5,477 | 6,445 | 6,391 | 8,330 | 7,902 | |||||||||||||||

Subtotal | 1,039,421 | 1,019,573 | 840,352 | 840,936 | 795,427 | |||||||||||||||

Originated loans individually evaluated for impairment | ||||||||||||||||||||

Commercial | — | — | — | — | — | |||||||||||||||

Commercial real estate | 2,204 | 3,290 | 1,658 | 1,668 | 1,677 | |||||||||||||||

Residential mortgage | 655 | 663 | 672 | 1,362 | 631 | |||||||||||||||

Home equity | — | — | — | — | 240 | |||||||||||||||

Consumer | 3 | 3 | 5 | — | — | |||||||||||||||

Subtotal | 2,862 | 3,956 | 2,335 | 3,030 | 2,548 | |||||||||||||||

Acquired loans collectively evaluated for impairment | ||||||||||||||||||||

Commercial | 910 | 1,057 | 1,204 | 1,362 | 1,753 | |||||||||||||||

Commercial real estate | 11,368 | 13,293 | 13,630 | 16,346 | 17,194 | |||||||||||||||

Residential mortgage | 2,335 | 2,683 | 3,459 | 3,911 | 4,139 | |||||||||||||||

Home equity | 2,415 | 2,432 | 2,743 | 2,943 | 3,213 | |||||||||||||||

Consumer | 185 | 226 | 273 | 314 | 358 | |||||||||||||||

Subtotal | 17,213 | 19,691 | 21,309 | 24,876 | 26,657 | |||||||||||||||

Acquired loans individually evaluated for impairment | ||||||||||||||||||||

Commercial | — | — | — | — | — | |||||||||||||||

Commercial real estate | — | — | — | — | — | |||||||||||||||

Residential mortgage | 55 | — | 58 | 58 | 61 | |||||||||||||||

Home equity | — | — | — | — | — | |||||||||||||||

Consumer | — | — | — | — | — | |||||||||||||||

Subtotal | 55 | — | 58 | 58 | 61 | |||||||||||||||

Acquired loans with deteriorated credit quality | ||||||||||||||||||||

Commercial | 29 | (1 | ) | 3 | 5 | 24 | ||||||||||||||

Commercial real estate | 350 | 372 | 560 | 649 | 786 | |||||||||||||||

Residential mortgage | 935 | 952 | 938 | 980 | 1,071 | |||||||||||||||

Home equity | 19 | 19 | 20 | 21 | 22 | |||||||||||||||

Consumer | 1 | 2 | 2 | — | 1 | |||||||||||||||

Subtotal | 1,334 | 1,344 | 1,523 | 1,655 | 1,904 | |||||||||||||||

Gross Loans | $ | 1,060,885 | $ | 1,044,564 | $ | 865,577 | $ | 870,555 | $ | 826,597 | ||||||||||

Total originated loans | $ | 1,042,283 | $ | 1,023,529 | $ | 842,687 | $ | 843,966 | $ | 797,975 | ||||||||||

Total acquired loans | 18,602 | 21,035 | 22,890 | 26,589 | 28,622 | |||||||||||||||

Gross loans | $ | 1,060,885 | $ | 1,044,564 | $ | 865,577 | $ | 870,555 | $ | 826,597 | ||||||||||

The following table presents historical allowance for loan losses allocations by portfolio segment and impairment evaluation as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Originated loans collectively evaluated for impairment | ||||||||||||||||||||

Commercial | $ | 632 | $ | 535 | $ | 478 | $ | 358 | $ | 301 | ||||||||||

Commercial real estate | 5,113 | 4,564 | 3,609 | 2,790 | 2,539 | |||||||||||||||

Residential mortgage | 3,281 | 3,080 | 2,442 | 1,917 | 1,820 | |||||||||||||||

Home equity | 416 | 353 | 280 | 195 | 198 | |||||||||||||||

Consumer | 101 | 102 | 89 | 87 | 87 | |||||||||||||||

Subtotal | 9,543 | 8,634 | 6,898 | 5,347 | 4,945 | |||||||||||||||

Originated loans individually evaluated for impairment | ||||||||||||||||||||

Commercial | — | — | — | — | — | |||||||||||||||

Commercial real estate | 289 | 100 | 111 | 127 | 26 | |||||||||||||||

Residential mortgage | 5 | 5 | 6 | 128 | 27 | |||||||||||||||

Home equity | — | — | — | — | 213 | |||||||||||||||

Consumer | 3 | 3 | 5 | — | — | |||||||||||||||

Subtotal | 297 | 108 | 122 | 255 | 266 | |||||||||||||||

Acquired loans collectively evaluated for impairment | ||||||||||||||||||||

Commercial | 1 | 1 | 1 | 1 | 2 | |||||||||||||||

Commercial real estate | 7 | 9 | 7 | 5 | 5 | |||||||||||||||

Residential mortgage | 9 | 9 | 9 | 8 | 9 | |||||||||||||||

Home equity | 18 | 15 | 14 | 12 | 13 | |||||||||||||||

Consumer | — | — | — | — | — | |||||||||||||||

Subtotal | 35 | 34 | 31 | 26 | 29 | |||||||||||||||

Acquired loans with deteriorated credit quality | ||||||||||||||||||||

Commercial | — | — | — | — | — | |||||||||||||||

Commercial real estate | 32 | 22 | 39 | 34 | 31 | |||||||||||||||

Residential mortgage | 189 | 189 | 156 | 147 | 137 | |||||||||||||||

Home equity | 4 | 4 | 4 | 4 | 5 | |||||||||||||||

Consumer | — | — | — | — | — | |||||||||||||||

Subtotal | 225 | 215 | 199 | 185 | 173 | |||||||||||||||

Allowance for loan losses | $ | 10,100 | $ | 8,991 | $ | 7,250 | $ | 5,813 | $ | 5,413 | ||||||||||

Total originated loans | $ | 9,840 | $ | 8,742 | $ | 7,020 | $ | 5,602 | $ | 5,211 | ||||||||||

Total acquired loans | 260 | 249 | 230 | 211 | 202 | |||||||||||||||

Allowance for loan losses | $ | 10,100 | $ | 8,991 | $ | 7,250 | $ | 5,813 | $ | 5,413 | ||||||||||

Commercial | $ | 633 | $ | 536 | $ | 479 | $ | 359 | $ | 303 | ||||||||||

Commercial real estate | 5,441 | 4,695 | 3,766 | 2,956 | 2,601 | |||||||||||||||

Residential mortgage | 3,484 | 3,283 | 2,613 | 2,200 | 1,993 | |||||||||||||||

Home equity | 438 | 372 | 298 | 211 | 429 | |||||||||||||||

Consumer | 104 | 105 | 94 | 87 | 87 | |||||||||||||||

Allowance for loan losses | $ | 10,100 | $ | 8,991 | $ | 7,250 | $ | 5,813 | $ | 5,413 | ||||||||||

The following table summarizes the Corporation's current, past due, and nonaccrual loans as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Accruing interest | ||||||||||||||||||||

Current | $ | 1,058,437 | $ | 1,042,589 | $ | 862,581 | $ | 867,901 | $ | 824,587 | ||||||||||

Past due 30-89 days | 1,703 | 948 | 2,152 | 1,213 | 1,089 | |||||||||||||||

Past due 90 days or more | 86 | 361 | 166 | 239 | 209 | |||||||||||||||

Total accruing interest | 1,060,226 | 1,043,898 | 864,899 | 869,353 | 825,885 | |||||||||||||||

Nonaccrual | 659 | 666 | 678 | 1,202 | 712 | |||||||||||||||

Total loans | $ | 1,060,885 | $ | 1,044,564 | $ | 865,577 | $ | 870,555 | $ | 826,597 | ||||||||||

Total loans past due and in nonaccrual status | $ | 2,448 | $ | 1,975 | $ | 2,996 | $ | 2,654 | $ | 2,010 | ||||||||||

The following table summarizes the Corporation's nonperforming assets as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Nonaccrual loans | $ | 659 | $ | 666 | $ | 678 | $ | 1,202 | $ | 712 | ||||||||||

Accruing loans past due 90 days or more | 86 | 361 | 166 | 239 | 209 | |||||||||||||||

Total nonperforming loans | 745 | 1,027 | 844 | 1,441 | 921 | |||||||||||||||

Other real estate owned | — | — | 400 | — | — | |||||||||||||||

Total nonperforming assets | $ | 745 | $ | 1,027 | $ | 1,244 | $ | 1,441 | $ | 921 | ||||||||||

The following table summarizes the Corporation's primary asset quality measures as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | |||||||||||

Nonperforming loans to gross loans | 0.07 | % | 0.10 | % | 0.10 | % | 0.17 | % | 0.11 | % | |||||

Nonperforming assets to total assets | 0.06 | % | 0.08 | % | 0.12 | % | 0.14 | % | 0.09 | % | |||||

Allowance for loan losses to gross loans | 0.95 | % | 0.86 | % | 0.84 | % | 0.67 | % | 0.65 | % | |||||

The following table summarizes the balance of net unamortized discounts on purchased loans as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Net unamortized discount on purchased loans | $ | 877 | $ | 1,058 | $ | 1,233 | $ | 1,462 | $ | 1,626 | ||||||||||

As outlined in the preceding tables, the Corporation has grown its loan portfolio over the past 12 months with most of the growth coming in the form of commercial and commercial real estate loans. Despite the significant growth, the Corporation has not relaxed its underwriting standards. Included in the increase in commercial loans were $211,060 of PPP loans.

Despite historically strong credit quality indicators, there continues to be significant uncertainty surrounding the overall impact of COVID-19 on the loan portfolio. This uncertainty resulted in the Corporation increasing the ALLL by $4,287, or 73.75%, since December 31, 2019. Management will continue to monitor the loan portfolio to ensure that the ALLL remains at an appropriate level.

The following table summarizes the average loan size as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||

Commercial | $ | 166 | $ | 171 | $ | 214 | $ | 228 | $ | 204 | ||||||||||

Commercial real estate | 672 | 654 | 644 | 641 | 605 | |||||||||||||||

Total commercial loans | 321 | 325 | 513 | 514 | 481 | |||||||||||||||

Residential mortgage | 180 | 177 | 194 | 198 | 200 | |||||||||||||||

Home equity | 45 | 45 | 46 | 44 | 45 | |||||||||||||||

Total residential real estate loans | 129 | 128 | 137 | 138 | 139 | |||||||||||||||

Consumer | 22 | 25 | 26 | 32 | 31 | |||||||||||||||

Gross loans | $ | 215 | $ | 213 | $ | 234 | $ | 234 | $ | 225 | ||||||||||

COVID-19, CARES Act and SBA activity

The communities which the Corporation serves were not immune to the fallout of the COVID-19 global pandemic. The Corporation has committed significant efforts to work with customers through temporary loan modifications and participation in the PPP loan program through the SBA.

The Corporation considers the modification type on a loan-by-loan basis. Most modifications for loans held within the Corporation's loan portfolio resulted in the deferment of principal and interest payments for 3 months.

In regards to commercial loan modifications, loan officers are contacting the borrowers to determine an appropriate strategy for the next 3 months. If an additional 3 months of principal deferral is warranted, the Corporation is generally collecting accrued interest.

Portfolio residential mortgage loans may have their deferral extended an additional 3 months if the borrower is experiencing a hardship. If the borrower has an escrow established, the Corporation is generally continuing to collect escrow payments.

The Corporation also provides a variety of accommodations for loans that the Corporation services for FHLMC including providing mortgage forbearance for up to 12 months, waiving assessments of penalties and late fees, halting foreclosure actions and evictions, and offering loan modification options that lower payments or keep payments the same after the forbearance period.

The table below outlines the COVID-19 related loan modifications granted by the Corporation as of September 30, 2020:

Number of Modifications | Outstanding Balance | ||||||

Commercial | 11 | $ | 3,020 | ||||

Commercial real estate | 30 | 24,169 | |||||

Total commercial loan modifications | 41 | 27,189 | |||||

Portfolio residential mortgage loans | 92 | 20,591 | |||||

Home equity | 11 | 645 | |||||

Total residential real estate loan modifications | 103 | 21,236 | |||||

Consumer | 3 | 25 | |||||

Total portfolio modifications | 147 | $ | 48,450 | ||||

Residential mortgage loans serviced for FHLMC | 101 | $ | 20,195 | ||||

The Corporation was extremely active in participating in the PPP loan program. As of September 30, 2020, the Corporation funded 1,370 loans with outstanding balances totaling $211,060. The SBA is expected to begin processing applications for forgiveness of PPP loans in the fourth quarter of 2020.

The Corporation generated $6,738 in fees from the SBA through the PPP loan program. The income will be recognized over the life of the PPP loans, which were originated with 24 and 60 month terms. As of September 30, 2020, the Corporation has recognized $2,361 in income, with $4,377 remaining as unearned income.

All other assets

The following tables outline the composition and changes in other assets as of:

9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | 9/30/2019 | ||||||||||||||||||

Premises and equipment, net | $ | 15,267 | $ | 15,323 | $ | 15,533 | $ | 15,245 | $ | 15,443 | ||||||||||||

Corporate owned life insurance | 10,225 | 10,115 | 10,380 | 10,316 | 10,248 | |||||||||||||||||

Accrued interest receivable | 5,645 | 5,266 | 3,124 | 2,877 | 2,954 | |||||||||||||||||

Mortgage servicing rights | 4,376 | 3,816 | 3,980 | 4,030 | 3,900 | |||||||||||||||||

Federal Home Loan Bank stock | 3,488 | 3,488 | 3,150 | 3,150 | 3,150 | |||||||||||||||||