The Fertilisers And Chemicals Travancore (NSE:FACT) Share Price Has Gained 63% And Shareholders Are Hoping For More

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at The Fertilisers And Chemicals Travancore Limited (NSE:FACT), which is up 63%, over three years, soundly beating the market return of 14% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 4.4% in the last year.

View our latest analysis for Fertilisers And Chemicals Travancore

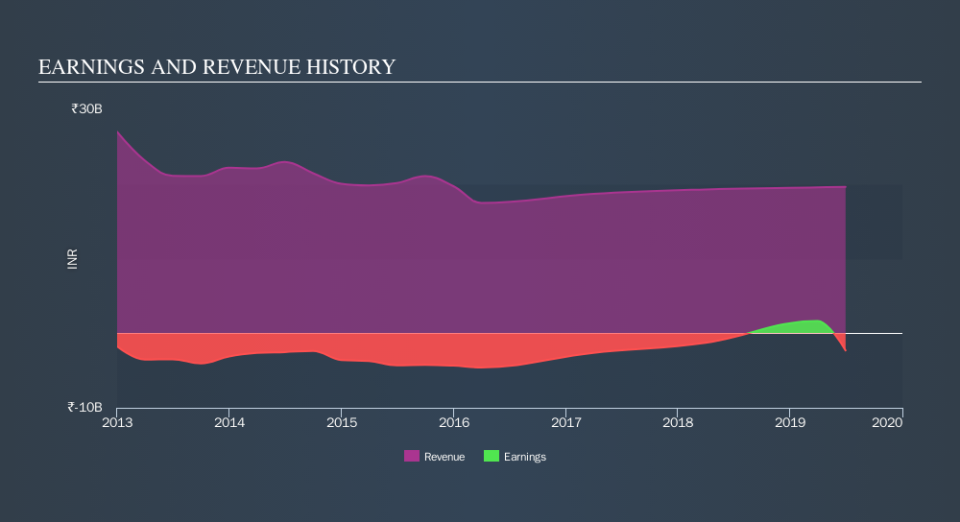

Because Fertilisers And Chemicals Travancore is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We're pleased to report that Fertilisers And Chemicals Travancore shareholders have received a total shareholder return of 4.4% over one year. Having said that, the five-year TSR of 6.3% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. You could get a better understanding of Fertilisers And Chemicals Travancore's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Fertilisers And Chemicals Travancore may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.