'A fighting force': How Americans with crushing debt plan to repay their student loans

Many Americans are worried about having to start paying their student loans again. For some, it might mean getting a second job and cutting back on their spending, including dining out less or not buying name-brand goods and foods when shopping.

The Consumer Financial Protection Bureau recently warned that about 1 in 5 student loan borrowers have risk factors that mean they will struggle when repayments resume.

The fretting comes as part of the bipartisan agreement to raise the federal debt ceiling that President Joe Biden signed into law includes a provision officially ending the more than three-year pause on student loan payments. This means about 45 million Americans with loans amounting to more than $1.6 trillion, will start repaying as soon as October, and with no reprieve from the Supreme Court. In a ruling Friday, the court gutted Biden's plan that would have erased some or all debt for tens of millions of borrowers.

Supreme Court decision on Biden's forgiveness plan is expected any day now.

"We can't afford to live as it is, and making those payments will be that much harder," said Richelle Brooks, an administrator at a Los Angeles charter high school and a mother of two teens. "I'm already overextended. There can’t be any more cuts in my household."

Student loan payments resume soon: The payment pause will end this fall

'My student loan debt outweighs my income'

Brooks, a principal at Matrix for Success Academy in South L.A. for three years, said her love for teaching others has come at a steep cost. She borrowed about $203,000 in student loans for her undergraduate, graduate and doctoral studies. Add more than $30,000 in interest and counting.

The pause in payments during the COVID-19 pandemic was a blessing for Brooks. And it gave her a sense of relief and hope, she said.

"I wish I could've made some payments," Brooks said. "But I don’t have any extra money; things are very expensive."

When loan payments restart, Brooks calculates her monthly payment will be about $600 – that's on top of about $4,500 in rent, a car note and auto insurance, for starters.

And, she said her mother recently moved in with her due to L.A.'s high rental costs.

"Some things are inaccessible to regular, working-class folks," Brooks said. "Wages aren't increasing and living expenses keep rising. There is no give and take."

She said even with a "good-paying job" that earns her about $100,000 annually, it's still not enough when her loans are double her salary. Brooks added that she's not above getting a second job, maybe driving Uber, or maybe being a part-time education consultant.

"My student loan debt outweighs my income," Brooks said. "We're trying to make our money stretch. Always trying."

For the past three years, Brooks has been politically active about her inability to pay her debt. She is a member of Debt Collective, a national union of workers from all backgrounds lobbying lawmakers to cancel student debt among other issues. Her cause has taken her to Washington, D.C., to speak for herself and on others' behalf.

GOP unveils its student loan debt plan Republicans are rolling out a plan to take on student loan debt. Here's how the package could work.

Student loan debt 'scares me and makes me angry,' organizer says

Ian Rhodewalt said he and his wife, Courtney, have a combined $132,000 in student loan debt.

Instead of paying down their debt, the couple from Amherst, Massachusetts, used the payment pause to buy new appliances, including a refrigerator and oven for their home, and a new car after their old vehicle's engine died.

"It was a much-needed reprieve," said Rhodewalt, 37. "It gave us a sense that we were kind of above water and some breathing room."

He hasn't done the math yet, but Rhodewalt knows the loan payments are going to be a bit tough to tackle.

"It scares me and makes me angry," said Rhodewalt, a field organizer for the Western Massachusetts Area Labor Federation, a coalition of more than 60 public and private unions. "Education is a right and public education used to be free, or very close to free. We shouldn’t be punished by being anchored in generations of debt for wanting to pursue higher education."

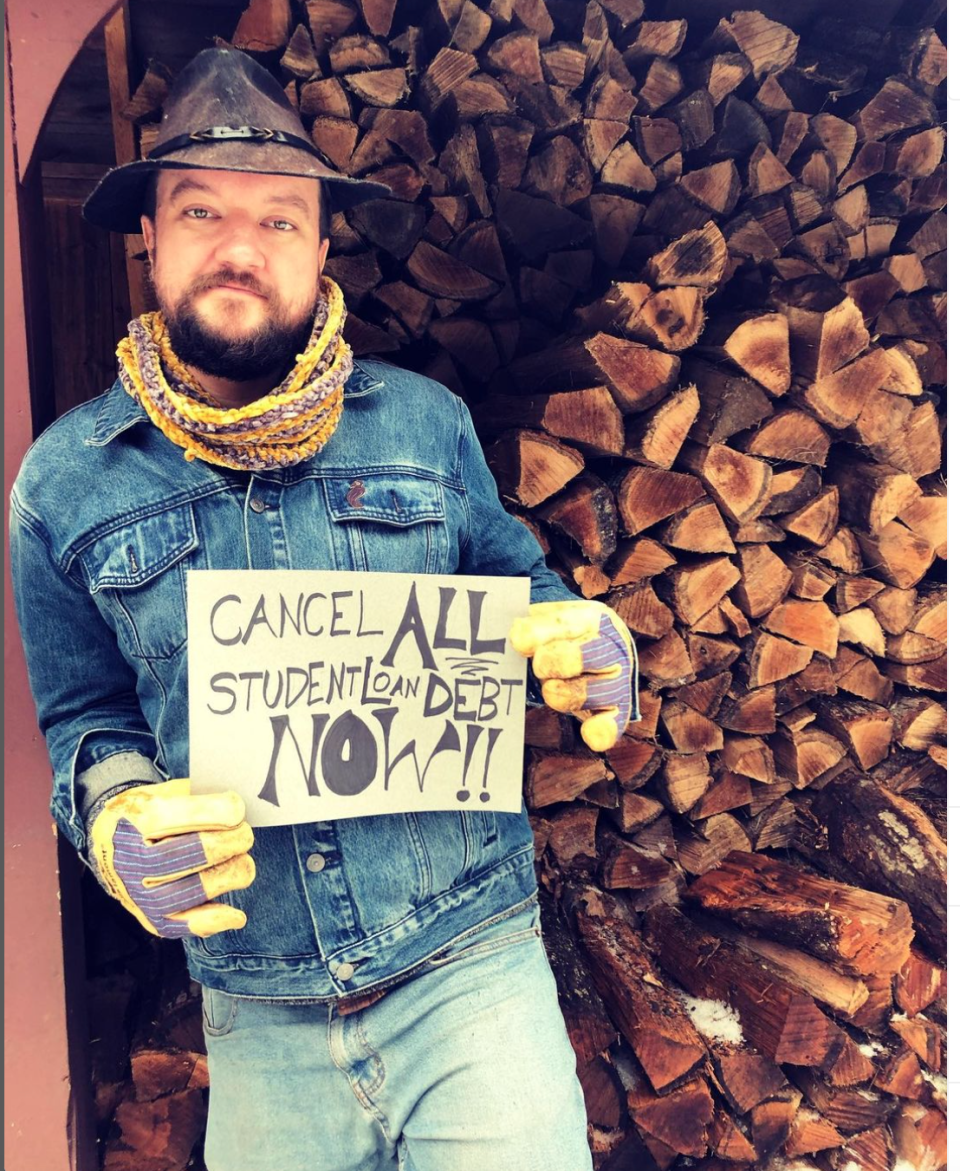

Rhodewalt's coalition passed a resolution urging Biden to cancel all federal student debt by executive order. He helped organize a rally with members who collectively had more than $1.2 million in loan debt, outside the federal courthouse in Springfield, Massachusetts, as the Supreme Court heard oral arguments over student loan debt in Washington.

He's written opinion pieces on his position saying that student debt cancellation can improve racial, economic and gender equity issues, citing a 2020 study that Black women carry about 20% more debt than white women.

"Me and my wife, we’re both white," Rhodewalt said. "But the heavier impact will be felt by communities of color in general and Black communities specifically."

While Rhodewalt said he's "very concerned about the financial constraints" the repayments will place in his household, he believes it will be worst for others.

"The economic damage that will be wrought upon whole communities and local economies by restarting these repayments is morally wrong, profoundly unjust and politically dangerous," he said.

To forgive or not forgive student debt? When do student loan repayments start? The debt ceiling deal gives a firm deadline

'We are not going to be able to afford a new house'

Beth Romaker, 30, of Hillsdale, New York, owes about $35,000 in student loans, while her boyfriend, Spencer Crawford, 28, owes around $7,000.

They have plans to buy a bigger house for themselves and their dog, get married and maybe even start a family. But that all may be put on hold if they have to start repaying their loans.

"Spencer and I made a whole budget this past winter, and we didn’t calculate our student loans," Romaker said. "We're mostly worried that we are not going to be able to afford a new house anymore.

"This is . . . quite life-altering," she concluded.

Romaker said the couple, both environmentalists, admittedly don't make a lot of money. She's an ecological restoration manager; he's an ornithologist – an expert on birds – so money is already tight, and it's likely that whatever's been saved will go to loan repayments.

But will it be enough? She said they definitely will cut back on shopping for organic food and her hobby of growing their own food, for starters.

"It's going to take a lot to figure out where the money is coming from," Romaker said. "I just don’t know what the plan is yet. It’s anxiety-inducing for sure."

Payment pause is ending... now what? When do student loan repayments start? The debt ceiling deal gives a firm deadline

'A lot of people are suffering'

Wen Zhuang, 26, of New Haven, Connecticut, doesn't have doubts about going to art school to get her bachelor's degree and her master's in American studies.

But with about $50,000 in student loan debt, Zhuang, a first-generation college student whose parents emigrated from China, wishes her education would've come cheaper.

"It's pretty daunting," said Zhaung, a labor organizer for health care employees in Hartford. "I'm still looking at the next 10 to 12 years of paying off these loans and not really saving much. I'm really wondering am I in a good financial situation to buy a house? Maybe get married, have kids?

"It's a more far-reaching goal," Zhaung said. "Hindsight is 20/20, I guess."

However, Zhaung said she knows there are millions of more Americans in worse fiscal straits. She worries about them and their futures. She said debt cancellation has now become this "unicorn political action" as "we debtors aren't asking for much."

Zhaung said no matter how eye-opening this debate has been, she's not expecting an 11th-hour reprieve.

"Like 10 years ago, debt cancellation wasn’t even a part of the larger conversation. Now it’s become a fighting force," Zhaung said. "We will see how this all shakes out. I don’t think this is over. A lot of people are suffering."

This article originally appeared on USA TODAY: Student loans 2023: How Americans plan to repay their crushing debt