Bitcoin No Longer Trading at a Premium on Coinbase, Data Show

The so-called Coinbase premium has evaporated, indicating a weaker stateside buying pressure.

At press time, bitcoin was trading at $64,000, down over 12% from record highs reached last week.

A market dynamic that characterized bitcoin’s {{BTC}} recent rally to record highs has changed, signaling a weaker stateside demand for the leading cryptocurrency.

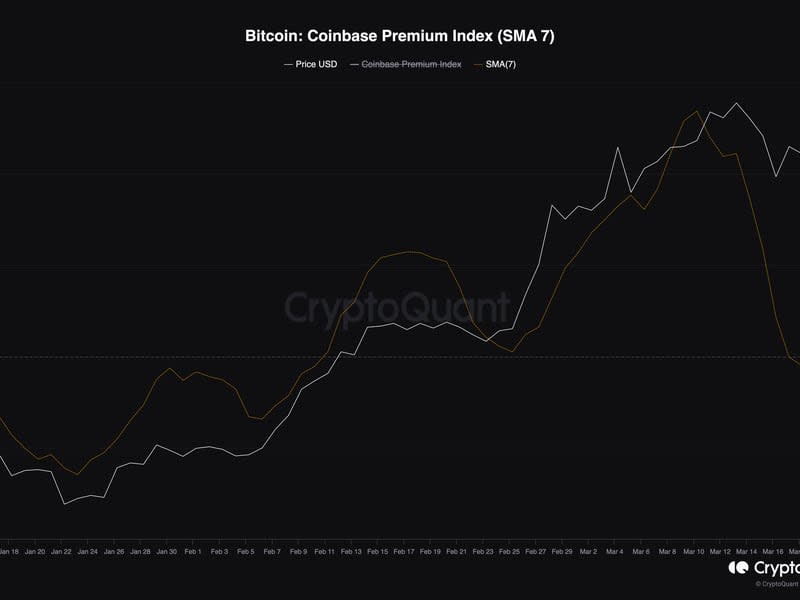

The seven-day moving average of the so-called Coinbase Premium indicator, which tracks the spread between bitcoin’s prices on the Nasdaq-listed Coinbase (COIN) exchange and the offshore giant Binance, has flipped negative, according to data tracked by CryptoQuant.

In other words, bitcoin is now trading at a discount on Coinbase, which serves as custodian for eight of the 11 spot ETFs that debuted in the U.S. two months ago.

The development likely reflects relatively weaker net buying from U.S. investors. Inflows into spot ETFs slowed on Monday, with Grayscale’s ETF losing a record $642.5 million in outflows. Fidelity’s ETF amassed just $5.9 million, the lowest single-day inflow on record.

The Coinbase premium surged to a 12-month high of 0.16 during bitcoin’s recent uptrend from $48,000 to new record highs above $73,500 last week.

Since then, the cryptocurrency has pulled back over 12% to $64,000, CoinDesk data show. The CoinDesk 20 Index, a broader market gauge, has declined 19% to 2,446 points.

Analysts foresee a deeper bitcoin price slide should the ETF inflows struggle to gather pace.