Forget Johnson & Johnson: Buy This Better Healthcare Stock Instead

Many healthcare investors look at Johnson & Johnson (NYSE: JNJ) and see a good, safe dividend stock. But I see an investment that's full of uncertainty and risk.

The company continually runs into legal problems, and I can't help but wonder if one day it will follow in the path of 3M, which was also once seen as a top investment option for risk-averse investors who just wanted to collect a safe dividend; it, too, has run into many legal problems, and 3M is now looking to reset its payout after decades of dividend growth.

I would argue Johnson & Johnson isn't worth the risk. And given the uncertainty it faces and its low growth rate, it's too expensive, even at what might seem to be a modest 22 times earnings. Instead of investing in Johnson & Johnson, I suggest you consider a better and safer investment in AstraZeneca (NASDAQ: AZN).

AstraZeneca's growth prospects look more promising

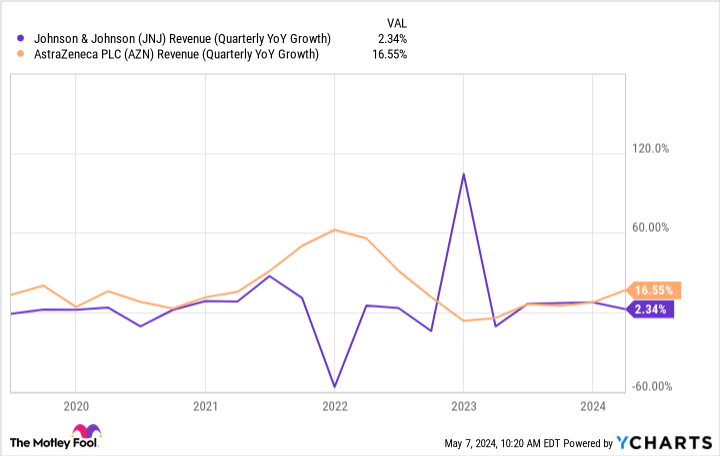

Biopharmaceutical company AstraZeneca has a broad and diverse business, not unlike Johnson & Johnson's. But there's a lot to like about the company with its strong oncology business and CEO Pascal Soriot having said that it's on track to deliver 15 new products before the end of the decade. And for the most part, AstraZeneca has been generating better growth numbers than Johnson & Johnson.

JNJ revenue (quarterly YoY growth) data by YCharts; YoY = year over year.

In its most recent quarterly results, for the period ending March 31, the company reported $12.7 billion in revenue, up 19% year over year. And its oncology business increased sales by 26% to $5.1 billion. Multiple segments generated double-digit growth this past quarter.

Meanwhile, Johnson & Johnson is targeting growth between 5% and 7% to the end of the decade.

Johnson & Johnson should trade at more of a discount

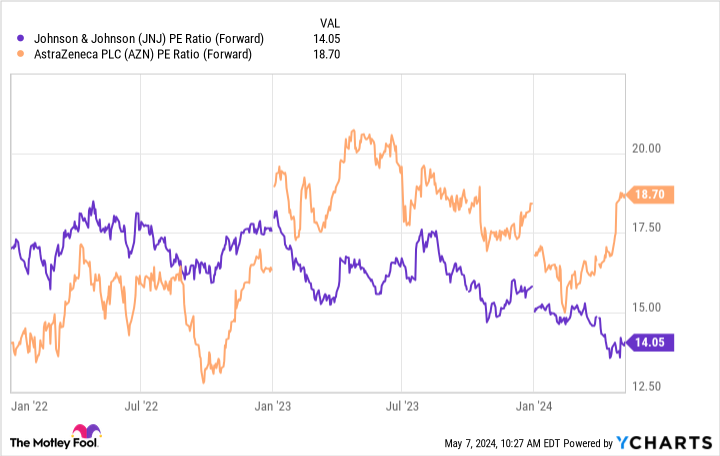

In terms of valuation, AstraZeneca is a slightly more expensive stock than Johnson & Johnson right now. But investors often expect to pay a premium for a better growth stock. And I would argue that up until recently, their valuations were fairly close, in terms of their forward price-to-earnings multiples, which are based on analyst estimates of how they will perform over the next 12 months.

JNJ PE ratio (forward) data by YCharts; PE = price to earnings.

Throw in the fact that Johnson & Johnson still has the cloud of its unresolved talc lawsuits hanging over it, and there's even more reason investors should be demanding a discount for the troubled healthcare stock. The company is trying to resolve its talc lawsuits through a bankruptcy filing involving a subsidiary (this is its third attempt), but it's no guarantee that will definitively put the matter to rest.

Overall, AstraZeneca stock looks cheap considering what it's offering investors: a reliable dividend, a diverse business, and solid long-term prospects. And while it's more expensive than Johnson & Johnson shares, the premium seems warranted.

AstraZeneca is better on multiple fronts

The main reason I could see investors wanting to buy Johnson & Johnson stock instead of AstraZeneca is the dividend. At 3.3%, Johnson & Johnson stock offers a higher yield, versus the 1.9% yield you can get with AstraZeneca.

But if Johnson & Johnson's returns would have been stronger over the years, its dividend yield would be much lower. In five years, its shares have risen by just 5% while AstraZeneca has doubled in value, which is a key reason its yield might look unappealing to dividend investors.

There's danger in focusing solely on the dividend (and its yield) without going through the underlying fundamentals of the business as a sense check, because as 3M has demonstrated recently, even a Dividend King doesn't necessarily make for an airtight investment option. What matters is what could happen in the years ahead, not what a company has done in the past. And AstraZeneca's future looks a lot brighter than Johnson & Johnson's.

Should you invest $1,000 in AstraZeneca Plc right now?

Before you buy stock in AstraZeneca Plc, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AstraZeneca Plc wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends 3M, AstraZeneca Plc, and Johnson & Johnson. The Motley Fool has a disclosure policy.

Forget Johnson & Johnson: Buy This Better Healthcare Stock Instead was originally published by The Motley Fool