Here's how the economy and the stock market could react to the 4 possible outcomes of the debt ceiling standoff

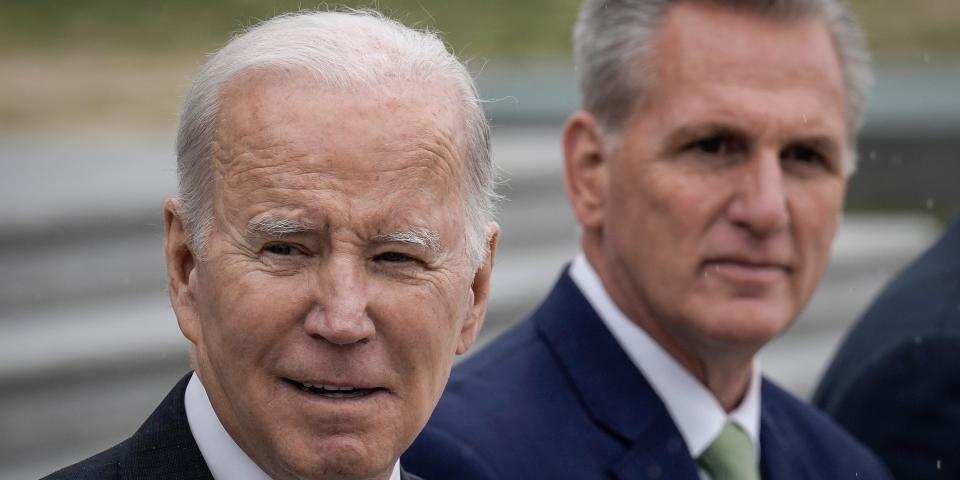

The US debt ceiling showdown in Congress is fast approaching a potential early June deadline.

Republicans and Democrats appear to be at an impasse with no progress made towards a deal.

These are the four scenarios and their potential impact on the US economy, according to Ned David Research.

The latest debt ceiling showdown appears to be extraordinary as no party is in full control of Congress, and that could lead to disastrous outcome for the US economy, according to a Wednesday note from Ned Davis Research.

While the ongoing US debt ceiling showdown in Congress is nothing new for investors, as the debt limit has been raised year after year with a typical show of political theater, it could have grave implications if the crisis isn't ultimately solved this time around.

"Market participants have been conditioned over the years to expect that any debt ceiling impasse would be resolved in time to avoid a default, even if it comes down to the wire. It runs on the trust that politicians understand that the potential consequences of a default are too dire, including wreaking havoc on the global financial system and causing a recession in the US and possibly the global economy," NDR explained.

The note referenced what happened in 2011 as a barometer for what's possible this time around, in which the S&P 500 sank nearly 20% over a period of a few months because the US lost its AAA rating from Standard and Poor's due to the political brinkmanship that was sparked by a debt ceiling crisis.

"While we expect that the debt limit will be adjusted again, we see a significant risk of financial market volatility between now and the X-date of June 1," NDR said.

These are the four potential outcomes of the current US debt ceiling showdown in Congress, according to the note.

1. Standoff continues past the X-date - 5% odds.

In this most dire scenario, the US government would partially default on its debt due to political brinkmanship between Democrats and Republicans. The government would miss payments to retirees, veterans, military personnel, and contractors, but it would continue to make bond payments.

Because of a partial default, US debt would be downgraded by credit agencies, which would lead to investors demanding a higher risk premium. There would be a decline in confidence and spending among consumers, and the US economy would fall into a recession. This is the worst possible scenario for the stock market.

2. Clean debt ceiling increase - 10% odds.

In this scenario, a debt default would be fully averted thanks to the Republicans giving up on its spending cut demands at the last minute. In this scenario, there would be no change to the outlook for economic growth in 2023.

3. Biden caves to some Republican demands - 20% odds.

In this scenario, a US debt default would be averted because Biden would give into some spending cut demands from Republicans. Government spending cuts would go into effect for 2023 and 2024. This would lead to rising uncertainty among investors and businesses, as spending approved by one Congress could be undone by the next, especially with the likelihood that the next debt ceiling deadline down the road could be leveraged by the minority political party. This scenario would lead to slower economic growth in 2023 and 2024.

4. Debt ceiling suspended - 65% odds.

In this scenario, Congress suspends the debt ceiling limit, creating time for extended negotiations. This scenario would avert a debt default, though some government spending cuts would be likely. If Congress kicks the can down the road for a few months into Fall 2023, the same issues today would resurface then and it would add the risk of a potential government shutdown. This scenario would lead to slower economic growth in 2023 and 2024.

"We favor the outcome of a temporary debt ceiling suspension either for a brief period of time or until September when Congress will be debating the budget for the next fiscal year. The government has done this repeatedly, including seven times between 2013 and 2019," NDR said.

Read the original article on Business Insider