Meet the doomsayers waiting for the economy to crash

Economic doomers are getting louder as they say the economy is headed for a collapse.

Membership on the r/economiccollapse subreddit rose by 80% from the end of 2021 to the end of 2023.

There's a divergence between what experts say is a healthy economy and the experience of many individuals.

Daniel, a Reddit user based in Washington, DC, has been browsing the subreddit r/economiccollapse for about four years. He says he isn't a doomsayer, but he sees an economic implosion coming for the US that could mirror the Soviet Union's collapse at the end of the Cold War.

Daniel, who asked to only use his first name to protect his privacy, has taken steps to prepare for his grim vision of the future. He refuses to hold his savings in cash and has all of his money invested in a portfolio of defense stocks, gold, crypto, and other assets he thinks will maintain their value.

"The one thing that our economy is going to be guaranteed is a wartime economy," Daniel told Business Insider in an interview. "Only time will tell how bad it will truly get."

Observers may be quick to dismiss such talk as conspiratorial or alarmist, but a growing number of people in online communities on Reddit and elsewhere say their unease about the economy and material conditions in the US points to a coming collapse.

The sentiment has been on the rise amid the frustration and anxiety that came with the pandemic and never seemed to subside, experts say, though most economists agree that the economy is probably fine for now.

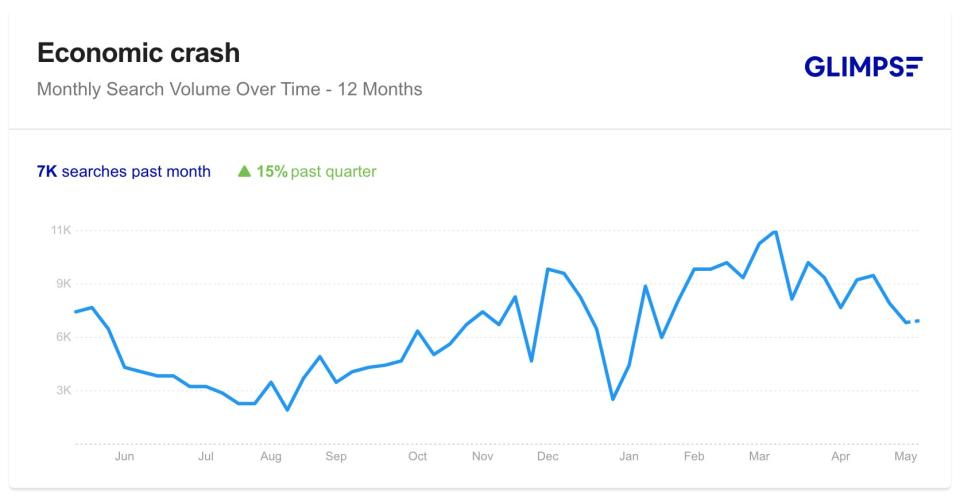

Interest in ultra-bearish takes on the market or the economy is on the up based on raw search data. Google searches for "stock market crash" have jumped 17% over the last quarter, while searches for "economic crash" have surged 15%, according to search analytics firm Glimpse.

Membership on the r/economiccollapse subreddit has also climbed in recent years, rising by 80% from the end of 2021 to the end of 2023. The broader doomsday message board, r/collapse, has also seen an increase in membership, rising 26% since the end of 2021, according to the analytics site Subreddit Stats.

In both communities, users are sounding the alarm on all sorts of apocalyptic scenarios for the economy, with some predicting a stock market crash, housing market crash, or a total collapse of the US financial system.

One r/economiccollapse member Business Insider connected with, who withheld their identity to maintain their privacy, said they believed the stock market would "plummet" if the Fed didn't continue to raise interest rates, causing a hyperinflation problem to spread through the economy.

"I have encountered only a small handful of people in person who truly know what's up," they told BI. "I am very pessimistic because I don't have much control over it, and I have not seen any evidence of things getting back on track."

Another user warned the recent run-up in AI stocks could lead to a dot-com-style crash.

"Irrational exuberance and greedy speculation. Big money to be made in the short term, but massive hangover when the party is over," they wrote in a post. "I wouldn't want to be left holding the bag when it all falls in."

Many doomers say they're just presenting a more realistic version of the situation. Freddie Smith, a Florida-based real-estate agent, says he isn't an alarmist, but regularly posts warnings on the economy on his social media accounts. In one TikTok, he speculates the economy is now even worse than it was during the Great Depression due to the higher cost of living.

"They're still kind of sucking the money, pushing people to the edge," Smith said of the government's treatment of the middle class. He anticipates rising homelessness and more people living paycheck to paycheck if economic reforms aren't made.

Jonathan Rose, the CEO of the commodities firm Genesis Gold Group, says he's also noticed increasing anxiety among his clients. The number of investors he works with who have bought physical gold specifically as a store of value has surged around 40%-60% since the pandemic, Rose estimated.

Rose said he believed some of the clients looking to hold onto gold were preppers and homesteaders, people who look to prepare for a major disaster or otherwise achieve a fully self-sufficient lifestyle "off the grid."

"People are looking to prep with metals," Rose said. "There's always a steady influx of people who are always looking to protect and diversify. But I think the past couple of years, there's definitely been an uptick."

Perception and reality

The economic reality doesn't quite square with what many on these forums say they're preparing for.

The US has avoided a recession that's been predicted for the last two years. The labor market also remains relatively robust, with the unemployment rate remaining near historic lows in March.

Rose speculates that pessimism over the economy has surged since the start of the pandemic. That experience of uncertainty and fear has made people more aware of risks facing the economy, he says, which include high government debt levels, rising geopolitical tensions, and stubbornly high inflation.

"I think that there are just more problems today than we had 10 years ago. So people are concerned about these problems, and people are saying we are due for something to happen. And I'd agree with that," Rose said.

Many people may also be reacting to the fact that their lived experience of the economy may not be matching up with the strength of the data that's been reported.

A higher cost of living has begun to sting the US middle-class, and a survey from Northwestern Mutual found that financial anxiety among Americans is hovering at its highest level since 2012.

"I certainly notice the higher prices and living costs that inflation has given us at restaurants and grocery stores," Richard Sylla, a financial historian at New York University said. "Others may not be as lucky and could be constrained by them, and that could color their outlooks for the stock market and the economy."

Smith said he makes videos both to educate people about the economy and to air out his frustrations about the working class.

"I look at these 23-year-olds online talking about how they're working 40, 50 hours a week and living with their parents," Smith told BI. "The whole world has changed in the past 10 years ... I guess the frustration is the lack of recognition of a broken system," he said.

Read the original article on Business Insider