Red Bank households can expect property tax hike of over $100; here's what it will pay for

RED BANK - The average borough household would see a $103.74 municipal tax increase this year if the borough adopts its proposed budget.

The average Red Bank home would pay $2,639.05 this year. Compared to 2023, the average municipal tax would increase by 2.9%.

According to Borough Administrator Jim Gant, much of the increase is due to inflation, rising health care costs for borough employees and other payments that are required by the state such as pensions.

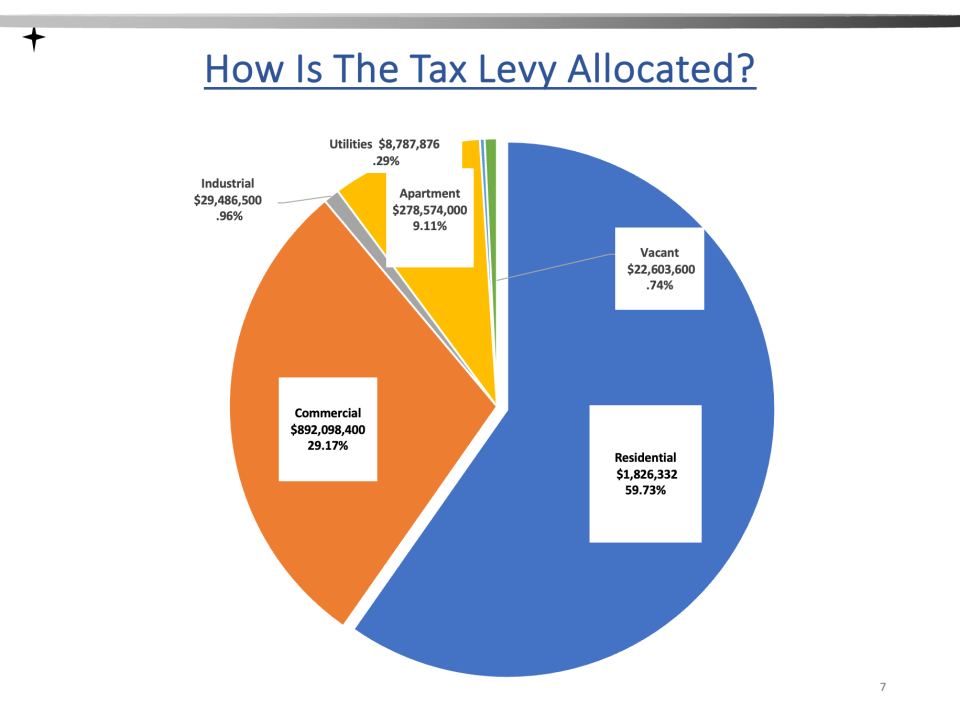

Despite residents seeing a property tax increase, the municipal tax rate of 49 cents per $100 of assessed valuation is lower than 2023’s municipal tax rate of 50 cents per $100 of assessed valuation.

Red Bank: First legal marijuana store in the borough opens it doors

This is due to the average residential assessment in 2024 of $539,000 being higher than the 2023 average residential assessment of $505,000.

Red Bank properties are reassessed yearly. In 2020, the average residential assessment was $384,000.

The borough is looking to raise just under $15 million to run municipal services and to jump start municipal projects. Municipal taxes make up 26.4% of borough residents' property taxes. The local school district receives 35.1%, Red Bank Regional High School receives 24.9%, the county receives 11.7% and the library receives 1.9%.

No more plastic utensils? Red Bank law aims to cut down on takeout waste

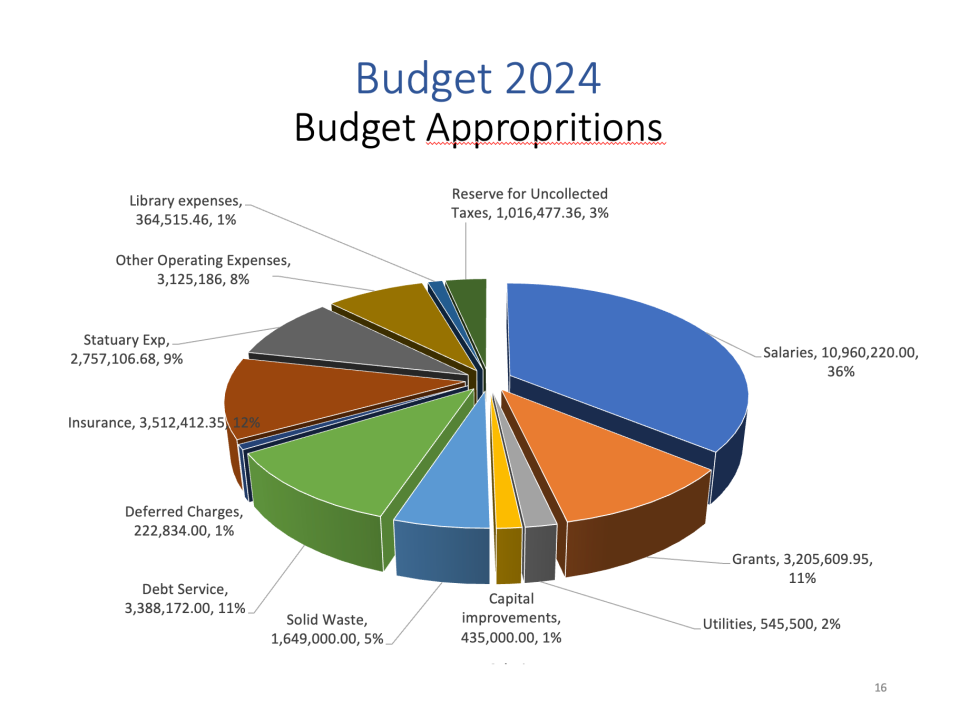

According to the borough’s chief financial officer, Thomas Seaman, nearly all of the main budget categories, including salaries and wages, utilities, capital improvement and debt services have increased. The borough also had to undergo emergency repairs to the Department of Public Works building in 2023. In total, all deferred charges for emergency work increased from $32,000 in 2023 to $223,000 in 2024.

Revenue budgeted for capital improvements and grants also increased. Capital improvements increased from $100,000 in 2023 to $435,000 in 2024. Grants increased from $721,000 in 2023 to $3.2 million in 2024.

Capital improvements include road improvements to Alston Court, Hubbard Park, Allen Place, Harrison Avenue, Linden Place, Chestnut Street, Boat Club Court and River Street. It would also improve Count Basie Park, Marine Park and a few buildings owned by the borough.

Red Bank: After four-year delay, borough could get its largest apartment building

Grants include the Shrewsbury Avenue improvement grant and the Department of Transportation Safe Streets to Transit grant to improvement the area around the train station.

The borough council will vote on the budget at 6:30 p.m. on Thursday, May 9, at Borough Hall.

Olivia Liu is a reporter covering transportation, Red Bank and western Monmouth County. She can be reached at oliu@gannett.com.

This article originally appeared on Asbury Park Press: Red Bank municipal taxes could increase by nearly $104 per household