How Financially Strong Is Lonza Group Ltd (VTX:LONN)?

The size of Lonza Group Ltd (VTX:LONN), a CHF22b large-cap, often attracts investors seeking a reliable investment in the stock market. Market participants who are conscious of risk tend to search for large firms, attracted by the prospect of varied revenue sources and strong returns on capital. But, its financial health remains the key to continued success. Let’s take a look at Lonza Group’s leverage and assess its financial strength to get an idea of their ability to fund strategic acquisitions and grow through cyclical pressures. Note that this information is centred entirely on financial health and is a high-level overview, so I encourage you to look further into LONN here.

View our latest analysis for Lonza Group

Does LONN Produce Much Cash Relative To Its Debt?

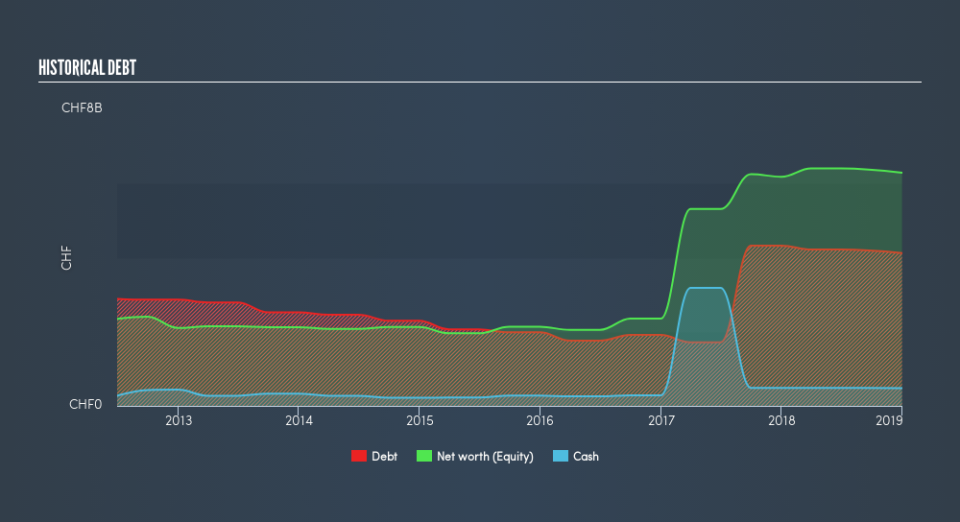

LONN has sustained its debt level by about CHF4.1b over the last 12 months which accounts for long term debt. At this stable level of debt, the current cash and short-term investment levels stands at CHF478m , ready to be used for running the business. On top of this, LONN has produced CHF1.1b in operating cash flow over the same time period, resulting in an operating cash to total debt ratio of 26%, indicating that LONN’s current level of operating cash is high enough to cover debt.

Does LONN’s liquid assets cover its short-term commitments?

With current liabilities at CHF2.4b, the company has been able to meet these obligations given the level of current assets of CHF3.5b, with a current ratio of 1.48x. The current ratio is the number you get when you divide current assets by current liabilities. For Life Sciences companies, this ratio is within a sensible range since there's a sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Can LONN service its debt comfortably?

With debt reaching 66% of equity, LONN may be thought of as relatively highly levered. This isn’t surprising for large-caps, as equity can often be more expensive to issue than debt, plus interest payments are tax deductible. Consequently, larger-cap organisations tend to enjoy lower cost of capital as a result of easily attained financing, providing an advantage over smaller companies. We can test if LONN’s debt levels are sustainable by measuring interest payments against earnings of a company. Preferably, earnings before interest and tax (EBIT) should be at least three times as large as net interest. In LONN's case, the ratio of 9.81x suggests that interest is appropriately covered. It is considered a responsible and reassuring practice to maintain high interest coverage, which makes LONN and other large-cap investments thought to be safe.

Next Steps:

LONN’s high cash coverage means that, although its debt levels are high, the company is able to utilise its borrowings efficiently in order to generate cash flow. This may mean this is an optimal capital structure for the business, given that it is also meeting its short-term commitment. This is only a rough assessment of financial health, and I'm sure LONN has company-specific issues impacting its capital structure decisions. You should continue to research Lonza Group to get a better picture of the large-cap by looking at:

Future Outlook: What are well-informed industry analysts predicting for LONN’s future growth? Take a look at our free research report of analyst consensus for LONN’s outlook.

Valuation: What is LONN worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether LONN is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.