Fintech Focus For December 21, 2020

Quote To Start The Day: When you feel like giving up, remember why you held on for so long in the first place.

Source: Paulo Coelho

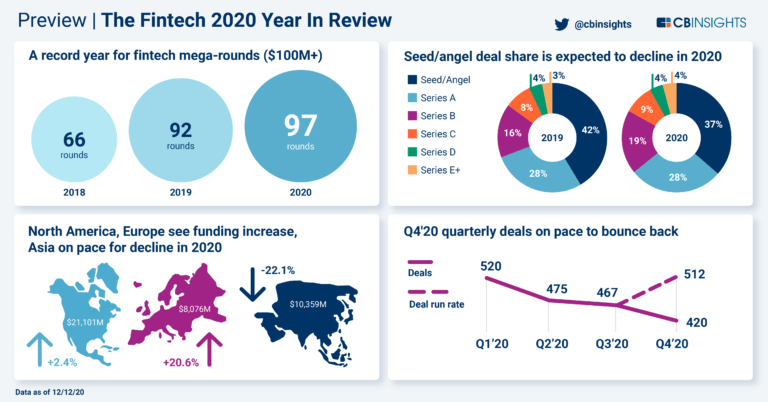

One Big Thing In Fintech: Seed and angel deals are projected to fall to 37% of total deal activity in 2020, down from 42% in 2019. We expect Series B rounds to finish the year with the greatest increase in share, up 3 percentage points to 19% by year-end.

Source: CB Insights

Other Key Fintech Developments:

FinCEN proposing new KYC rules.

N26 to fundraise before 2023 IPO.

Paxos taps $142M Series C funds.

Mettalex added to Binance’s Chain.

Treasury weighing new crypto rule.

Making money in fintech is difficult.

NerdWallet has hired eBay’s CFO.

ABN Amro app breaks login record.

Finicity introduced Brex agreement.

Citi builds new fintech marketplace.

ESMA opens consult on algo trade.

Watch Out For This: [C]onstructing a massive amount of new infrastructure that achieves a cohesive set of national goals is impossible if we simply allow cities and citizens to prioritize their individual concerns.

Source: MIT

Interesting Reads:

The impact of financial stress in US.

Tiny reactor yields lots of hydrogen.

MX: The State of Banking into 2021.

Space Force discusses partnerships.

D91: The Personal Finance Survey.

Amazon Halo tracker raises concern.

Hedgeye CEO on models, investing.

Eliminate wasteful worker spending.

Apple Pay draws antitrust attention.

Market Moving Headline: U.S. index futures auctioned to new all-time highs last week, before weakening into Friday’s derivative expiry.

Key Takeaways:

- Financial markets are priced to perfection.

- Vaccine progress, stimulus both positives.

- Innovation gains traction, softens inflation.

- Depth, breadth of recovery remains rough.

- Sentiment and positioning levels elevated.

- Higher-time frame breakouts remain intact.

As BlackRock Inc (NYSE: BLK) said in one Q1 2021 commentary, “a rising tide lifts all boats”; though financial markets have largely priced in positive news surrounding vaccines and stimulus, the rally remains intact, bolstered by a drive for yield — technical factors as a result of resurgent systemic and hedge fund strategies, among other things.

Source: Physik Invest

See more from Benzinga

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.