The Fiore Gold (CVE:F) Share Price Is Up 181% And Shareholders Are Boasting About It

It hasn't been the best quarter for Fiore Gold Ltd. (CVE:F) shareholders, since the share price has fallen 18% in that time. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Like an eagle, the share price soared 181% in that time. So it is important to view the recent reduction in price through that lense. The real question is whether the business is trending in the right direction.

Check out our latest analysis for Fiore Gold

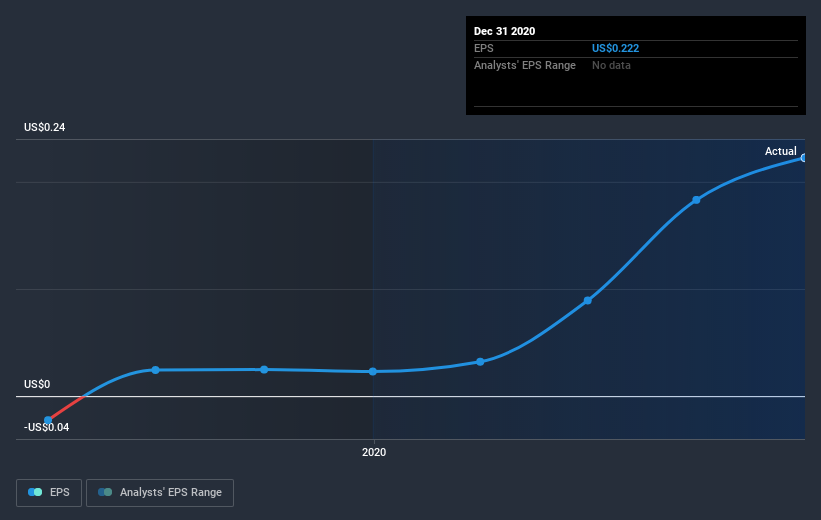

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Fiore Gold saw its earnings per share (EPS) increase strongly. While that particular rate of growth is unlikely to be sustained for long, it is still remarkable. We are not surprised the share price is up. Strong growth like this can be evidence of a fundamental inflection point in the business, making it a good time to investigate the stock more closely.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Fiore Gold has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Fiore Gold stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Fiore Gold shareholders have gained 181% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 19%. Given the track record of solid returns over varying time frames, it might be worth putting Fiore Gold on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Fiore Gold (of which 1 makes us a bit uncomfortable!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.