First Eagle Investment Exits Omnicom, Cuts Weyerhaeuser

First Eagle Investment manages a $31.82 billion equity portfolio composed of 98 stocks as of the quarter's end. The firm sold shares of the following stocks during the second quarter of 2020.

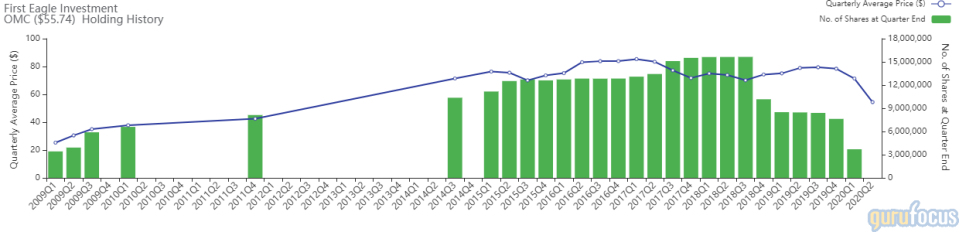

Omnicom

The fund closed its position in Omnicom Group Inc. (OMC). The trade had an impact of -0.74% on the portfolio.

The holding company has a market cap of $11.98 billion and an enterprise value of $16.04 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 37.3% and return on assets of 3.86% are outperforming 70% of companies in the media - diversified industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.48 is below the industry median of 0.87.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 1.32% of outstanding shares, followed by HOTCHKIS & WILEY with 0.45% and John Rogers (Trades, Portfolio) with 0.27%.

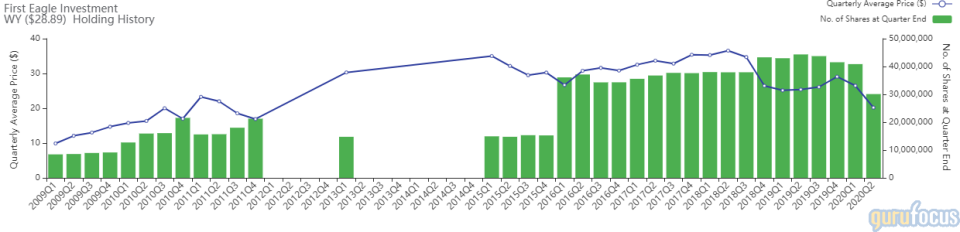

Weyerhaeuser

The fund reduced its Weyerhaeuser Co. (WY) holding by 26.34%. The portfolio was impacted by -0.66%.

The forest product company has a market cap of $21.56 billion and an enterprise value of $27.25 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 3.67% and return on assets of 1.83% are underperforming 61% of companies in the REITs industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.1 is above the industry median of 0.08.

Other notable guru shareholder of the company include the T Rowe Price Equity Income Fund (Trades, Portfolio) with 1.30% of outstanding shares, Third Avenue Management (Trades, Portfolio) with 0.25% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.21%.

Barrick Gold

The fund curbed its position in Barrick Gold Corp. (GOLD) by 15.87%. The portfolio was impacted by -0.49%.

The gold producer has a market cap of $46.42 billion and an enterprise value of $57.53 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 22.28% and return on assets of 10.63% are outperforming 95% of companies in the metals and mining industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.64 is far below the industry median of 16.25.

Some other notable guru shareholders are Simons' firm with 1.41% of outstanding shares, Stanley Druckenmiller (Trades, Portfolio) with 0.24% and Pioneer Investments (Trades, Portfolio) with 0.19%.

Truist Financial

The fund reduced its Truist Financial Corp. (TFC) holding by 31.42%, impacting the portfolio by -0.45%.

The bank has a market cap of $54.85 billion and an enterprise value of $67.54 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. While the return on equity of 6.27% is underperforming the sector, return on assets of 0.91% is outperforming 58% of companies in the banks industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.88 is above the industry median of 1.34.

The largest guru shareholder of the company is Dodge & Cox with 2.06% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.11% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.03%.

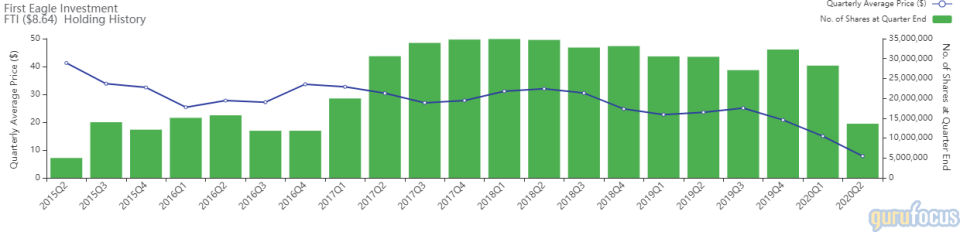

TechnipFMC

The investment fund trimmed its holding in TechnipFMC PLC. (FTI) by 51.76%. The trade had an impact of -0.36% on the portfolio.

The company, which provides subsea equipment and subsea engineering and construction services, has a market cap of $4.01 billion and an enterprise value of $4.43 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -80.17% and return on assets of -26.65% are underperforming 88% of companies in the oil and gas industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.9 is above the industry median of 0.39.

Some notable guru shareholders include Richard Pzena (Trades, Portfolio) with 4.09% of outstanding shares and Pioneer Investments (Trades, Portfolio) with 1.97%.

Franco-Nevada

The investment fund reduced its Franco-Nevada Corp. (FNV) position by 24.65%. The trade had an impact of -0.31% on the portfolio.

The company has a market cap of $27.04 billion and an enterprise value of $26.66 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 4.12% and return on assets of 3.91% are outperforming 85% of companies in the metals and mining industry. Its financial strength is rated 10 out of 10 with no debt.

The largest guru shareholder of the company is Simons' firm with 2.58% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.24% and Chuck Royce (Trades, Portfolio) with 0.08%.

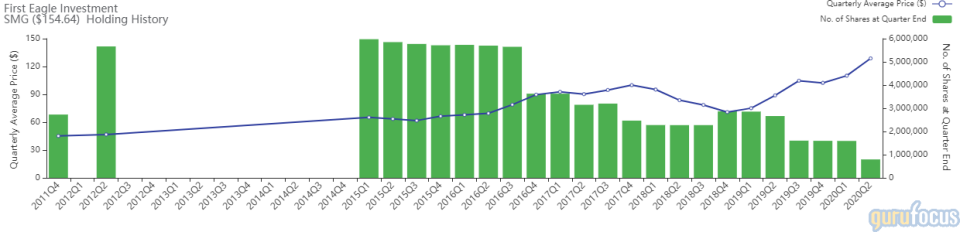

The Scotts Miracle

The investment fund curbed its holding in The Scotts Miracle Gro Co (SMG) by 50.06%. The trade had an impact of -0.30% on the portfolio.

The company, which provides gardening and lawncare products, has a market cap of $8.62 billion and an enterprise value of $10.30 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 41.42% and return on assets of 9.07% are outperforming 87% of companies in the agriculture industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.03.

The largest guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 1.58% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 1.43% and Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.17%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Viking Global Investors Trims Technology Company Holdings in 2nd Quarter

5 Predictable Stocks With a Margin of Safety

5 Health Care Companies Outperforming the Market

Not a Premium Member of GuruFocus? Sign up for afree 7-day trial here.

This article first appeared on GuruFocus.