First glitch of the tax season is here: That IRS child tax credit letter may be inaccurate

The first potential glitch of tax season involves new concerns about the accuracy of some letters that the IRS is sending out relating to the child tax credit.

The Internal Revenue Service said it is reviewing complaints by some taxpayers who say that the IRS Letter 6419 sent to them spells out the wrong dollar amount for what the families received in 2021 for the advance payments of the child tax credit, which were issued each month from July through December.

Families who received the advance monthly payments in 2021 must reconcile what they received last year with what their financial situation is this year and file a Schedule 8812 with their 2021 federal income tax return.

But it may be a little worrisome if you're thinking that the information the IRS is sending isn't exactly correct right now.

The good news is it's still possible that it's early enough in the tax season that we'll get some information that can help straighten all this out soon.

So far, some complaints appear to be limited.

The Association of International Certified Public Accountants said it reached out to members on its tax committees and those CPAs said the child tax credit numbers have been correct on the letters they’ve seen so far this tax season.

The IRS had to address these complaints during a call with the news media on Monday that was timed to kick off the tax season. The IRS began accepting and processing 2021 federal income tax returns Monday. The tax filing deadline for most of the country is April 18.

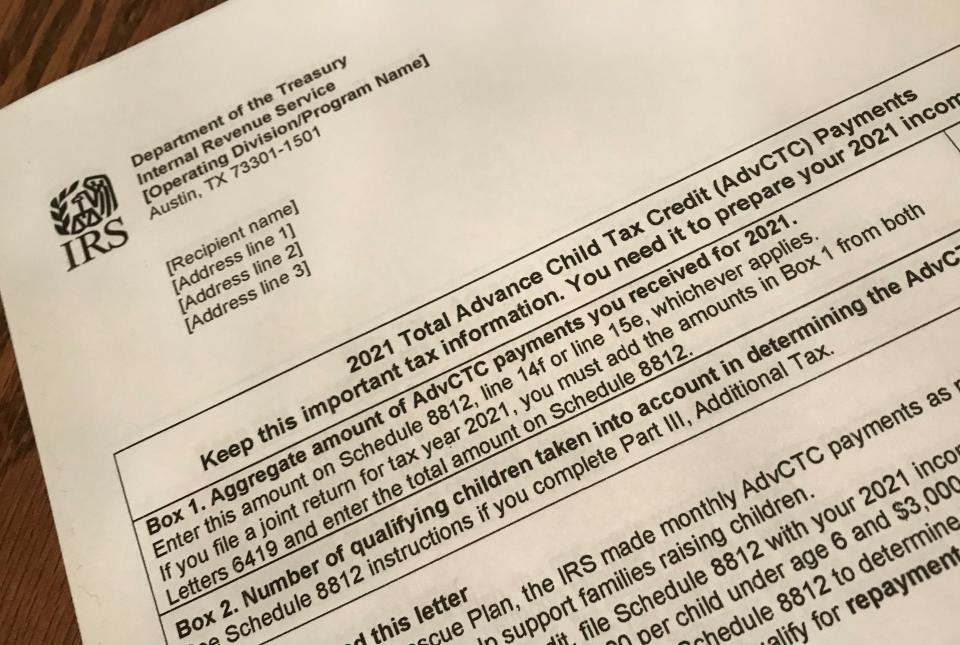

The letter itself spells out two key components that were used to calculate your advance child tax credit payments in 2021.

Box 1, which is at the very top of this letter, will tell you the total dollar amount of money you received for the advance child tax credit payments over six months in 2021. You need to enter that amount on Schedule 8812 called "Credits for Qualifying Children and Other Dependents" on line 14f or line 15e, whichever applies.

Box 2, which is right under Box 1, lists the number of qualifying children that were taken into account when the advance payments were determined for 2021.

Yet some reports say that the total amount some families are seeing isn't right.

Reporters on the call Monday indicated that some tax filers are complaining that they're seeing incorrect dollar amounts listed on Letter 6419 that they've received so far.

Are all the letters wrong? The IRS says no.

How many letters are wrong? The IRS said it doesn't know yet.

The IRS said it does not know at this point the extent of the complaints. The IRS said it will be releasing more information as it explores the issue.

IRS Commissioner Chuck Rettig cautioned journalists on the Monday a media call that the scope of the errors is likely limited.

He said he was "highly confident that it is nowhere near millions or hundreds of thousands."

He cautioned the media about not creating unnecessary anxiety for taxpayers.

He said the IRS would release more information on that situation when it is available.

TAXPAYERS BEWARE: IRS: Mistakes with child tax credit, stimulus can trigger refund delays

ABOUT THAT IRS LETTER: 5 things to know about IRS Letter 6419 and the child tax credit

Ken Corbin, wage and investment division commissioner and chief taxpayer experience officer for the IRS, said it is possible that issues may involve taxpayers who moved or changed bank accounts in December and now are seeing discrepancies with the information on their latest correspondence with the IRS on Letter 6419.

Corbin noted the letter might have been generated in those cases before money may have been received by the taxpayer.

Some tax professionals have taken to social media to alert people to what they see as a significant problem ahead for some. One couple reported that their payments were overstated by about $1,600 and that included some money that never arrived.

I posted warning about the 6419 letter and got this comment. We’re so screwed. Had two DMs from others having issues. #TaxTwitter #DumpsterFire pic.twitter.com/X0yp7yQAcu

— Matthew J. Cordes, EA (@cordes_tax) January 23, 2022

Matthew Cordes, an enrolled agent who prepares about 650 individual returns a year, said he has had one client so far who received a Letter 6419 with the wrong amount listed for the money received in 2021. But after posting concerns on Twitter, he has been contacted regarding at least two others that he has not seen yet.

"There could be many different reasons for the incorrect letters. Changing bank accounts could be one of them," Cordes told the Free Press.

"But even if it is limited, the problem is that those who receive the incorrect letter could have real problems. The IRS doesn’t have the systems in place or the manpower to deal with phone calls or letters in response to issues."

He noted that computer mismatches trigger delays for receiving a tax refund, often a good deal of money that some taxpayers rely on as part of their household budget.

What should parents do? Be sure to save Letter 6419. You do need it to work through your tax situation.

Talk with your tax professional. If you're doing taxes yourself, you want to take extra care before you file any return using a number for the total amount received for the child tax credit.

"I am telling clients to verify their letter is correct," said Cordes, who lives in Garrett, Indiana, north of Fort Wayne.

Confirm information by looking at your bank records, if the money was direct deposited. The IRS said tax filers also can check the amount of their payments in their Online Account, which has to be set up on IRS.gov in addition to the letters.

If there is a discrepancy between the letter and the IRS portal information, Cordes said, per the IRS, tax filers should use the portal information on the tax return.

If you're married and filing a joint return, check and see if you received two letters. Accounting experts say two letters will be sent to married couples filing a joint return and you'd need to take both letters into account when completing your taxes.

Kathy Pickering, of the H&R Block Tax Institute, said many taxpayers have already received the 6419 letter, as the IRS started sending those letters in December and expects to have them fully distributed soon.

"However, for those who don’t have the letter," she said, "they can go to the IRS website to access the CTC Update Portal to view the amounts."

Given the concerns about some of these letters, it seems more important to move cautiously and review bank records, as well as what's available on the IRS child tax credit portal. Take an extra close look at Letter 6419, too.

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

This article originally appeared on Detroit Free Press: IRS letter 6419 for child tax credit may have inaccurate information