First Mover Asia: Taiwan Chip Manufacturer TSMC Remains a Crypto Skeptic; Major Cryptos Decline

Don't miss CoinDesk's Consensus 2022, the must-attend crypto & blockchain festival experience of the year in Austin, TX this June 9-12.

Good morning. Here’s what’s happening:

Prices: Bitcoin, ether and other major cryptos decline amid ongoing macroeconomic uncertainty.

Insights: Taiwan chip manufacturer has stayed largely out of the crypto mining fray.

Technician's take: BTC's bullish countertrend signals require weekly price closes above $40K.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis. And sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.

Prices

Bitcoin (BTC): $39,875 -3.3%

Ether (ETH): 3,017 -3.3%

Top Gainers

Top Gainers

Top Losers

Asset | Ticker | Returns | Sector |

|---|---|---|---|

Solana | −4.5% | ||

Cardano | −4.4% | ||

Ethereum Classic | −4.2% |

Bitcoin and other cryptos plummet

A day after bitcoin and other major cryptos had their best day since the beginning of the month, they were back in the doldrums as Russia escalated its attacks on the southern and eastern parts of Ukraine, spurring new angst among investors about the global economy.

The largest cryptocurrency by market capitalization dipped below $40,000 during Thursday trading and was recently down over 3% for the past 24 hours. Ether was changing hands at about $3,000, down similarly for the same period. Other major cryptos were solidly in the red. SOL and ADA were both recently off more than 4%. DOGE was a rare bright spot, up over 1.5%.

Crypto prices tracked equity markets, which also sank, with the tech-heavy Nasdaq off 2.1% and the S&P 500 down a percentage point as investors continued to shy away from riskier assets.

Meanwhile, economic fallout from Russia's unprovoked invasion continued to mount.

A day after saying that peace talks with Ukraine had reached a dead end, Russian President Vladimir Putin acknowledged on Thursday that economic sanctions from the U.S. and other countries opposed to Russia's unprovoked aggression were hurting his country's oil and gas industry. European Union countries continued to discuss the possibility of a complete ban on Russian energy products. The price of Brent crude oil, a widely regarded measure of global energy markets, soared past $111, a roughly 40% gain from the start of the year.

Paul Robinson, strategist at news and research website Daily FX, noted in an email that "contracting price action" for bitcoin over the first quarter this year "could continue to make things even choppier in the near term."

Given the nature of volatility (expanding/contracting) and the fact that this is BTC, volatility is likely to ramp up again as we head towards the middle of the year," Robinson wrote.

"Typically once BTC gets rolling it doesn’t take long to muster a fresh level of market interest," he added. "If we were to see that fail to be the case this time around, then it could mean that BTC is headed for an extended period of sideways price action, or worse."

Markets

S&P 500: 4,392 -1.2%

DJIA: 34,451 -0.3%

Nasdaq: 13,351 -2.1%

Gold: $1,973 -0.1%

Insights

Taiwan chipmaker TSMC does not mention crypto mining in its latest earnings

Taiwan Semiconductor Manufacturing Company (TSMC) posted another record profit for the quarter, hitting the $7 billion mark on continued strong demand for electronics and gadgets.

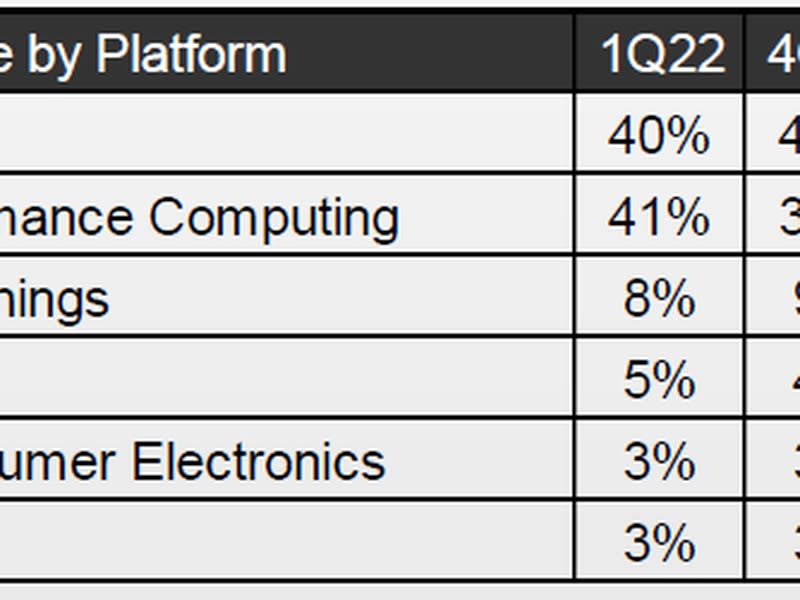

But absent from TSMC earnings was talk of mining. On the company’s earnings report for revenue by platform you can find categories like smartphone, high-performance computing, internet-of-things (IoT) and automotive, but nothing about crypto mining.

TSMC tends to be secretive when speaking about its customers. As a pure-play semiconductor foundry, the company has to be agnostic. Its engineers will fabricate chips for the fiercest of competitors, like AMD (AMD) and Nvidia (NVDA), so it stays silent on any sort of market commentary.

It wasn’t always this way, though. During the first major bitcoin mining boom of 2017, TSMC specifically called out crypto’s rise and mobile’s decline in a press release for its fourth quarter 2017 earnings.

“Our fourth-quarter business was supported by major mobile product launches and continuing demand for cryptocurrency mining,” said Lora Ho, senior vice president and chief financial officer of TSMC at the time. “Moving into first-quarter 2018, we expect the strong demand for cryptocurrency mining will continue while mobile product seasonality will dampen our business in this quarter. ”

But this being crypto, fortunes fall as quickly as they rise.

As crypto historians know, 2018 was a bear market for crypto, and this was reflected in TSMC’s earnings as the year continued.

By the third quarter, executives were blaming the “further weakening of cryptocurrency mining demand” for missed revenue guidance. By the end of the year, that language had been revised to “a big drop. It's almost a double-digit.”

The 2018 bear market also hit other semiconductor companies hard too. Nvidia said that it had a glut of unsold graphics cards in its inventory, alongside an 18% fall in the company’s stock price shaving $23 billion off its market value, which Nvidia CEO Jensen Huang called the "post-crypto hangover."

Fast forward to 2022 and TSMC is still skeptical about crypto’s long-term viability, especially when it’s also dealing with a period of high demand from other customers. It’s understood that TSMC just doesn’t want to allocate its limited fab capacity to businesses that it considers fairweather friends that fluctuate order volume on seasonality – crypto’s notorious bull and bear markets.

And we haven’t even mentioned Bitmain.

In early 2021, prosecutors in Taiwan charged Bitmain with setting up clandestine front companies to poach engineers from TSMC to help it accelerate the development of new business lines and diversify away from crypto.

Given Taiwan and China’s tense political status, the Taiwanese government does not allow Chinese firms to establish research hubs to develop technology for export to China. Chinese firms are allowed to set up branch offices in Taiwan, but they need to be specifically registered with the government and are closely monitored.

TSMC still allows for Bitmain to fabricate chips in its facilities, but TSMC requires the company to attest that its crypto-mining chips don’t violate any of TSMC’s intellectual property. If Bitmain does, the company will be banned and its chips discarded.

So it’s easy to see why TSMC doesn’t prioritize the crypto industry. The company bet big on crypto during the last bull run, and it was burned when the bear market started. Given the continued demand for semiconductors worldwide, there are also plenty of demand elsewhere.

Technician's take

Bitcoin Neutral, Support at $37K and Resistance at $46K

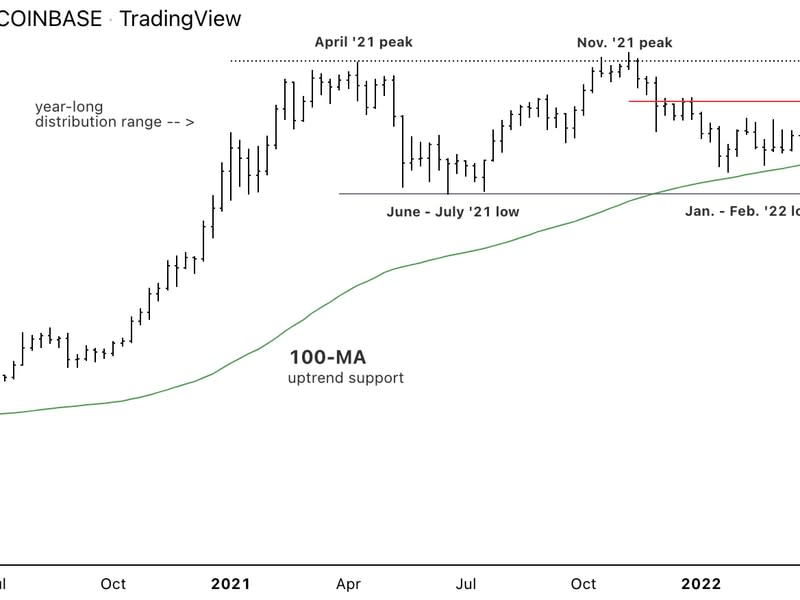

Bitcoin (BTC) continued to bounce around the $40,000 price level this week, indicating uncertainty among market participants.

The cryptocurrency is down by 8% over the past week and slightly positive over the past 30 days. Most technical indicators are neutral, although short-term buyers could remain active between the $35,000-$37,000 support zone, similar to what occurred earlier this year.

Momentum signals, per the MACD indicator, are positive on the weekly chart and negative on the monthly chart. That suggests a period of rangebound price action could persist, albeit with an average price swing of 20%.

On the weekly chart, the 100-week moving average, currently at $35,388, is an important gauge of trend support. Buyers will need to keep BTC above that level in order to sustain the recovery phase.

Still, there is strong resistance at the 40-week moving average (equivalent to 200-days), which at $46,800.

Further, an upside target at $50,966 was within close distance on March 28, although a pullback unfolded, similar to what occurred in September of last year.

For now, bullish countertrend signals will need to be confirmed with weekly price closes above $40,000.

Important events

Good Friday holiday

9:30 a.m. HKT/SGT(1:30 a.m. UTC): China house price index (March)

2:45 p.m. HKT/SGT(6:45 a.m. UTC): France consumer price index (EU norm/MoM/YoY March)

CoinDesk TV

In case you missed it, here is the most recent episode of "First Mover" on CoinDesk TV:

Elon Musk Offers to Buy Twitter, Bitcoin Holding Support At $40K, ETH Merge to Be Delayed and More

Bitcoin was trading steadily around $40,000. Meanwhile, Elon Musk was bidding to take over Twitter (TWTR) for $54.20 per share. Noah Perlman of Gemini joined "First Mover" to share his crypto markets analysis as well as details on the launch of a Gemini crypto rewards credit card. NEAR token has doubled its price in the past four weeks; Near Protocol co-founder Illia Polosukhin shared details of the protocol's rise. Plus, "First Mover" hosts spoke with Fireblocks Head of Corporate Strategy Adam Levine and Galaxy Digital's Christine Kim.

Headlines

Some Indian Payment Processors Cut Off Local Crypto Exchanges: The moves follow a new tax on crypto profits and come as regulators pressure the payments companies, sources say.

South Korean Smart Contract Auditing Platform Sooho.io Raises $4.5M: The startup works with Samsung and LG.

US Officials Tie North Korea’s ‘Lazarus’ Hackers to $625M Crypto Theft: Axie Infinity’s Ronin blockchain suffered a massive exploit late last month.

Amazon Not Close to Accepting Crypto as Payment in Retail Business, CEO Says: Still, Andy Jassy said the company may sell NFTs in the future.

‘Jack Dorsey’s First Tweet’ NFT Went on Sale for $48M. It Ended With a Top Bid of Just $280: Crypto entrepreneur Sina Estavi bought Twitter founder Jack Dorsey’s first-ever tweet as an NFT for $2.9 million last year. He listed the NFT for sale again at $48 million last week.

Longer reads

Sam Bankman-Fried: The Man, the Hair, the Vision: SBF is 30 and his company, FTX, is everywhere. He'll be appearing at CoinDesk's Consensus festival in June.

Today's crypto explainer: India Crypto Tax Guide 2022

Other voices: Bitcoin could hit $100,000 within a year, crypto firm’s CEO predicts (CNBC)

Said and heard

"These images have been seen before. Some are a part of [Pattie] Boyd’s first gallery show, “Through the Eye of a Muse,” which traveled from San Francisco to Dublin to Sydney to Almaty, Kazakhstan. The photos provide an intimate look at the life she shared with her first husband, Beatles’ guitarist George Harrison, and later her second husband, his best friend and guitar god Eric Clapton. It also contains what Boyd claims is the world’s first “selfie,” discovered years after the fact, that has gone on to be one of her best-selling photographs." (CoinDesk columnist Daniel Kuhn) ... "Elden Ring is not just hugely successful, but a huge creative departure from current game-industry norms. It’s the seventh game in a string of titles by developer From Software, all marked by their thoroughly unconventional gameplay and, especially, their experimental approach to storytelling. They’re obscure, challenging and extremely weird." (CoinDesk columnist David Z. Morris) ... "The interest rate on America’s most popular mortgage hit 5% for the first time in more than a decade, extending a sharp rise that has yet to significantly slow the red-hot housing market." (The Wall Street Journal)