Is First Solar a Buy in 2019?

A stock as volatile as First Solar's (NASDAQ: FSLR) is bound to create some polarizing opinions. On the one hand, you have one of the top manufacturers of solar panels that's been one of the best in the business at turning a profit. On the other hand, you have a company in a highly cyclical business, where industry prospects can swing wildly based on government decisions.

Those bullish on the industry can point to the incredible growth prospects and rapid cost reductions for the industry, while bears can point to the past decade of growth that has left investors with little to show for it. With all of this in mind, let's take a look at where First Solar stands today and whether investors should consider buying this stock.

Image source: First Solar.

Management is expecting a strong showing in 2019 and beyond

2018 wasn't a great year for the solar industry in general. Tariffs for imported panels muted demand for panels somewhat, but a large driver of industry weakness was China's decision to slow down its renewable energy investments by reducing feed-in tariffs and capping distributed generation projects.

On paper, these two events shouldn't impact First Solar's business that much. First Solar's thin-film panels were exempt from U.S. tariffs, and its sales in China are minimal. These two events ended up having a significant impact on its business, though, because many U.S. solar developers bought panels in 2017 to avoid tariffs, which pulled forward a lot of demand into 2017. Also, China's slowing demand created an oversupply of panels, which drove down selling prices and deeply impacted margins. These events came at an inconvenient time for First Solar because it was in the middle of ramping up production at several of its facilities and operating costs were exceptionally high.

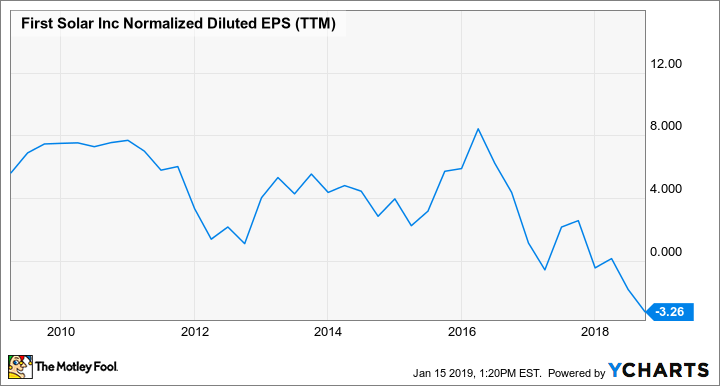

Management thinks that the worst is behind it and expects better things this year. Those higher operating costs for new production means the company will increase production from less than 3 gigawatts in 2018 to a record 5.2-5.5 gigawatts in 2019. That will help to boost revenue to $3.25 billion to $3.45 billion for the year. While one could argue that its margin outlook still doesn't look great, the positive takeaway here is that the company should get back to generating respectable profitability after slipping into negative territory in 2017 for the first time in over a decade.

FSLR Normalized Diluted EPS (TTM) data by YCharts.

After 2019 is when First Solar should really shine, however. By the end of 2019, the company should complete upgrades at its last two of five facilities manufacturing its most advanced Series 6 panels. Once complete, it will be able to reduce operating expenses related to expansion to $55 million and reduce capital expenditures to $100 million to $150 million. For reference, 2018 operating costs and capital expenditures for its series 6 panels were $190 million and $700 million, respectively. With so much less cash going out the door, the company will be able to start replenishing its sizable cash pile and prepare it for the next wave of investment.

What investors should watch

The solar industry, in general, has made incredible strides in lowering costs to become competitive with other energy sources without any aid from subsidies or other government initiatives. That has come to pass in the past couple of years. According to financial advisory firm Lazard's most recent levelized cost of energy study, the only source of power that is less expensive on a per-megawatt-hour basis is wind. In fact, the cost for a utility-scale installation using First Solar's thin-film panels is similar in cost to an existing, fully depreciated coal facility. This implies that utility-scale power providers could even save money decommissioning existing coal facilities and building new solar farms. A new solar facility has cost less than a new coal facility for years, but this is one of the first times that new solar facilities cost less than existing coal plants.

For investors, being able to be so cost competitive with other sources should make solar power development less sensitive to government policies and hopefully make panel demand more consistent from year to year. That would be great news for investors in this industry that have seen solar stock valuations swing wildly with any policy changes.

The other thing that First Solar investors should watch closely is management's ability to diversify its sales. A vast majority of its panel sales are in North America, and it makes the company particularly sensitive to the American market. What's more, First Solar's particular panel technology tends to perform better in higher temperature and higher humidity environments than conventional silicon wafer panels. So, in theory, it could take market share in fast-growing power markets across much of Latin America, South East Asia, the Middle East, and Africa.

Time to buy in 2019?

According to management's estimates, the company should produce between $2.25-$2.75 per share in earnings. At today's stock price, that gives the company a price to estimated 2019 earnings of 17-20 times. That's a decent price, but it doesn't exactly sound like a screaming bargain. For one, it would have to hit those targets, which isn't guaranteed because there are always unforeseen obstacles.

Looking farther down the road, First Solar's stock looks more attractive. Once it wraps up spending on its expansion spending it should generate lots of cash to add to its current $2.1 billion war chest -- one that will give the company flexibility to invest in the business to improve the technology and further expand production. It's a luxury that no other solar panel producer has.

Also, the longer-term outlook for solar power suggests there will be more than enough demand for decades to come regardless of government policies. So the longer your holding period for stocks, the more seriously you should consider First Solar's stock today.

More From The Motley Fool

Tyler Crowe owns shares of First Solar. The Motley Fool recommends First Solar. The Motley Fool has a disclosure policy.