Fisher Asset Management Cuts Total, Mastercard

- Oops!Something went wrong.Please try again later.

- By Tiziano Frateschi

Fisher Asset Management, LLC's Ken Fisher (Trades, Portfolio) sold shares of the following stocks during the third quarter, which ended on Sept. 30.

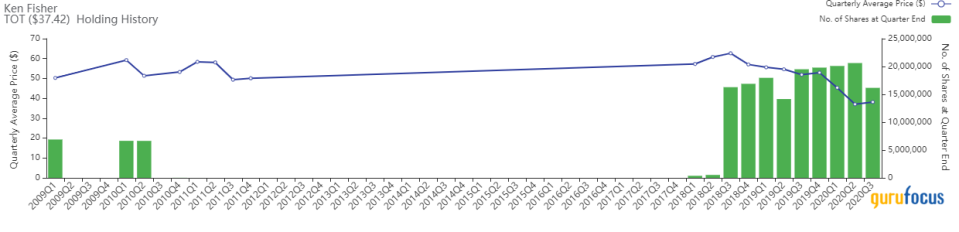

Total

The firm reduced its stake in Total SE (TOT) by 21.61%. The trade had an impact of -0.17% on the portfolio.

The integrated oil and gas company has a market cap of $99.72 billion and an enterprise value of $141.14 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -5.01% and return on assets of -2.08% are outperforming 53% of companies in the oil and gas industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.48 is above the industry median of 0.38.

The company's largest guru shareholder is Fisher with 0.61% of outstanding shares, followed by Charles Brandes (Trades, Portfolio) with 0.03% and T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.02%.

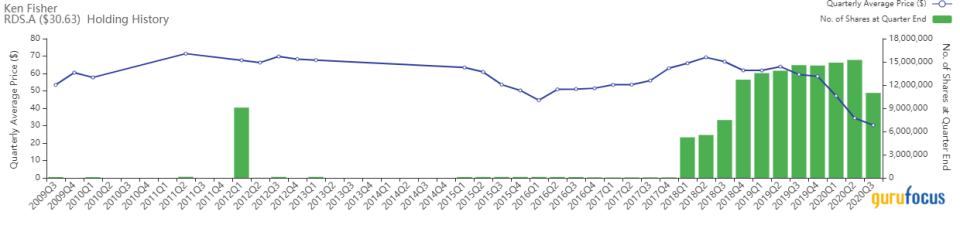

Royal Dutch Shell

The Royal Dutch Shell PLC (RDS.A) position was curbed by 27.97%, impacting the portfolio by -0.14%.

The integrated oil and gas company has a market cap of $118 billion and an enterprise value of $195 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -9.75% and return on assets of -4.35% are underperforming 51% of companies in the oil and gas industry. Its financial strength is rated 4 out of 10. The cash-debt ratio 0.33 is above the industry median of 0.38.

The largest guru shareholder of the company is Fisher with 0.28% of outstanding shares, followed by HOTCHKIS & WILEY with 0.21% and Richard Pzena (Trades, Portfolio) with 0.11%.

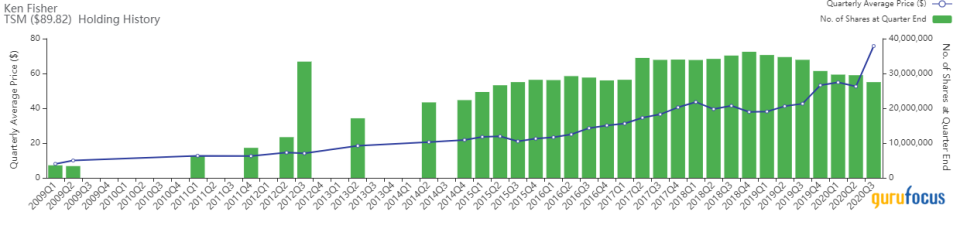

Taiwan Semiconductor

The firm cut its position in Taiwan Semiconductor Manufacturing Co Ltd. (TSM) by 6.75%. The portfolio was impacted by -0.11%.

The company has a market cap of $465 billion and an enterprise value of $460 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 29.29% and return on assets of 20.76% are outperforming 95% of companies in the semiconductors industry. Its financial strength is rated 8 out of 10. The cash-debt ratio of 0.68 is few above the industry median of 0.6.

The largest guru shareholder is Fisher with 0.53% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 0.19% and Ruane Cunniff (Trades, Portfolio) with 0.13%.

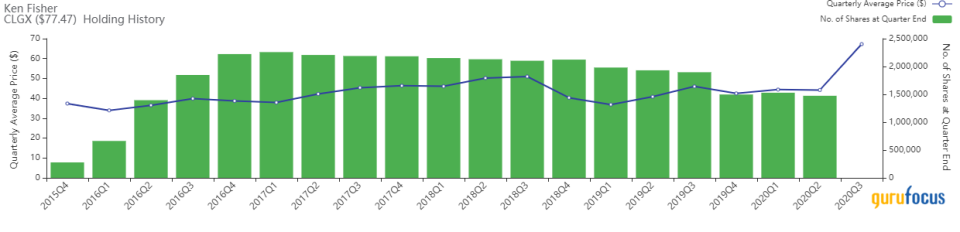

CoreLogic

The firm closed its CoreLogic Inc. (CLGX) holding, impacting the portfolio by -0.10%.

The company, which provides data and analytics for the real estate sector, has a market cap of $6.03 billion and an enterprise value of $7.41 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 23.91% and return on assets of 5.62% are outperforming 67% of companies in the software industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.18 is above the industry median of 2.28.

The largest guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.23% of outstanding shares, followed by Louis Moore Bacon (Trades, Portfolio) with 0.07% and Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.03%.

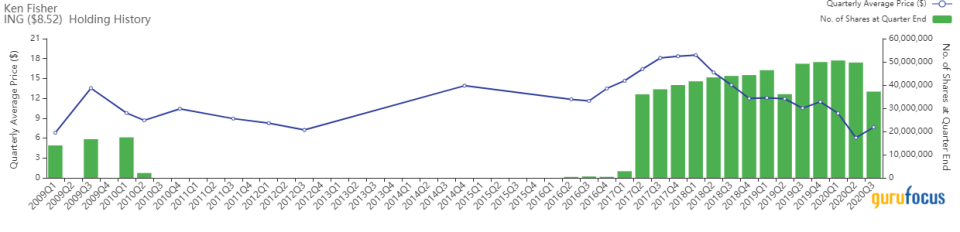

ING Groep

The investment firm reduced its ING Groep NV (ING) position by 25.19%. The trade had an impact of -0.09% on the portfolio.

The company has a market cap of $33.23 billion and an enterprise value of $35.95 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 3.33% and return on assets of 0.19% are underperforming 82% of companies in the banks industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.99 is below the industry median of 1.44.

The largest guru shareholder of the company is Fisher with 0.95% of outstanding shares, followed by Sarah Ketterer (Trades, Portfolio) with 0.09% and NWQ Managers (Trades, Portfolio) with 0.05%.

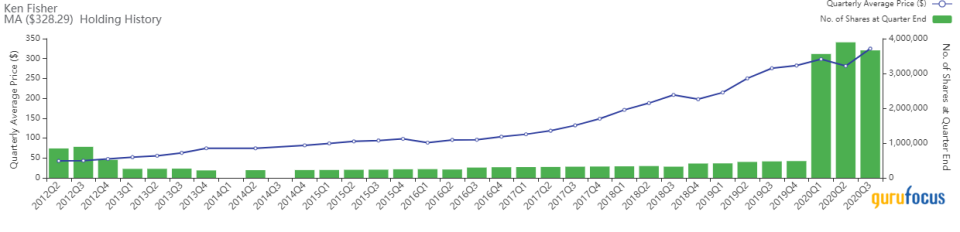

Mastercard

The investment firm reduced its Mastercard Inc. (MA) position by 5.94%. The trade had an impact of -0.07% on the portfolio.

The payment processor company has a market cap of $327 billion and an enterprise value of $329 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 117.98% and return on assets of 22.48% are outperforming 99% of companies in the credit services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.85 is above the industry median of 0.29.

The largest guru shareholder of the company is Chuck Akre (Trades, Portfolio) with 0.59% of outstanding shares, followed by Tom Russo (Trades, Portfolio) with 0.49% and Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 0.46%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Capital Growth Management Exits KB Home, Dollar Tree

5 Insurance Companies Trading with Low Price-Sales Ratios

5 Banks Outperforming the S&P 500

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.