How to fix Bitcoin's energy-consumption problem

Bitcoin mining consumes a lot of energy. Every once in a while, someone compares this to another random metric — say, the energy consumption of Ireland — and it induces a collective gasp. How can this thing be sustainable?

Well, it probably isn't. But, long-term, it might not be that big of a deal.

SEE ALSO: Bitcoin's little brother Ethereum is at an all-time high

It's true that Bitcoin mining is an awful energy drain. Hundreds of thousands of application-specific integrated circuits or ASICs — specific hardware aimed exclusively for mining cryptocurrencies — hum in huge halls, mainly located in China, and use enormous amounts of electricity to create new bitcoins. They also power the Bitcoin transaction network, but they do it in a horribly inefficient way. The fact that a huge chunk of China's electricity comes from fossil fuels makes the situation even worse.

It just seems so wrong, and on some levels, it is.

But things aren't that simple. We don't know, exactly, how power-hungry Bitcoin really is. And whatever the figure is, Bitcoin certainly doesn't need that much energy to run. Furthermore, energy consumption issues can potentially be fixed with a future upgrade of the Bitcoin software, which is easier than, say, reducing the energy footprint of Ireland. Finally, there are other cryptocurrencies out there working on a solution to this problem.

Despite what you might've read, we don't have exact figures on Bitcoin's energy consumption. A site called Digiconomist keeps stats on how much energy Bitcoin is consuming, and it's the primary source for the stories circulating on the subject. Some of these stats look horrific: Bitcoin's current energy consumption is 30.2 terawatt-hours (TWh), which is more than 63 specific countries, and a single Bitcoin transaction consumes enough energy to power nearly 10 U.S. households for an entire day. But we shouldn't blindly trust those numbers.

Getting exact energy consumption figures for miners, many of whom are secretive and located in China, is not easy, so Digiconomist uses a very roundabout way to make its estimates. The site makes quite a few broad assumptions — for example, that miners, on average, spend 60% of their revenues on operational costs, and that for every 5 cents spent on those costs 1 kWh of electricity was consumed. It's impossible to say how accurate Digiconomist's index is, but it could be off by some measure.

Transactions don't matter

Furthermore, the energy consumption is rising because of Bitcoin's quite insane price rise, not because the network actually requires it.

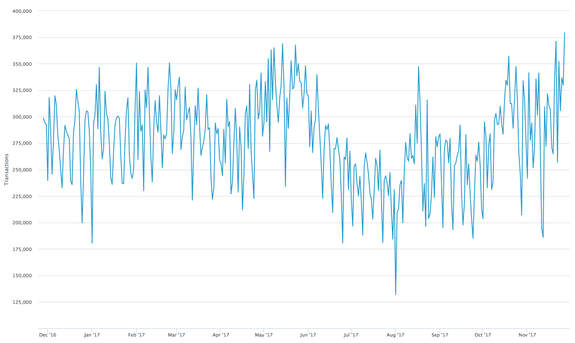

Bitcoin's price is at $10,466 at time of writing, up more than 1,000% since the beginning of the year. This price growth is a huge incentive for miners to add even more ASICs and use up even more energy, but it doesn't really have to do much with the number of transactions on the network. In fact, the number of transactions on Bitcoin's network hasn't significantly increased in a year.

Image: blockchain.info

There are two reasons for this. Bitcoin's network can't handle many more transactions (though a recent software upgrade, yet to take full effect, should improve this). Furthermore, Bitcoin isn't exactly doing its job the way its creator, Satoshi Nakamoto, had intended. Due to its price rise, not many owners actually use their bitcoins to purchase goods; instead, everyone is either hoarding it or speculating with it.

This means that talking about the energy cost of one Bitcoin transaction is misleading. A figure that's thrown around often is the energy cost of one Visa transaction (also a very rough estimate), which is orders of magnitude smaller than that of one Bitcoin transaction. But for Bitcoin, the transactions are not the problem.

In fact, you could theoretically run Bitcoin's entire network on a dozen 10-year old PCs. It wouldn't be very secure from attacks, though, which is another reason why miners are constantly competing for dominance; no one wants to see any one miner control 51% of the network as that would enable them to take over Bitcoin completely.

But it's important to point out that the fact that Bitcoin is currently an enormous energy drain is not due to some irreparable flaw in Bitcoin's protocol. Bitcoin can run more efficiently; it could probably run more efficiently than Visa as it doesn't require offices, staff and other overhead energy costs.

For that to happen, though, something needs to change.

The problem already has a solution...

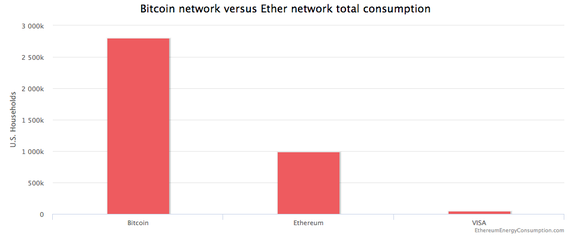

One project Bitcoin could take cues from is Ethereum, the second largest cryptocurrency right now. According to Digiconomist, Ethereum uses roughly three times less energy than Bitcoin; and yet there are twice as much transactions per day on Ethereum's network.

Image: digiconomist.net

And even that could get a lot better in the near future, as Ethereum's development team plans to gradually switch to a completely different mechanism of verifying transactions. Called proof-of-stake, it replaces the current system, called proof-of-work (also used by Bitcoin). Instead of having miners solving complex math calculations, it would reward owning the coins. The concept isn't implemented in Ethereum yet (read here for a detailed explanation) but if it does work as intended, the energy costs, compared to proof-of-work, would be orders of magnitude smaller.

Bitcoin's developers aren't looking to switch to proof-of-stake very soon, but they are working on a solution called Lightning Network that would ideally vastly increase the number of transactions on the network without the need for additional hash power.

...but you never know with Bitcoin

So is Bitcoin's lust for energy just a temporary issue that will easily go away? Probably not. Ethereum's leadership has successfully implemented major changes on the network in the past without many problems. Bitcoin, on the other hand, hasn't been able to implement a far more simple upgrade for years, as any upgrade needs a consensus of nearly all users of the network or a (potentially dangerous) hard fork. And Lightning Network, as promising as it is, is just a concept at this stage.

But Bitcoin's problems aren't insurmountable. The solutions are already out there. Sooner or later, Bitcoin will have to adapt.

If it doesn't, in the long run some other cryptocoin will solve it and take its place. Bitcoin has the first-mover advantage, but that quickly wears off when everyone else is leaner, faster, and more efficient than you. And that's perfectly alright; Bitcoin and its energy woes might be forgotten some day, but cryptocurrencies are here to stay.

Disclosure: The author of this text owns, or has recently owned, a number of cryptocurrencies, including BTC and ETH.

WATCH: Tesla's Solar Roof tiles are out... and OMG