'Flawed' student loans should be abolished and replaced with graduate tax, ministers urged

Student loans are so “flawed” they should be abolished entirely and replaced with a graduate tax, ministers have been urged.

The current system for financing undergraduate degrees operates under a “fiscal illusion” and costs the Exchequer billions of pounds each year, according to a new report by the Higher Education Policy Institute (Hepi).

It comes as ministers prepare a response to an official review of higher education which recommended last year that tuition fees should be capped at £7,500.

The Government will also publish a skills white paper on Thursday which sets out plans for a massive expansion of students loans to cover vocational and technical courses as well as degrees.

The Hepi paper argues the student loan scheme is “so flawed that there is no realistic way in which it could be revised to make it workable”.

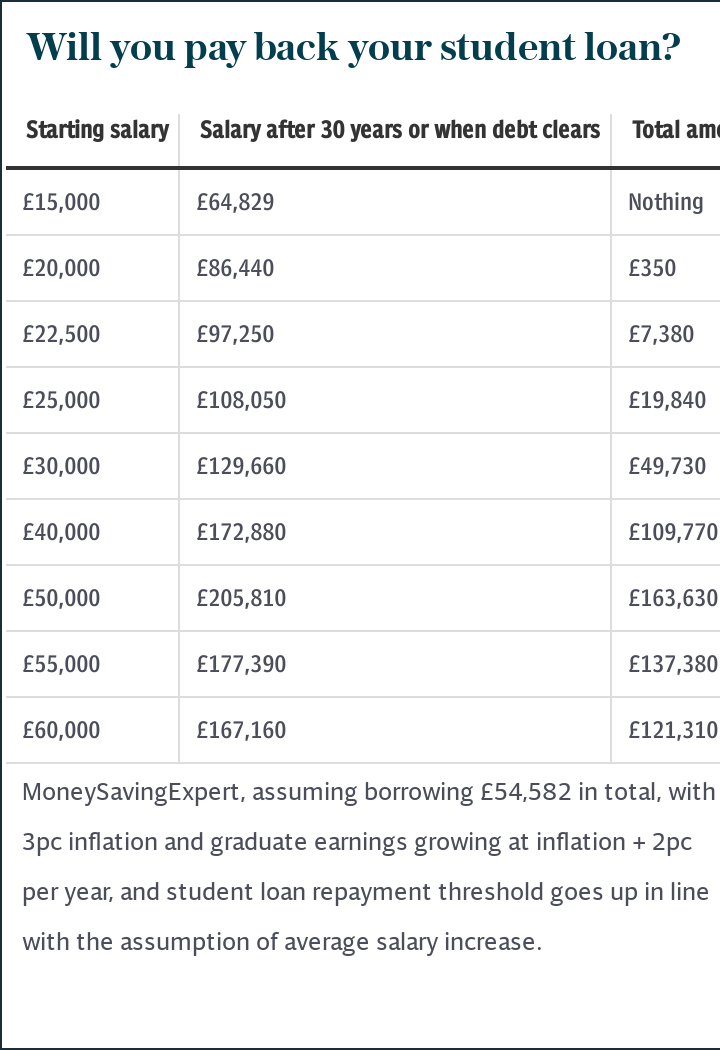

Under the current system, students take out loans for up to £9,250 per year to cover their tuition fees. They pay the loan back out of their earnings after they graduate, but if they have not been repaid within 30 years they are written off and the Exchequer effectively foots the rest of the bill.

The Hepi report points to an official analysis by the Office for Budget Responsibility which found that at the moment 62 per cent of the total of loans being made to students will never be paid back and that only 17 per cent of graduates will fully repay their loans.

It argues that as a result, the cost of the scheme has previously been underestimated by around £15 billion per year, wiping out the predicted savings to the Exchequer.

“This leaves the current scheme for financing higher education in ruins. Its rationale for existence, its financial outcomes and even its terminology are untenable,” the Hepi report says.

It argues the scheme should be replaced with a new and more transparent graduate contribution scheme that would remove the debts currently incurred by students, enable costs to be shared more fairly and, potentially reduce the cost to the Exchequer.

On Thursday, the Government will publish its long-awaited response to an official review of higher and further education, that was commissioned by the former Prime Minister Theresa May.

Led by Philip Augar, the former equities broker, the review was the first one since 1963 that the Government ordered into higher and further education.

In his report, published last year, Mr Augar said that the post-18 study is a “story of both care and neglect”, with universities enjoying huge amounts of public funding while vocational and technical education has been subjected to a “steep, steady decline” in cash.