Florida home prices could be falling due to rising insurance costs. Is Pensacola next?

The ongoing home insurance crisis hangs over Floridians like dark storm clouds ready to burst at any moment. South Florida may already be experiencing the first drops pattering on their roofs if preliminary reports of falling home prices continue to sustain.

Bloomberg News reported that active listings for single-family homes in Punta Gorda-Port Charlotte-North Port have more than doubled in the past year, jumping to 1,900 from 789 between November 2023 and December 2022.

The Cape Coral-Fort Myers area saw a similar rise in the number of inventory, with 3,900 listings reported in December 2022 and 6,200 in December 2023.

Home insurance prices: Wondering when your homeowners insurance premium will drop? Here's what the state is doing

While Florida residents settled along the Panhandle haven’t been immune from the rising costs of home insurance, recent data doesn’t show that it’s having an impact on inventory or home prices in the same way yet, but could be heading there.

Here’s what to know.

Pensacola’s real estate market in January at a glance

The Pensacola Association of Realtors’ Market Snapshot report for January shows that combined sales were down slightly from last year, the average days a home spent on the market in January was up slightly and home inventory for both residential homes and condos are up from last year.

Combined sales in Pensacola were down 7.6%

Quarterly sales have slightly declined since 2021, with the most significant drop occurring in the fourth quarter. Last year’s Q4 sales were just under 1,500, marking the lowest sales since 2016, the earliest data published in the report.

Home sales have seemingly slumped back to pre-pandemic levels, with Q1 and Q2 sales coming in slightly higher than 2016-2019. In Q3, sales dropped to the lowest since 2016 before decreasing even lower in Q4.

In January, PAR reported 499 combined sales for residential homes and condos, which is 7.6% lower than January last year.

Pensacola homes are on the market 18% longer

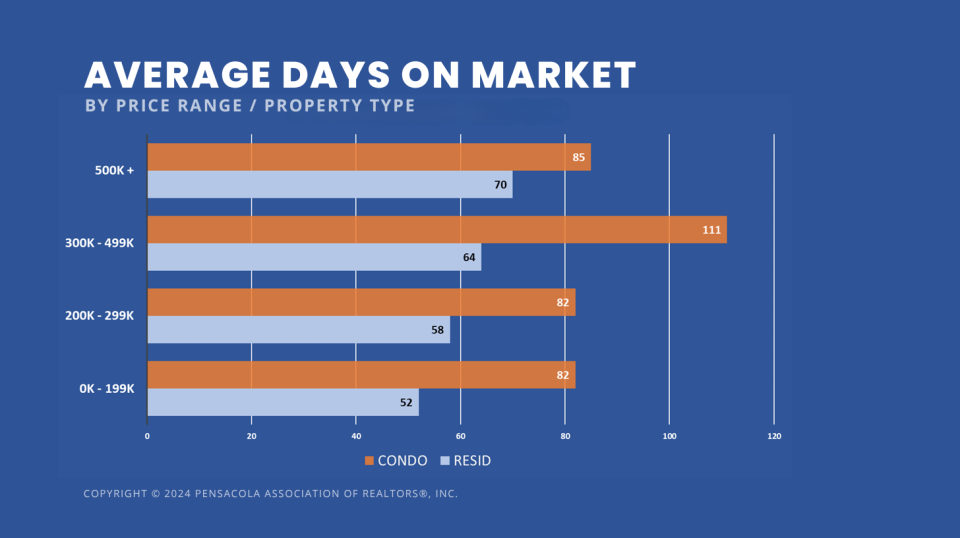

Residential homes and condos spent nine more days on the market in January than they did at the same time last year, clocking in at 59 days, up 18% from last year.

Single-family home inventory up 16.7% over last year, condos up 60%

New listings for residential properties in Pensacola were identical, year-over-year, at 896. Condo listings were up to 92 in January 2024 from 69 last year, a 33% increase. Meanwhile, home inventory has gone up 20% from last year.

In January, Pensacola’s single-family home inventory was 2,890, an increase of 484 more than this time last year, which is a 16.7% year-over-year increase.

Condo inventory has seen a staggering 60% year-over-year increase, with inventory sitting at 371 in January, up 139 units from last year.

Pensacola median home prices remain high

Despite everything, median home prices in January were up $12,000 from last year, a 4% increase. In January, the median home sales price was about $310,000, up from $298,000 the year before.

This article originally appeared on Pensacola News Journal: South Florida home prices are dropping. What about Pensacola Panhandle