Florida housing increases leave state with most cost-burdened renters in the country

Florida had three of the top six metro areas with the largest share of cost-burdened renters and five of the top 15, tying with California for the most markets with the highest share of cost-burdened renters.

The Miami metropolitan area topped the list for places where people paid the highest portion of their household budgets for housing, followed by the Orlando area (No. 3), Cape Coral-Fort Myers (No. 6) and Daytona (No. 9), with Sarasota-Bradenton-North Port just outside the top 10 at No. 12.

Across much of the country, rents have spiked, but incomes have not kept pace, leading to housing costs eating up an ever larger portion of household budgets.

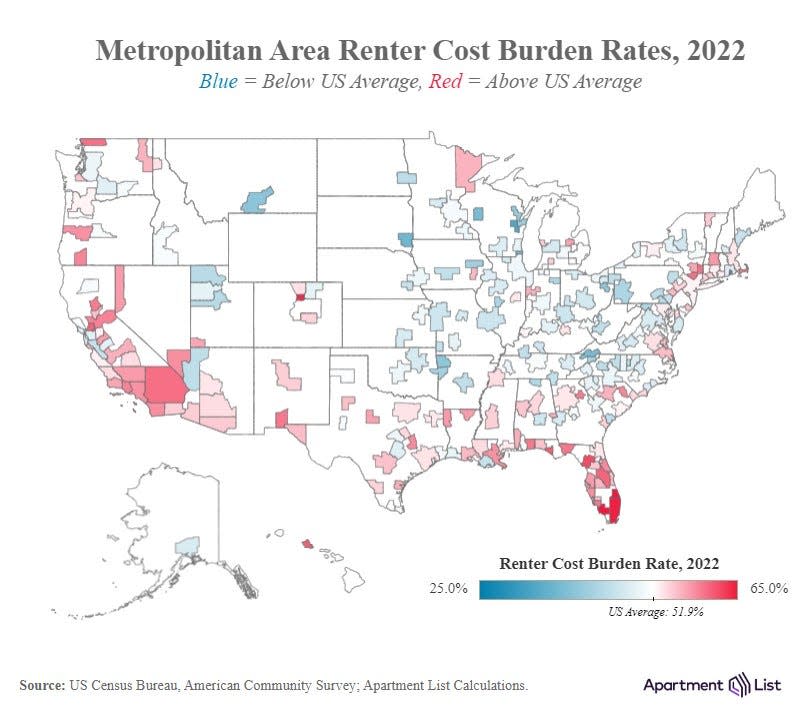

The share of renters who pay more than 30% of their income in rent shot up to the highest levels since 2005 with 51.9% of the nation's renters cost-burdened by their housing costs in 2022, according to data from the U.S. Census Bureau and statistics from the American Community Survey analyzed by the website Apartment List.

"Even in markets with below-average cost burden rates, the affordability picture is worsening," the Apartment List report stated. "All but six of the nation’s 100 largest metros saw rent burden worsen from 2019 to 2022, with rates exceeding 50 percent in 65 of those metros."

Rounding out the top 10 were Honolulu (No. 2), Riverside-San Bernardino (No. 4), Poughkeepsie-Newburgh-Middletown, N.Y. (No. 5), Sacrmenton, Calif. (No. 7), Thousand Oaks-Ventura (No. 8) and Las Vegas (No. 10).

The share of renters who pay more than 50% of their income in rent each month was 31% in Sarasota-Manatee, a proportion that housing advocates describe as "severely cost burdened." Another 27% of renters pay between 30% to 50% of their income for housing in the North Port-Sarasota-Bradenton metro area.

William Russell, the president of the Sarasota Housing Authority, said the increased share of renters defined as cost-burdened crystalizes the need for more action from national, state and local leaders.

"Our policymakers really need to really look at what levers they can pull to see some sort of relief," he said.

Housing demand outstrips supply in Sarasota-Manatee

Russell said both increased demand and rising costs in recent years have led to declining housing affordability in Southwest Florida and across the country.

He said there has been some discussion that the market may correct itself in the coming years, but without intervention, Russell doesn't think that's likely.

"Short of a major recession, I do not see the real estate market becoming more affordable," he said.

Since 2019, the Sarasota Housing Authority has built more than 200 affordable units across two projects that took years of planning and funding requests, but the area's population has seen tens of thousands of new people added over that time.

A U.S. Census Bureau estimate of Sarasota-Manatee's growth over the past two years pegs the population increase at nearly 60,000 — about the equivalent of a city the size of Sarasota — for the two-county area.

While the Sarasota Housing Authority has started construction on an 84-unit development near Amaryllis Park called Cyprus Square at a cost of $28.4 million, that's a drop in the bucket compared to the area's affordable housing need.

Russell said as a developer of affordable housing, he understands the challenges private developers face in the current market, pointing to increased insurance, maintenance and operation costs for apartment owners.

Increased costs threatened Cyprus Square leading Russell to seek funds from the Sarasota County Commission to fill a $3 million gap in construction costs.

"The Housing Authority cannot develop our way out of this problem," he said. "It's just really expensive to develop apartments."

A list of the most cost-burdened metropolitan areas in the U.S. as of 2020, according to an analysis of U.S. Census data by Apartment list, with the percentage of renters considered cost burdened, meaning they spent more than 30% of gross household income on housing:

Miami-Fort Lauderdale-Pompano Beach, 65%

Urban-Honolulu, Hawaii, 61%

Orlando-Kissimmee-Sandford, 61%

Riverside-San Bernardino-Ontario, California, 60%

Poughkeepsie-Newburgh-Middletown, New York, 60%

Cape Coral-Fort Myers, 59%

Sacramento-Roseville-Folsom, California, 59%

Oxnard-Thousand Oaks-Ventura, California, 59%

Deltona-Daytona-Ormond Beach, 59%

Las Vegas-Henderson-Paradise, Nevada, 59%

San Diego-Chula Vista-Carlsbad, California, 59%

North Port-Sarasota-Bradenton, 58%

Los Angeles-Long Beach-Anaheim, California, 58%

New Orleans-Metairie, Louisiana, 58%

Springfield, Massachusetts, 58%

Recent coverage: Study shows more Sarasota-Manatee retirees are struggling economically

More: Sarasota's rising area income means higher rents for some, housing assistance for others

This article originally appeared on Sarasota Herald-Tribune: Florida metros lead list of cost-burdened renters after rent spike