Florida lawyer writes rules to win condo auctions for $100. Judges let him do it.

Editor's note: Viewing this story in our app? Click here for a better experience on our website.

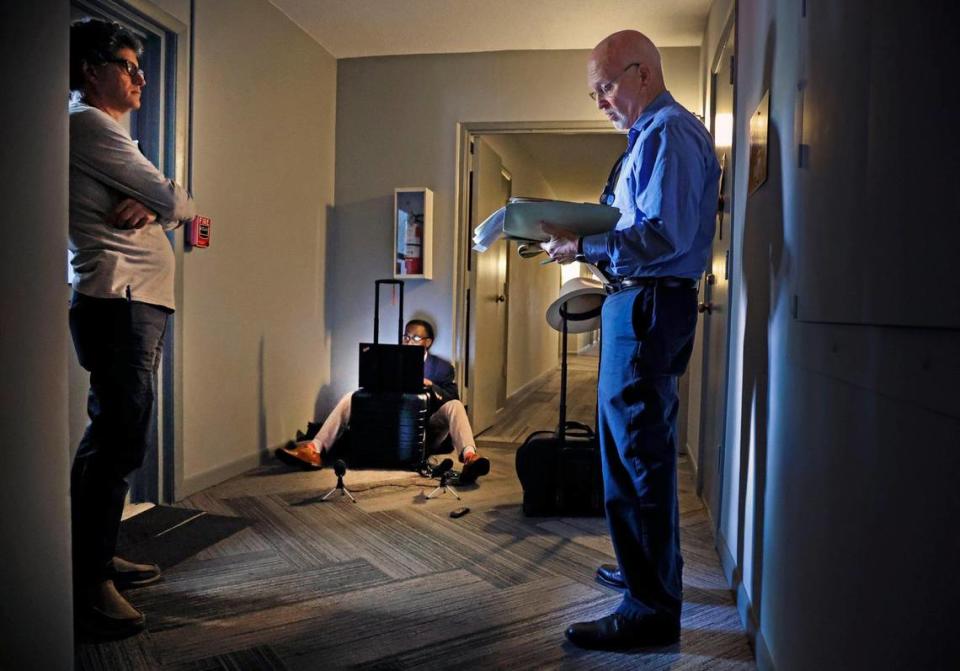

In the dimly lit hallway of a South Florida condominium, a man in a white fedora presides over an auction.

The prize is around the corner, a 700 square foot, one-bedroom apartment left behind by a woman with dementia who died estranged from her heirs.

Two bidders arrive, a mysterious, curly-haired woman and a man with a general contracting business. They are joined by a court reporter who perches his laptop on a suitcase and sits on the floor.

Bidding starts at $1,000 and quickly reaches $45,000. “Going once … going twice,” says the man in the white fedora, turning to face the woman. She places the winning bid of $46,000.

The auction of this Oakland Park condo is not normal by the standards of Florida foreclosure sales, but for attorney Brad Ira Schandler, the auctioneer that day, it’s straight from his playbook. As with nearly every foreclosure auction he’s involved in, he and his associates win.

The victorious bidder this morning? Schandler’s sister, Nadine August. She bought the property on behalf of a shell company created the day before the auction, and her brother signed the paperwork registering the company with the state.

Schandler is convincing judges in both Broward and Miami-Dade counties to sign off on unorthodox foreclosure auction rules that virtually ensure his clients will wind up owning the property, a Miami Herald investigation found.

Some bidders on the losing end of auctions have alleged in court documents that Schandler’s network works with shill bidders who drive up the prices of the auction with no intention of actually paying, and the Herald found evidence supporting this claim. While most auctions would get a redo in these circumstances, a rule employed by Schandler instead gives the property directly to his clients, typically for $100.

His methods have been described by attorneys as a “fraud and hoax” upon the court, illicit “equity stripping,” and “brazen manipulation of the court system,” but authorities have taken no action and South Florida judges keep enabling him.

The cases point to a weakness in the Florida foreclosure process at an especially dangerous time, as assessments and liens are expected to increase to meet new condo maintenance laws passed after the 2021 Surfside condo collapse.

The patterns the Herald found reveal how savvy lawyers can work the system to wrest condos away from absentee owners and the relatives of dead owners over liens as small as a few thousand dollars. Heirs who lost out and legitimate bidders who were shut out said they were shocked that Schandler and his network have the courts’ blessing to operate the way they do.

One woman said her family didn’t lose just their Kendall condo, but also everything inside of it, and a Jeep parked outside. Another said she fought to save her grandparents’ condo but lost the ocean-view unit and everything in it, including the paintings. Both missed a legal window of opportunity to collect their belongings.

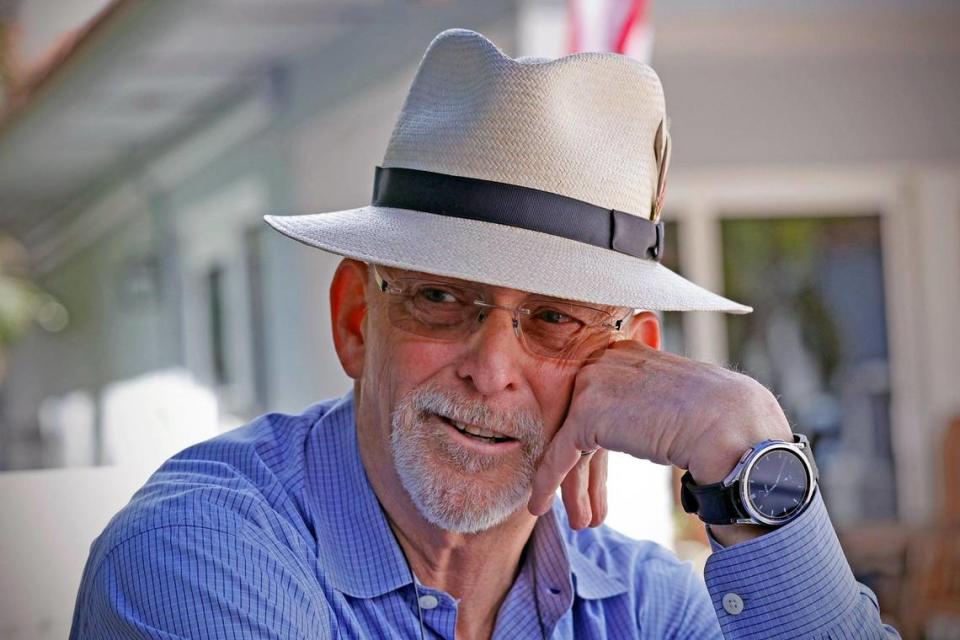

Schandler, 68, who lives with his wife in a modest townhouse in Hollywood’s Emerald Hills neighborhood, grew up in South Florida. His parents, Bernie and Dolly, owned a Wolfie’s on 163rd Street in North Miami Beach in the ‘60s, ‘70s and ‘80s, according to his father’s obituary. He earned his law degree at the University of Miami in 1983.

He said his tactics aren’t unique. “I know there are other people probably doing similar things,” Schandler told a Miami Herald reporter at the Oakland Park hallway auction on Feb. 27.

In a written response supplied by his attorney on March 26, Schandler said he uses an “alternative, legal foreclosure sale method” to help condo associations quickly clear up cases where an owner is in default and the condo may be “long abandoned.” They are cases “where no property owner or family member of a property owner remains with any interest in the property.”

“Our clients can promptly pay the condo the unpaid fees or assessments much faster than if the association paid a lawyer to proceed with the foreclosure case, which can drag on for months or years,” the statement said.

“In the rare instance where a distant family member emerges late in the process, after the court has unsuccessfully attempted to locate them, my clients and I make every effort to resolve the foreclosure to the family member’s satisfaction.”

How this secret system works

The Herald found nearly 30 cases in Broward and Miami-Dade counties in which Schandler and associated lawyers used a series of similar, unconventional tactics to game the system and buy condos for a fraction of their market value.

Schandler and his network typically pursue properties owned by the estates of people who have died and whose mortgages were fully paid off, leaving no banks to complicate an otherwise simple proceeding. In some cases, owners or heirs live in other countries. The properties are often in foreclosure over unpaid condo assessments or fees.

Schandler usually pays off the condo debt in exchange for the right to try to recover that money through the foreclosure case. That gives him standing to join a case and request modifications to the foreclosure process.

The Herald found a pattern of Schandler persuading judges to approve three unusual tactics that helped him upend the normal foreclosure auction process and ensure a win:

▪ On-site auctions: Instead of holding foreclosure auctions online, as is typical in Florida now, Schandler gets judges to let him hold auctions at the property. In the cases reviewed by the Herald, few if any competing bidders showed up to the in-person auctions.

▪ No redos: While auctions typically are redone if the winning bidder fails to pay, Schandler has persuaded judges to declare that if the winner doesn’t make good on their bid, Schandler’s client can have the property, typically for $100.

▪ Bidding credits: When the auction is held online, Shandler has persuaded judges to give his clients an unlimited “bidding credit.” They can bid as high as they need to win, but they don’t have to pay that amount. They are only required to pay the debt owed on the property and a little extra to cover fees.

Schandler’s rules

When Brad Schandler becomes involved in condo foreclosure cases, they quickly deviate from the norm. Scroll to learn more.

Debt

A condo owner incurs a debt, often from non-payment of condo fees.

Case

The holder of the debt, often the condo association, files a foreclosure suit against the owner.

Judgment

A judge approves a final judgment, authorizing the sale of the property at auction and setting how much money the holder of the debt is owed from the proceeds.

Auction

The property is put up for sale, typically online. The proceeds from the sale are used to repay the debt-holder.

Schandler's Rules

Most auctions changed to on-site at property. If the top bidder fails to pay, Schandler’s client wins the auction for little cost.

Schandler's Rules

In some online auctions, Schandler gets a bidding credit which allows his client to bid an unlimited amount but only have to pay the judgment amount plus fees.

Proceeds

Other parties can apply for any funds leftover from the sale after the judgment has been repaid. This is when other heirs could make a claim for surplus funds.

Schandler's Rules

After auctions with Schandler rules, there is typically no surplus left over for heirs.

Ownership

Once the sale is final, the winner of the auction takes ownership, at which time they can either keep the property or re-sell it.

Schandler's Rules

When Schandler writes the auction rules, his client is virtually guaranteed to win.

Manny Farach, a West Palm Beach real estate lawyer who served as the past chair of the American Bar Association’s real property litigation committee, said that the rules pushed through by Schandler are “pretty extreme” and a “deviation from standard foreclosure practices.”

But because they’ve gotten the blessing of a judge, Farach said they are probably legal.

“If a judge orders it, what can we say other than that the judge was taken advantage of,” he said.

The courts effectively operate on an honor system, relying on the good faith and accuracy of pleadings filed by lawyers, said Broward Chief Judge Jack Tuter.

“We’re not investigators,” he said. “It’s very difficult for us.”

Schandler told the Herald he “didn’t invent” the notion of holding foreclosure auctions in person. They used to all be handled that way - on the courthouse steps. Today’s online auctions, he said, can attract bidders who don’t research ahead of time, default after winning, and add delay and cost to the case. So, he said, he borrowed tactics he’d seen in other cases, and wrote auction terms he likes better.

“They are real auctions,” he said. “Anyone can appear.”

Schandler said in his written statement that the unlimited bidding credits he wins on behalf of clients are “innovative” but “not particularly unusual.”

But he declined to explain the rationale behind the credits. “I am sure you understand that I am not going to discuss my legal strategies with you,” he said.

Those strategies have been effective for Schandler. The Herald found five instances in which his clients had been granted this allowance, bidding just over $637,000 to win the properties but paying only $134,000 to claim them.

Did you, or someone you know, have a similar foreclosure experience? Let us know by filling out this form.

Kitty and Katz

In the past 10 years, Schandler’s network has snapped up at least 20 properties worth more than $4.5 million, according to the Herald’s analysis of court records. Typically they paid little more than the cost of the judgment associated with the foreclosure, a fraction of the property’s value.

It isn’t clear how much of that money has made its way into Schandler’s pockets. He declined to discuss how much he makes from his work when asked by the Herald at the Oakland Park auction, saying only, “It beats waiting tables.”

Schandler said in his written statement that the proceeds from these transactions go to his clients, not him. He declined to say who his clients are.

Though Schander told the Herald “I practice by myself,” a small group of people have been present in many of his cases, including attorneys Robert C. Meyer of Coral Gables and Samuel R. Danziger (now deceased) of Miami, and a man named Louis S. Katz, location unknown.

Schandler’s sister, Nadine August, appears to have been involved in at least two of the cases examined by the Herald. In one case she bid under her real name. In the other, a competing bidder identified her as the woman who bid under the name “Kitty Lefkowitz.”

Schandler said he wasn’t comfortable talking with the Herald about his cases or associates. In a written statement from his lawyer, he said they were “colleagues” and have done nothing improper.

Meyer and August didn’t respond to multiple requests for comment.

The Herald was unable to find any public footprint in Florida or contact information for Katz or Lefkowitz.

‘Something very dirty is going on here’

Right before the auction was to start on a two-bedroom Pompano Beach condo with ocean views, a woman showed up and said her name was Kitty Lefkowitz.

She joined a retired Realtor named Hernando Posse, who was the only other bidder at the July 2021 auction at the property, in foreclosure over unpaid condo assessments.

Schandler presided over the auction in the lobby of the condo building, and it went quickly. As Posse recalled, whatever he bid, Lefkowitz bid more. The price soon exceeded what Posse could afford, and Lefkowitz won with a bid of $185,000.

Lefkowitz never paid the full amount she owed, but the condo didn’t go back to auction. Instead, thanks to a rule written by Schandler and approved by Broward Circuit Judge Nicholas Lopane, the property went for $100 to a company represented by Schandler.

There would soon be doubts about whether Lefkowitz was actually who she said she was.

When Herald reporters recently showed Posse a picture of Schandler’s sister, Nadine August, he recognized her as the bidder who gave her name as Kitty Lefkowitz.

August didn’t respond to questions from the Herald, and Schandler didn’t respond directly to the Herald’s question about whether his sister had posed as Lefkowitz. In his statement, he responded: “the business of foreclosure litigation and investing is ‘cut-throat.’ Many competing investors may want to take whatever actions possible to eliminate or defame and disparage their competition or the attorneys representing competing interests.”

Posse said he’s still upset about losing out on the apartment. He said he had been bidding in auctions for months hoping to find an affordable place to live in a region where such properties are in short supply.

“I needed a roof, I needed a place to live. That apartment would have been perfect,” he said. “Something very dirty is going on here and Brad Schandler is the engineer of it.”

Posse recently complained to the Florida Bar about what he saw. A Bar spokeswoman said they’d received an “inquiry” about Schandler but there was not “enough information to rise to the level of a legally sufficient complaint.”

Posse wasn’t the only person shut out of the auction.

The apartment had belonged to Kori Delcourt’s grandparents, whose closest relative was her uncle. It was only after her uncle died in summer 2021 that she learned it had been foreclosed.

Delcourt’s lawyer, Jordan Wagner, couldn’t find any record of Kitty Lefkowitz, and the only address listed for her in the court records was the property address itself.

Wagner submitted a scathing 70-page court filing in November 2021, seeking to undo the sale and highlighting what he called a “pattern of fraud, misconduct, and brazen manipulation of the court system.”

As Delcourt recalls, Schandler was eager to settle. She reluctantly agreed to the settlement — whose terms she can’t legally discuss — and withdrew her motion to overturn the sale, convinced it would be hard for her to win a better outcome. Years later, she is still upset that she lost the apartment.

The condo was sold in late 2022 for $520,000 by a company affiliated with one of Schandler’s associates. It’s back on the market now, with an asking price of $650,000.

‘How did you know about this?’

Tamir Ness was serving on a condo board at the Nine at Mary Brickell Village in Miami when he learned one of the units was headed to an auction to be held in the building. Ness decided he’d go.

The auction was held in front of the elevator on the 27th floor. Ness said anyone who didn’t live in the tower might have been turned away by security guards, who were unaware the auction was taking place.

When he spoke with Schandler to arrange giving him a cashier’s check ahead of time, a prerequisite to participate in the auction, Schandler asked him, “How did you know about this?”

Robert Meyer, the auctioneer that day, didn’t kick it off on time. He said he was waiting for another bidder to arrive and that if Ness didn’t like it, he could leave.

Meyer left, then returned 15 minutes later with the bidder, who gave the name Louis Katz.

Ness said he later viewed security footage and saw that Meyer and the bidder had arrived in the lobby together that morning.

The auction started 39 minutes late. Within three minutes, the bids were up to $430,000, and the man who identified himself as Katz won.

“I just kept bidding, bidding and I just stopped,” Ness said. “I could have gone to $10 million and he’d keep bidding.”

The next day, Katz didn’t pay the $430,000. So, by the terms of the auction approved by Miami Circuit Court Judge Renatha Francis (now on the Florida Supreme Court), the ownership of the condo went to Schandler’s client, a trust connected to Danziger.

Ness was in for a further surprise when he received a transcript of the auction and learned that the man who said he was Katz and put in the winning bid at the auction was identified in the transcript as Brad Schandler.

Thanks to the wording in Judge Francis’ order — written by Schandler and adopted verbatim by the judge — Schandler paid just $3,478 in condo debt to win the property.

Judge Francis declined to comment to the Herald, citing judicial codes of conduct that prevent her from discussing specific cases.

Ness’s lawyer filed a motion to reverse the sale on the basis of “fraud, misrepresentation, irregularity in the conduct of the sale and collusive bidding.”

“This gentleman is very creative, and he knows how to work around the law and ... he just knows these loopholes and he knows how to play the courts,” Ness told the Herald. “His wisdom and his experience unfortunately outweighs everyone else’s ignorance.”

Before things went any further with Ness’ complaint, the son and daughter of the condo’s deceased owner — a Kuwait resident — found out what happened and objected to the sale of the condo, saying they were the legitimate heirs.

The foreclosure case ultimately settled out of court, with undisclosed terms.

‘Keeping rightful heirs from what they were entitled to’

When foreclosure sales occur, relatives and other connected parties can petition the court for a portion of any sale proceeds left over after the debt from the property has been repaid.

Schandler ensured that Lori Evans didn’t get a penny when her cousin Erik Lemberg died, leaving behind no children and a two-bedroom condo in Tamarac.

“Erik and I were very close growing up,” she said. “I literally talked to him three days before he died.”

Evans didn’t have the money to take on her cousin’s property, which had fallen into disrepair and was headed to foreclosure over unpaid condo assessments. A lawyer told her she might still be able to claim a portion of the proceeds when the apartment was sold at auction.

“It would have definitely helped me in a big way,” said Evans, who raised her daughter alone in the Atlanta suburbs.

Given the value of the property and the $15,000 debt owed to the condo association, Evans’ lawyer estimated her portion of the leftover funds could be more than $30,000.

But Schandler convinced Broward Circuit Judge Florence Taylor Barner to give his client a mind boggling advantage — an unlimited bidding credit. Schandler’s client could bid any amount in the online auction, but would only have to pay $20,000.

Schandler’s client won the auction for $95,800, beating out numerous other bidders, including one who bid $95,700. Court records show that the bidder name associated with that winning bid was Adonai Lee, which translates to the “Lord is with me” in Hebrew. While the same bidder name, Adonai Lee, was associated with the winning bid in at least two other auctions won by Schandler’s clients, Schandler said in a statement that the name was listed incorrectly and that he “was not responsible for these forms, prepared by the clerk.”

Had Schandler’s client been forced to pay the full amount for the Tamarac condo, there would have been a surplus of roughly $80,000 and Evans likely would have been able to claim a portion of it.

“It just seemed like it was a scheming way of doing business and keeping rightful heirs from what they were entitled to,” Evans said.

Schandler’s client, a trust that lists the same address as Schandler’s virtual office, still owns the property, which is valued at a little more than $160,000.

‘We lost everything’

Schandler has used these online auction rules at least once to win control of a property from owners who were still alive, but living abroad.

Living in Peru and not understanding English well, Jose Manuel Aramayo didn’t have a good grasp of what was happening with his Kendall condo when it was foreclosed in 2018, his daughter, Maria Aramayo, told the Herald.

While he owned the condo free and clear, he had taken out a mortgage on it in 2017, and soon defaulted when an investment went sour. He owed the $15,000 on that mortgage, plus another $7,000 in fees and $7,099 in unpaid assessments.

He was consumed by depression, his daughter recalled, and didn’t tell family members what was going on.

Schandler convinced Miami-Dade Circuit Judge John Thornton Jr. to give his client an unlimited bidding credit when Aramayo’s foreclosed condo went to auction. So while his client won the auction with a bid of $150,400, it only paid $23,646.08, court records show.

Miami attorney John Paul Arcia tried to get the condo back for the Aramayo family, arguing that Thornton had erred in hastily signing a “nefarious court order” less than two hours after it was submitted by Schandler. He said it had been “intentionally drafted in a confusing manner so as to not arouse suspicion of its devious purpose.’’

He alleged that Asset Recoveries LLC, a Schandler- and Meyer-affiliated entity that ultimately paid the winning bid, engaged in “equity stripping.”

“The facts of this case are appalling, unjust, unconscionable, inequitable and it is hard to believe that these facts have actually transpired,” Arcia wrote.

Thornton retired from the bench soon after. Now a mediator and arbitrator, he did not respond to multiple requests for comment.

Asked to reconsider what Thornton had done, Miami-Dade Circuit Judge Oscar Rodriguez-Fonts ruled that Schandler’s client had been entitled only to a $7,099 bidding credit, but it was too late in the judicial process to undo the mistake. An appeals court upheld Rodriguez-Fonts’ decision.

Without the unlimited credit, Arcia argued, Aramayo would have been entitled to more than $100,000 left over after the small judgment was paid.

He got nothing. Even the contents of the condo were taken, Maria Aramayo said. Schandler, through his attorney, said Aramayo had more than three months after losing ownership to remove his belongings.

“We lost everything,” Maria Aramayo said. “Everything that you could have in an apartment to live, like everything.”

Gone were photo albums, a grandmother’s sewing machine, the Jeep Patriot that she and her husband drove when they were dating.

Jose Manuel Aramayo had bought the condo when his son was studying in Miami, and he thought his daughter could stay there when she visited from Indiana. It was an investment, and a safe one, or so it seemed. Losing it wrecked her father for a time, she said.

“He was just consumed then by this depression, anxiety and the fear of losing the apartment because that would have been something he would have used for his retirement,” she said in an interview. “I couldn’t believe the judge or the court would allow this.”

Asset Recoveries still owns the two-bedroom, two-bathroom condo, now valued at $215,814.

‘A scheme perpetrated by misrepresentation’

Arcia isn’t the only lawyer who has raised alarm bells about Schandler’s activity, but those warnings have never resulted in consequences.

In November 2017, Schandler tried to intervene in a Fort Lauderdale condo foreclosure, saying he represented a trust affiliated with Samuel Danziger that paid the cremation costs of the condo’s owner, Susan Koskey. He said the trust was assigned the right to collect that debt.

Broward County Circuit Judge Martin Bidwill allowed Schandler to intervene in the case, but reversed his decision when Ashley Tulloch, a lawyer representing the condo association, established that Schandler had not paid the medical examiner’s office that cremated Koskey and that the office didn’t assign anyone the right to collect payment for debts.

Bidwill blocked Schandler from joining the case, ruling that he carried out “a scheme perpetrated by misrepresentation.” But he took no action to hold Schandler accountable.

Tulloch filed a report with Fort Lauderdale police. But the police report showed that the case died after officers talked to another lawyer involved who told them that there were no victims because Koskey died with no heirs.

But Koskey did have relatives. And fortunately for them, Schandler wasn’t allowed to rewrite the rules of their auction. The sale yielded a surplus of nearly $150,000, and a handful of relatives collected a portion.

Koskey’s 80-year-old cousin, Barb Brenna of Cook, Minnesota, said she thought of the $12,000 payment she received as a “gift,” but would have been upset if the family had been denied a share of the proceeds because Schandler had changed the rules.

“It makes my heart sick when I think that somebody took something that belonged to somebody else,” she said.

Credits

Ben Wieder | Reporter

Brittany Wallman | Reporter

Dana Banker | Editor

Casey Frank | Editor

Neil Nakahodo | Illustration

Sohail Al-Jamea | Illustration

Susan Merriam | Development