Floundering Weed Stocks Test Wall Street’s Faith in 2024 Rebound

(Bloomberg) -- The case for investing in cannabis companies is, in theory, the strongest it’s ever been. Weed shops are popping up on street corners across the US at a frantic pace, while the 2024 presidential election offers an impetus for drug reform.

Most Read from Bloomberg

And yet the stocks underlying the industry are floundering, with even the bulls growing tired of waiting. An index tracking the shares of 100 marijuana-related companies has tumbled more than 15% so far this year, after touching an all-time low in October.

“The fundamentals don’t matter much at all, unfortunately,” said Dan Ahrens, managing director of Advisorshares Investments LLC. “They will again, but right now these companies and their stock prices are extremely tied to federal reform.”

Even though 24 states, two territories and Washington DC have all legalized weed for recreational use, the plant remains a Schedule I substance on a federal basis — on the same tier as heroin and LSD. Federal decriminalization has been a goal among Democrats, though there’s been relatively little progress under President Joe Biden’s administration.

On Wall Street, the lingering red tape is impossible to overlook. Because of marijuana’s status, cannabis companies are taxed so heavily that they struggle to make enough cash. Their shares — and the exchange-traded funds that track them — are also largely kept off of major marketplaces like the New York Stock Exchange, instead trading over the counter or on smaller Canadian exchanges.

That’s all but wiped out optimism among stock pickers who’d expected industry legitimization progress to unleash an epic windfall.

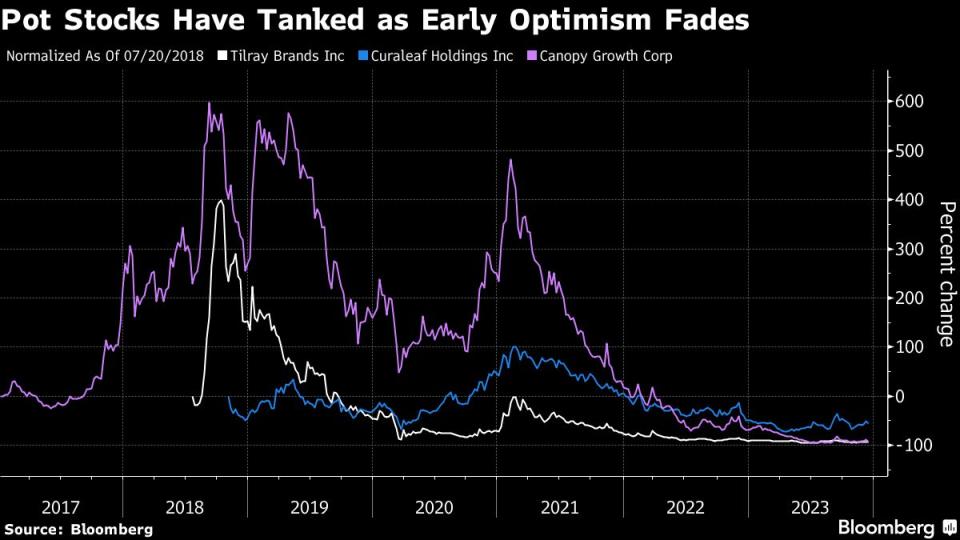

The highs and lows are clear in prices of pot stocks over the years: Tilray Brands Inc.’s US shares trade at just about $2 each, a tiny fraction of what they were worth in 2018, when the stock hit a high of about $214. Curaleaf Holdings Inc. has wiped out roughly $10 billion of shareholder value since a 2021 peak. And Canopy Growth this week resorted to plans for a one-for-10 reverse stock split in a desperate bid to ensure the stock trades at $1-or-more per share.

To Will Hershey, chief executive and co-founder of Roundhill Financial Inc., it’s a disappointment. When he launched an exchange-traded fund tracking US cannabis companies — ticker WEED — last year, the outlook was that 2023 would be a better year for beaten-down pot stocks.

“The whole idea was that we were going to have more progress than we’d seen on the regulatory front,” he said. “As long as these companies have to list on the small Canadian exchanges and have to operate with really burdensome tax regimes, the story is less interesting.”

His WEED fund hit an all-time low in August and has slumped 62% since it started trading on April 20, 2022.

Last Hope

There is, of course, still a chance that Democrats renew the push to reschedule and decriminalize cannabis, especially as they seek to win over voters ahead of Biden’s reelection campaign in 2024.

The next catalyst on investors’ radar is the potential reclassification of marijuana. Pot stocks jumped for one of their best weekly performances this year in September after the US Drug Enforcement Administration said it would review its classification of cannabis, an action taken after nudging by Biden’s team.

“Rescheduling is a major, fundamental catalyst that could result in better equity performance,” said Needham & Co. analyst Matthew McGinley.

Of course, any action by the DEA would likely face legal challenges. And, even in a scenario that sees reclassification and relief from taxes, the boost would be disparate, said Kris Inton, an analyst at Morningstar who covers cannabis companies.

Multistate operators have the most to gain if they face softer tax rules, from Cresco Labs Inc. and Trulieve Cannabis Corp. to Green Thumb Industries Inc.. Larger Canadian companies such as Tilray, Canopy Growth and Cronos Group Inc. would see less impact from rescheduling because they only sell THC products in Canada, not the US, Inton said.

“They’re really completely different exposures,” Inton said.

Plus, it would only be one step in the right direction. Most on Wall Street agree that beyond rescheduling, it would take both legislation — like the SAFER Banking Act, which would make banking and financial services more accessible for the industry — and legalization at the federal level for the industry to flourish.

The SAFER Banking Act, however, will expire if it’s not voted on by the end of the legislative session, meaning it would have to be reintroduced yet again. Any swift action from Congress seems unlikely as House Speaker Mike Johnson has voted against cannabis reform in the past.

Advisorshares’ Ahrens is still betting that federal reform is somewhere on the horizon, pointing to the expansion of states that have legalized cannabis for adult-use. His US cannabis-focused ETF, nicknamed MSOS, is down roughly 73% from its launch in 2020.

“We think it’s closer than ever,” he said. “But we also expected it about two-and-a-half to three years ago.”

(Adds quote in second section, graf six. An earlier version of this story was corrected to say that Canadian companies do not sell THC products in the US.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.