Ford Stock Trades in High Volume Amid Rivian News

Ford Motor Co (NYSE:F) has become one of the most frequently traded stocks during the past quarter with a three-month average daily volume of 108.351 million shares. The stock went into a bit of a tizzy in the middle of last year but ended 2021 strong as its F-150 lightning model recorded better sales figures than initially expected.

I think that even after last year's stellar gains, Ford is set for a good 2022 amid rising interest in both the company's cars and its stock.

What's the latest on Rivian

Ford owns approximately 12% of pure-play EV company Rivian Automotive (NASDAQ:RIVN) after investing a cumulative of $1.2 billion in the company. Earlier this week, Ford's management team announced that it plans to record an $8.2 billion investment gain in its Q-1 report, which includes $900 million in gains from last year that will be reclassified to match Q-1's accruals.

Ford owns the asset on a financial basis, meaning that it won't record any of Rivian's income on its own financial statements, but rather the investment gain as part of its equity account.

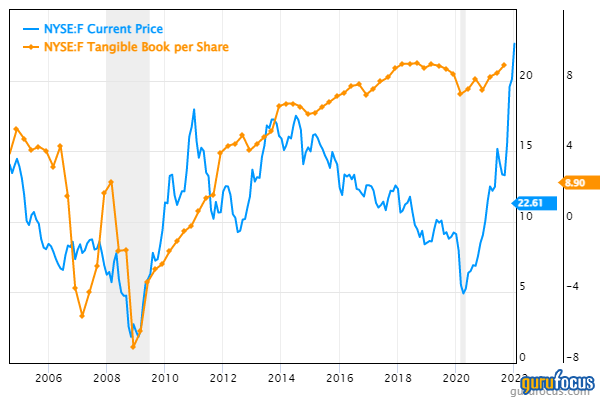

This isn't necessarily a bad thing for investors because it will increase the justified book value, and there's a close correlation between the stock's tangible book value and its market price.

Valuation and momentum

Further to the correlation with book value, Ford's stock is undervalued relative to its price-sales and price-to-free-cash-flow ratio benchmarks by 1.52 times and 2.80 times, respectively. In addition, Ford's stock has a PEG ratio of 0.20, meaning that its growth remains robust, which is good news because the stock market's gains are essentially a function of earnings growth, earnings yield and momentum.

Speaking of which, Ford stock has also formed an appealing momentum pattern by trading above its 50-, 100- and 200-day moving averages. I believe that the stock could traverse through the year while sustaining this pattern amid keen investor interest.

Final word

Ford's gains from its equity investment in Rivian are the latest in a sustained string of activities that could bolster Ford's stock price this year. The stock tends to correlate with its price-book ratio, suggesting that its latest gains from Rivian could bolster the stock's prospects just as much as its own sales growth.

This article first appeared on GuruFocus.