Forest Hills levy would save 15 teacher jobs, fund maintenance

Culture war issues in recent years have divided the Forest Hills School District in Anderson Township just east of Cincinnati.

Shouting matches have erupted at school board meetings over the cancelation of Diversity Day, rumors that the district might consolidate high schools, the change of the school's mascot from Redskins to Raptors, a resolution banning critical race theory and discussion of gender-assigned bathrooms.

But some parents hope Anderson Township voters will unite on Tuesday in favor of a tax hike they say will stave off cuts to teachers, bus drivers and maintenance.

A 6.9-mill levy for general operations, updates and maintenance is on the May 2 primary ballot. It's the largest of four school issues on the ballot in Hamilton County. There are six school tax issues on the ballot in Warren, Butler and Clermont counties.

Here's what you need to know about the levy:

How much would the levies raise taxes?

If the levy is approved, homeowners in Anderson Township would pay $242 more per $100,000 of home value annually to the school district. They currently pay $1,214 per $100,000.

Why is this needed?

The district was running a deficit by October 2022, Superintendent Larry Hook said at the time. Levy supporters and school officials blame a combination of inflation driving up costs for basic maintenance, decreased funding from the state of Ohio and the state's "unconstitutional funding model." In Ohio, school property tax rates approved by voters go down as inflation and property values go up, keeping school tax revenue flat.

"If things don’t change at the state level for fair funding for public education, then we’re forced to go back to our local taxpayers to make up the difference," said Sarah McGough, a parent of three children in Forest Hills schools and member of the steering committee of the pro-levy committee Citizens for Forest Hills.

What has the district done to stave off a tax increase?

Levy supporters point to $2.7 million in cuts the district has made since 2018 as an example of its efforts to stave off a tax increase. Even if the levy passes, the school will have to cut $750,000 out of the nine schools' $90 million annual operating budget. The cuts will include the elimination of several administrative positions, a teacher assigned to English as a second language classes and a reading specialist, according to school district officials.

What will the tax pay for?

The tax will pay for general operations, repairs, updates to schools and maintenance. Schools will get new roofs and buses will get replaced. A $538,000 roof replacement for Anderson High School tops the district's priority list. Second would be the replacement of six new buses at $118,000 each.

What happens if the tax doesn't pass?

The school would need to make an additional $1.8 million in cuts for the 2023-2024 school year if the levy fails. Those cuts would mean 15 teachers would lose their jobs.

A levy failure would also reduce bus drivers and routes. That would require the district to change school start times to give fewer drivers more time to transport more students. The two high schools, Turpin and Anderson, would start 25 minutes earlier. The middle and elementary schools would all start at different times, some earlier, some later.

It would also mean deferred maintenance, such as the needed roof repairs, and increased fees for students to participate in sports, band and theater.

Who supports the tax?

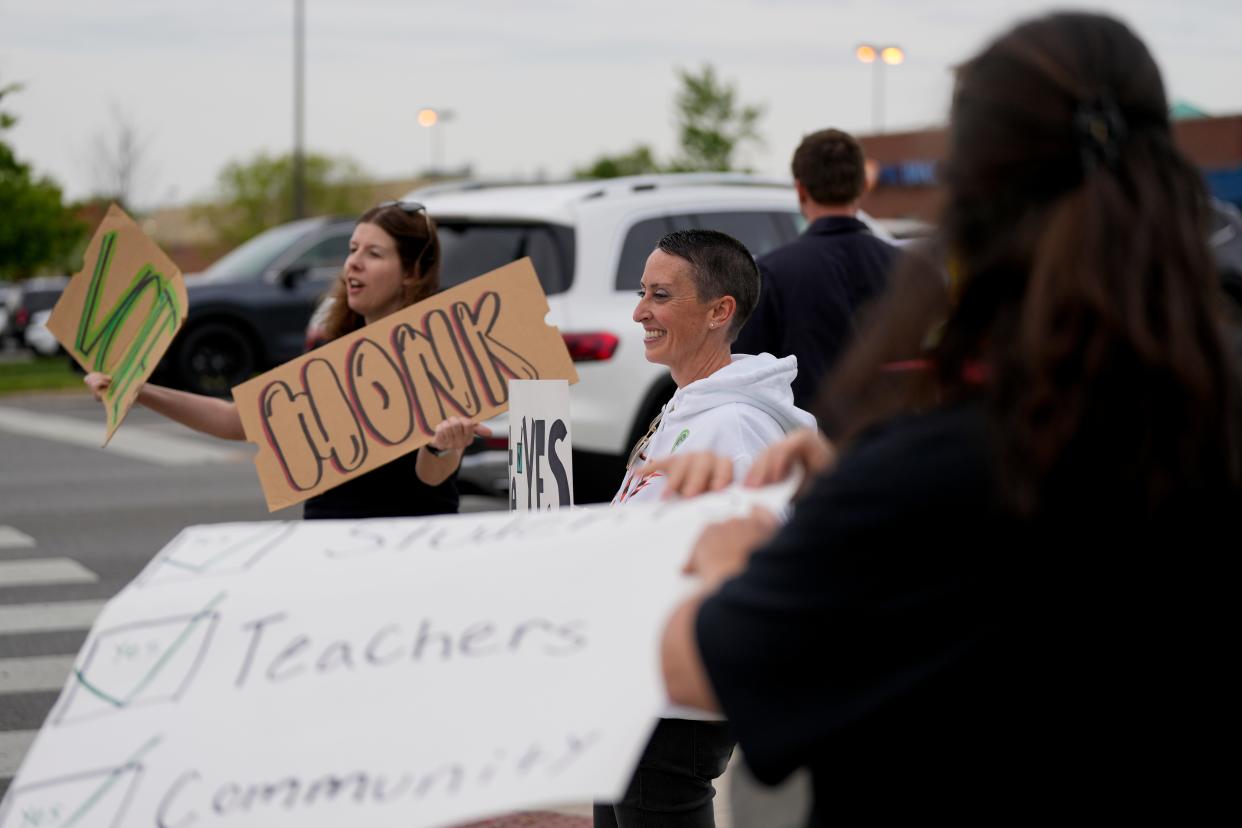

A group of parents and residents called Citizens for Forest Hills Schools has raised money and campaigned for the levy. The committee has collected $62,000 in support of the levy, according to filings with the Hamilton County Board of Elections.

Who opposes the tax?

No group has publicly come out against the levy. A website named Know the Levy has raised questions about the levy and school finances through videos and charts. The website doesn't identify who's behind it or have any disclaimers.

An anonymous man who narrates a video on the website identifies himself as a taxpayer in the Forest Hills School District and said "myself and some others, we started looking at how our tax dollars are used."

The website questions why state money goes to other districts and not back to Forest Hills, what impact declining enrollment will have, and whether the district will need to ask for another increase in three years.

Where do school board members stand?

The five-member school board unanimously voted to put the levy on the ballot. But as the election nears, only one member was willing to talk to The Enquirer about it.

Board member Leslie Rasmussen supports the levy and contributed at least $50 to the pro-levy campaign, according to the most recent filings with the Hamilton County Board of Elections.

The other four school board members did not return messages seeking comment.

This levy isn't about the divisive issues that have beset the school board in the past few years, Rasmussen said.

"At the end of the day, if this levy fails, it doesn't hurt the board," Rasmussen said. "It hurts our children. It hurts our teachers, and it hurts our greater community."

This article originally appeared on Cincinnati Enquirer: Why Forest Hills School District seeks a tax hike