Is forgiving student loans fair?

- Oops!Something went wrong.Please try again later.

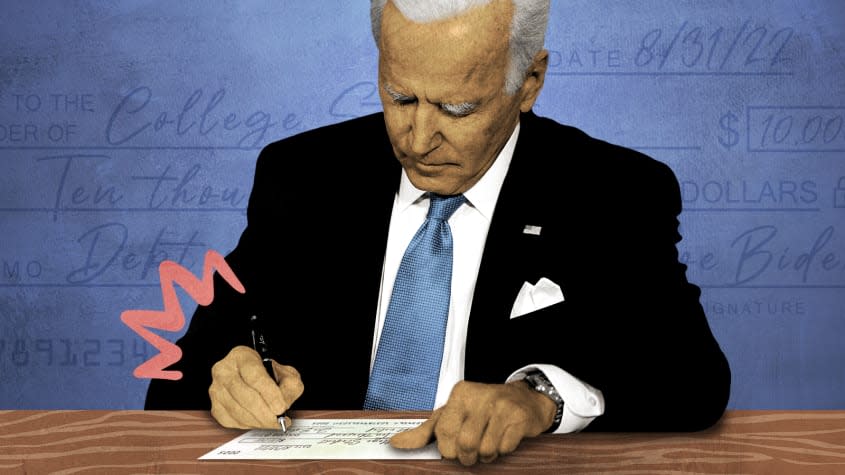

President Biden last week unveiled his long-awaited plan to forgive some student loan debt. Biden said his administration would cancel up to $10,000 in federal student loans for borrowers making under $125,000 a year, and another $10,000 for Pell Grant recipients under the same income threshold. Biden also extended the coronavirus-sparked repayment moratorium, which was set to expire at the end of August, until Dec. 31. Biden also said the administration would cut from 10 percent to 5 percent the amount of discretionary income that borrowers enrolled in an income-driven repayment plan must pay each month. Biden said he knew people on all sides of the issue would be unhappy with some parts of his plan.

Some progressives have called for bigger cuts in outstanding student loans, arguing that generational wealth disparities saddle Black and Hispanic families with heavier student debt, and the inequities are compounded after graduation because minority graduates typically earn less, making them more likely to default and preventing them from improving their financial situation by starting businesses or buying homes. Senate Minority Leader Mitch McConnell (R-Ky.), echoing complaints from other conservatives, called Biden's plan a "wildly unfair redistribution" of wealth, and Sen. Ted Cruz (R-Texas) said it amounted to a gift to any "slacker barista who wasted seven years in college studying completely useless things." Is Biden's student-debt policy fair?

It's unfair, and unwise

Biden's student loan forgiveness plan is a mistake, and, with a "mind-boggling" price tag of $330 billion, it's an expensive one, says Althea Cole in the Idaho Gazette. As The Washington Post noted in an editorial, it's regressive, because it takes money from the broader tax base, which is full of people who didn't go to college, and hands it to people with valuable degrees. It also "allows college tuition to continue to rise," and "rewards financial decision-making that is at best naive and at worst flat-out unwise." All that's going to do is "entice a whole new generation of Americans to make the same simple and consequential mistake as borrowers before them: buying an education they cannot afford." And for what? To buy some votes in November? "Regardless of what you feel about the loan recipients who stand to benefit in ways others will not, three things are clear: What's right isn't always fair; what's fair isn't always right; and the actions taken by the President and his Department of Education are neither fair nor right."

Every allotment of federal resources is unfair to someone

"I get that it feels unfair," says Megan Schrader in The Denver Post. It's understandable that many people feel slighted because they sacrificed to pay off their student loans on their own. But Schrader and her husband came from "upper-middle-class families that were able to put us through college debt-free," and when they left college were "able to buy a house in the depressed market of 2010 and get the $10,000 First Time Homebuyers government subsidy." Was that fair to people who didn't qualify for the same government largesse? When banks that bet on bad mortgages were on the brink of collapse in 2008, "(the equivalent of betting big on a college degree that went south), the federal government bailed them out." Wouldn't you rather be "bailing out 18-year-olds for their bad choices" than Wall Street bankers? With their loans forgiven, these borrowers will be able to pump their savings back into the economy, and maybe cover a down payment on a house. "Is it unfair? Yes. Is it good public policy? Absolutely."

This rewards elitist institutions for producing grads without useful skills

Higher education is "supposed to be an investment" in the student's future, says Allysia Finley in The Wall Street Journal. "The real problem is that federal subsidies have distorted this investment and resulted in a misallocation of human capital. America's bureaucratic-educational complex has produced too many young people with too much debt and too few skills that employers want, and not enough workers with skills that they do." We've all heard how college graduates earn more than people with just high school degrees, but that's not always true. A Columbia anthropology major "($85,967 annual sticker price)" would make more working for Deere & Co than doing something related to their degree. Biden's bailout will only benefit "woke" universities and help them lure students who might otherwise get marketable "skills training" in coding boot camps and trade schools that often aren't "eligible for federal aid." This isn't "good for the U.S. economy or democracy."

There's nothing elitist about forgiving student loans

Ted Cruz's claim that Biden is taking money from working-class people to benefit the unworthy "betrays an ignorance of working-class life in this country," says Jamelle Bouie in The New York Times. "To work as a truck driver or a medical technician or a home inspector or any number of other similar blue-collar jobs, you need training, licenses, certifications. People go to school to meet these requirements," often relying on the same federal student loans to pay tuition that college students use. And many blue-collar workers also have some college, piling up debt without graduating. Add to that the fact that most people standing to benefit from Biden's plan make less than $75,000, a disproportionate number of them young and Black, and it's clear this debt forgiveness would help people who have suffered most "in the history of capitalist inequality in the United States."

You may also like

Secret Service official who worked in Trump White House retires 2 days before Jan. 6 interview

Chris Rock says he turned down offer to host 2023 Oscars after Will Smith slap