Former CEO of Elkhart payroll company indicted on federal fraud charges

Najeeb Khan, the former owner and CEO of an Elkhart-based payroll company, was indicted by federal prosecutors on Tuesday after he allegedly defrauded clients out of more than $180 million in what court documents say may be "the largest and longest-running case of blatant check kiting in United States history."

Prosecutors in the Northern District of Ohio allege that from 2014 to 2019, Khan carefully timed the depositing and withdrawal of company payments across three different bank accounts to defraud the financial institutions and "fund his lifestyle, including the purchase of millions of dollars of automobiles, aircraft, and vacations homes."

The fallout from the alleged fraud bankrupted Khan's company, Interlogic Outsourcing Inc., which is headquartered northeast of Elkhart.

Court documents say Khan has been cooperating with federal prosecutors and intends to plead guilty. In addition to fraud, Khan is also accused of tax evasion for not paying over $7 million in income taxes from 2015-2018.

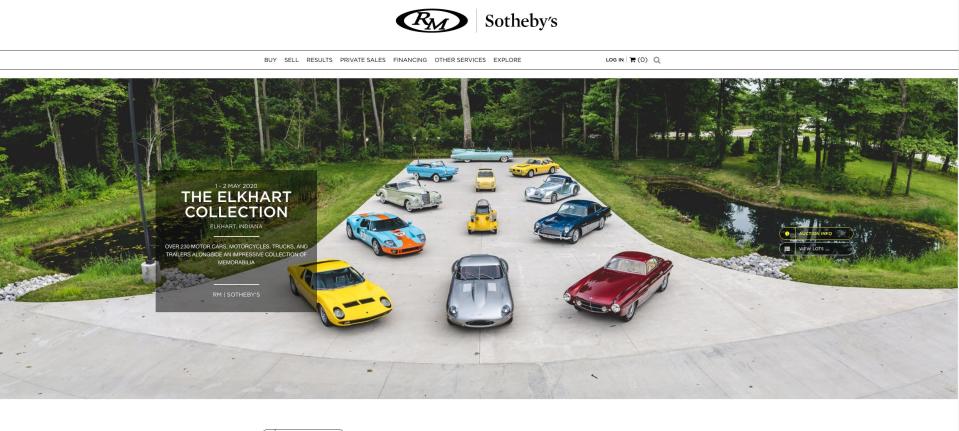

The indictment comes as the dust is finally beginning to settle in a series of lawsuits filed by Khan's creditors seeking to recoup their losses as the Edwardsburg resident has been liquidating his assets, auctioning off over 230 rare and exotic cars as well as vacation homes and other properties.

Check kiting

Tribune archives show Khan first bought Interlogic Outsourcing Inc. in 2002 and by the mid-2010s, IOI provided payroll services for nearly 6,000 individual clients across the country, including small businesses in Michiana along with national clients like the Boy Scouts of America, various Catholic archdioceses and and several large banks.

IOI first came under scrutiny in July 2019 when Khan made what appeared to be two routine transfers totaling $250 million to KeyBank, which would then distribute the money on behalf of Khan’s clients to workers, insurance companies and the government.

The transfers failed to clear because of insufficient funds in Khan’s business account at Lake City Bank, leaving KeyBank with a $122 million overdraft. Court documents state Khan "self-disclosed" the scheme to the banks and the government.

KeyBank filed a lawsuit, which sparked a series of other court filings as IOI's other clients realized they owed unpaid taxes the company had not been paying. The realization also set off a criminal investigation by federal prosecutors in Cleveland, where KeyBank is based and caused IOI to go bankrupt.

'Complete financial control':A man says a husband and wife — both Elkhart police officers —took control of his finances

The recent indictment, filed more than three years after the transaction which set off the investigations, claims Khan was skimming money meant for withholding taxes, then using carefully timed transfers between his company’s multiple bank accounts to hide the shortfall in a practice known as "check kiting."

The indictment also accuses Khan of filing falsified income tax statements since he was not disclosing the money he made from the alleged fraud.

A hearing in the case has been set for mid-January and the court docket indicates Khan is expected to plead guilty.

Jesse Barrett, an attorney representing Khan, released a written statement Saturday saying that "Mr. Khan has been cooperating with the government for over three years. His stipulation to the government’s filing of the information is another step in this process.”

Financial fallout

The criminal charges against Khan come after separate court battles regarding the repayment of the lost funds.

KeyBank, IOI's single largest creditor, filed the first lawsuit when it first learned of the company's shortfall, but others soon followed, seeking to block KeyBank from seizing Khan’s remaining assets ahead of other victims.

Elkhart fraud:Victims in Elkhart businessman's alleged fraud could soon recoup their losses

In April 2021, the various parties agreed to a repayment plan that gave KeyBank 60% (around $142 million) of whatever could be liquidated from Khan's fortune, while the rest of IOI's clients got the other 40% (around $33 million). The agreement was seen as a win for creditors, who received 65-100% of their money back, since such creditors usually get pennies on the dollar in fraud cases.

Lake City Bank has also now been pulled into litigation by IOI creditors with a lawsuit filed last year alleging the Warsaw-based bank collected more than $13 million in transaction fees from Khan that the bank knew, or should have known, were the result of fraudulent activity. That litigation is still pending.

In the meantime, Khan was forced to sell off his assets to repay his debts. The most valuable part of his fortune, a collection of more than 200 rare and exotic cars, dubbed the “Elkhart Collection,” brought in $40 million at auction in 2020.

Khan has also sold a yacht and the IOI company itself was sold to a different payroll processing firm for $3.5 million.

Email Marek Mazurek at mmazurek@sbtinfo.com. Follow him on Twitter: @marek_mazurek

This article originally appeared on South Bend Tribune: Ex-CEO of Elkhart payroll company charged with fraudulent check kiting