Former mayors: City must honor pledge to voters, let pension tax expire once debt is paid

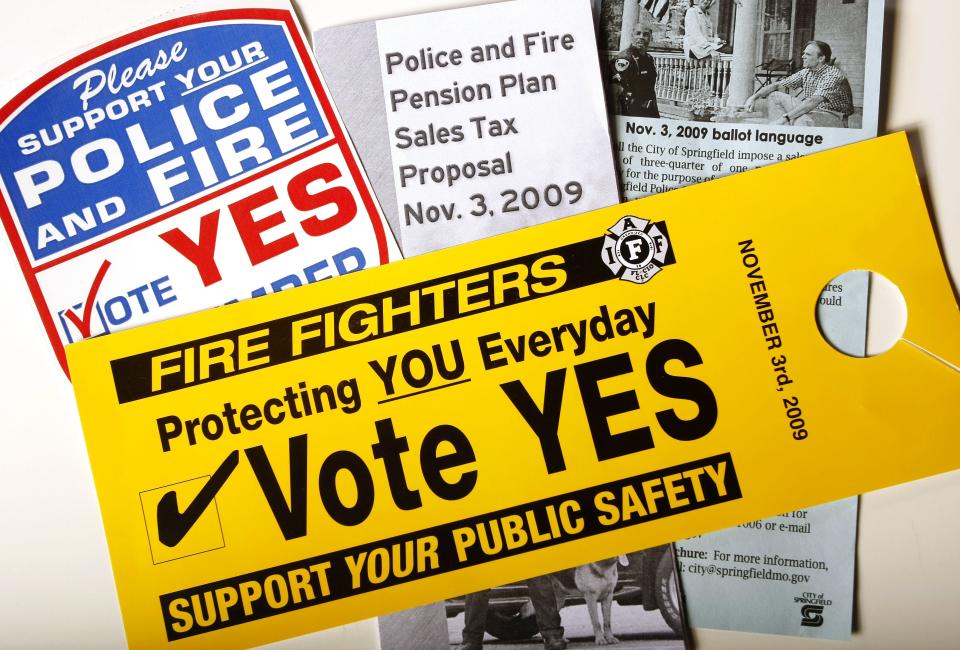

In 2009, Jim O’Neal was elected mayor and actively led the campaign to educate voters on the need for the Police/Fire Pension Tax and in advocating for its passage. As a new city councilman elected to the General Seat A position, Robert Stephens was equally active as a former human resources manager with actual professional experience with retirement and pension plans.

Our message to the voters was simple: The Police/Fire Pension deficit was getting close to tipping our entire city government into bankruptcy. That situation had to be fixed. Our promise was equally simple: If voters would approve the ¾-cent tax, the council would sunset it as soon as the pension deficit was erased.

We noted that the tax might have to be renewed, but again, once the deficit was eliminated, the tax would end. With the openness and transparency and the unanimity of Mayor O’Neal, City Council, City Manager Greg Burris and his staff, the voters were convinced and passed the tax by a 55%-45% margin. Keep in mind that this was November 2009, and we were suffering under the worst recession since the Great Depression.

Our historic City Hall and the adjacent Busch Municipal Building were built many years ago and are stoic reminders of the strength of our local government. While the government buildings we visit, work in, and serve in look incredibly strong, nearly indestructible, we learned in public service that they only stand because of consensus and they rest solely on a foundation of trust.

We’re referring to City Manager Jason Gage’s proposal, during a council study session, to extend the tax from a five-year renewal to a 20-year period and, once the pension fund is whole, divert that leftover amount to other items on the city’s “want list.” Mr. Gage was quoted in the News-Leader as saying, “another five-year renewal of the tax would produce far more revenue, about $45 million annually, than is necessary.” He even floated the idea of making the tax “permanent.” This would erode that foundation of trust we spoke of above.

Even though the original election was 14 years ago, our city government has coasted on the good will and trust with voters created during those earlier campaigns. And recently, the proposal was that the Capital Improvements tax be extended to 20-year renewals. A 20-year sunset is effectively no sunset at all.

It will now be decades before our citizens can vote to hold our city government accountable for our 1/4-cent Capital Improvements tax. The proposed scenario for the pension funding is much more egregious. Not only does the tax conceivably become perpetual, the uses of those leftover tax receipts may have no constraints.

Mr. Gage was not a Springfield citizen during that pension campaign and is perhaps unaware of the written (and perhaps codified) promises made by earlier elected officials. One of the recommendations by the Citizen’s Police and Fire Pension Task Force was to give voters a voice every five years on continuation of the tax, if it was needed. The commitment to our citizens on the 2009 ballot was that as soon as the pension plan was fully funded, the tax would end immediately. No ifs, ands, or buts. No smoke and mirrors. No bait and switch.

Springfield may perhaps find itself in the future to again have some unknown, severe, unfunded liability. If City Council fails to honor our word after the citizens trusted us to fix a complex problem — a problem of city government’s own making — and one which would have reduced Springfield into junk bond status, how can we go to them again in another crisis? Make no mistake: the Springfield we live in today would not exist had our citizens not chosen to fund our city-owned pension.

We certainly have well-known and critical community needs. We have identified them. Put workable solutions in front of the voters and trust them. Give voters the ability to review the results. Then trust them to decide if our local government is doing what it said it would do.

Jim O’Neal and Bob Stephens are both former mayors of Springfield who served on City Council when the police-fire pension sales tax was developed by a citizen task force and pitched to voters.

This article originally appeared on Springfield News-Leader: Former mayors say city must let pension tax expire to preserve trust