Fourth Dimension Solutions (NSE:FOURTHDIM) Use Of Debt Could Be Considered Risky

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Fourth Dimension Solutions Limited (NSE:FOURTHDIM) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Fourth Dimension Solutions

What Is Fourth Dimension Solutions's Debt?

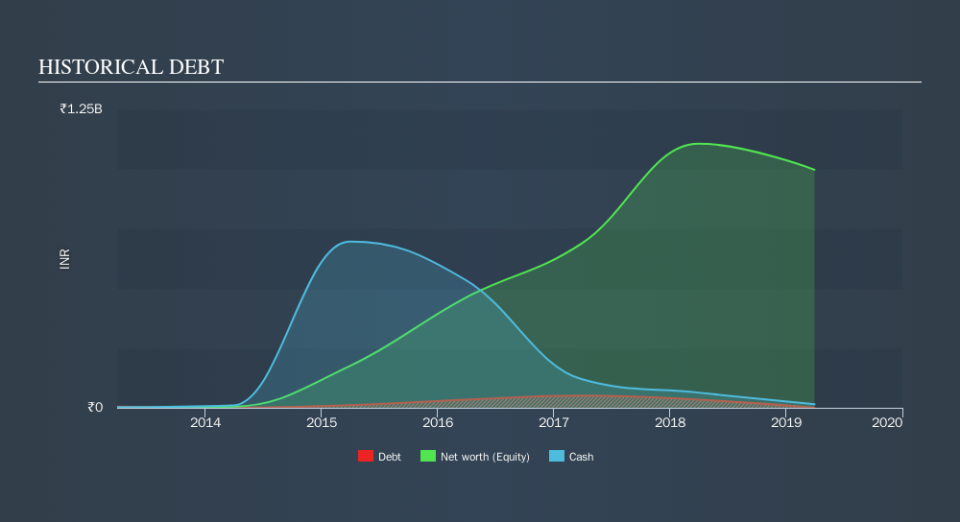

As you can see below, Fourth Dimension Solutions had ₹189.1k of debt at March 2019, down from ₹34.1m a year prior. However, it does have ₹14.8m in cash offsetting this, leading to net cash of ₹14.6m.

How Healthy Is Fourth Dimension Solutions's Balance Sheet?

We can see from the most recent balance sheet that Fourth Dimension Solutions had liabilities of ₹2.20b falling due within a year, and liabilities of ₹20.1m due beyond that. Offsetting these obligations, it had cash of ₹14.8m as well as receivables valued at ₹181.8m due within 12 months. So it has liabilities totalling ₹2.02b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₹354.0m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Fourth Dimension Solutions would likely require a major re-capitalisation if it had to pay its creditors today. Given that Fourth Dimension Solutions has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

In fact Fourth Dimension Solutions's saving grace is its low debt levels, because its EBIT has tanked 83% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But it is Fourth Dimension Solutions's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Fourth Dimension Solutions may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Fourth Dimension Solutions saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While Fourth Dimension Solutions does have more liabilities than liquid assets, it also has net cash of ₹15m. However, we do find both Fourth Dimension Solutions's level of total liabilities and its EBIT growth rate troubling. So despite the cash, we do think it carries some risks. Over time, share prices tend to follow earnings per share, so if you're interested in Fourth Dimension Solutions, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.