FPA Capital Fund Buys 4 Stocks in 4th Quarter

The FPA Capital Fund (Trades, Portfolio), part of Los Angeles-based First Pacific Advisors (Trades, Portfolio), disclosed this week that it established four new positions during fourth-quarter 2019: Centene Corp. (NYSE:CNC), ACI Worldwide Inc. (NASDAQ:ACIW), Science Applications International Corp. (NYSE:SAIC) and Spirit Airlines Inc. (NYSE:SAVE).

Managed by Arik Ahitov, the fund seeks long-term growth through investments in stocks of companies with strong balance sheets, high free cash flow and an understandable and successful business strategy. More specifically, the fund seeks companies with high returns on equity and are trading at attractive price-book and price-to-normalized-earnings ratios.

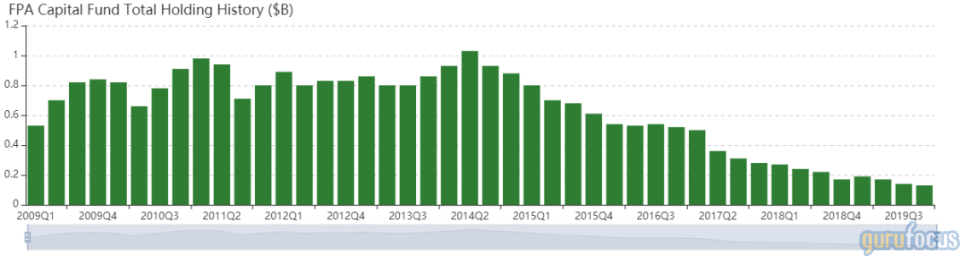

As of quarter-end, the fund's $133 million equity portfolio contains 23 stocks, with a turnover rate of 14%. The top three sectors in terms of portfolio weight are consumer cyclical, industrials and technology, with weights of 22.60%, 20% and 18.79%.

Centene

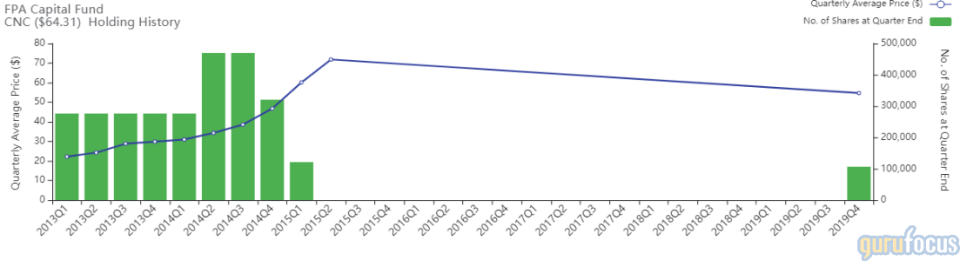

The fund purchased 106,602 shares of Centene, giving the position 5.03% weight in the equity portfolio. Shares averaged $54.66 during the quarter.

Centene offers health care plans to U.S. government-sponsored health care programs, with a focus on uninsured individuals. The St. Louis-based company disclosed on Tuesday that it extended the expiration date of the exchange offers issued by WellCare Health Plans Inc. (NYSE:WCG), the company bound to a merger with Centene, to Jan. 21. The exchange offers were made pursuant to the terms set forth in the offering memorandum dated Nov. 1, 2019.

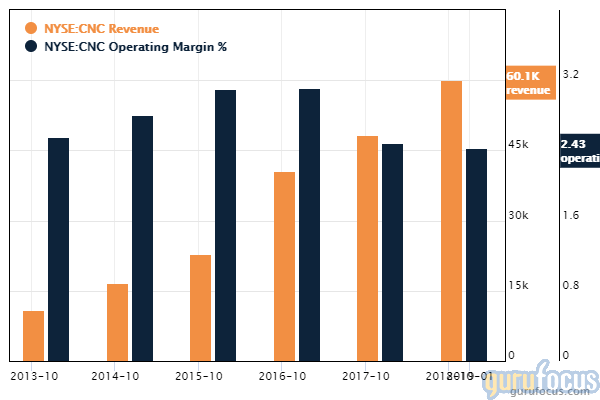

GuruFocus ranks Centene's profitability 8 out of 10: Even though operating margins have declined and are underperforming 76.47% of global competitors, the company has a three-star business predictability rank and a three-year revenue growth rate that outperforms 73.68% of global companies that offer health care plans.

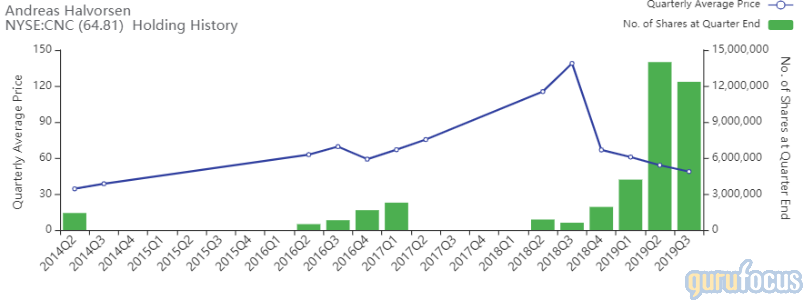

Andreas Halvorsen (Trades, Portfolio) and Lee Ainslie (Trades, Portfolio) also have holdings in Centene.

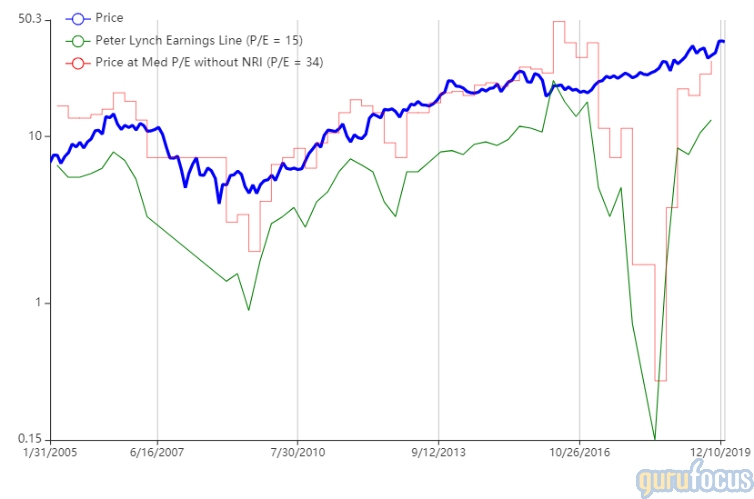

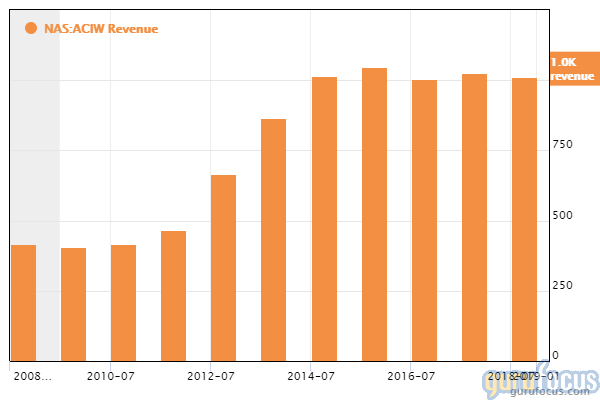

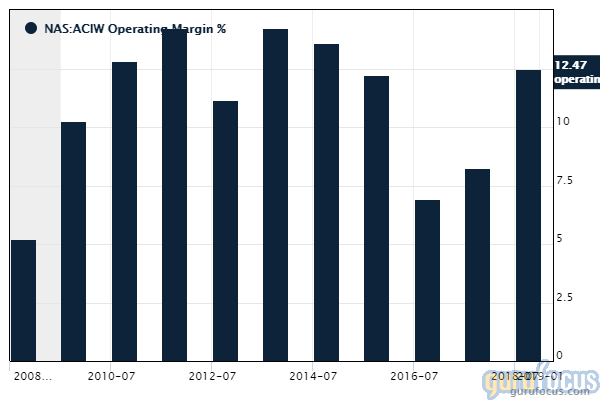

ACI Worldwide

The fund purchased 117,643 shares of ACI Worldwide, giving the holding 3.34% weight in the equity portfolio. Shares averaged $34.24 during the quarter.

The Naples, Florida-based company develops, markets and installs a range of software products primarily focused on facilitating electronic payments. GuruFocus ranks the company's profitability 7 out of 10: Although its revenue declined 0.80% per year over the past three years, ACI Worldwide's business predictability ranks two stars as revenues are overall still growing over the past 10 years.

Other factors that contribute to a profitability rank of 7 include operating margins that are outperforming approximately 74% of global competitors.

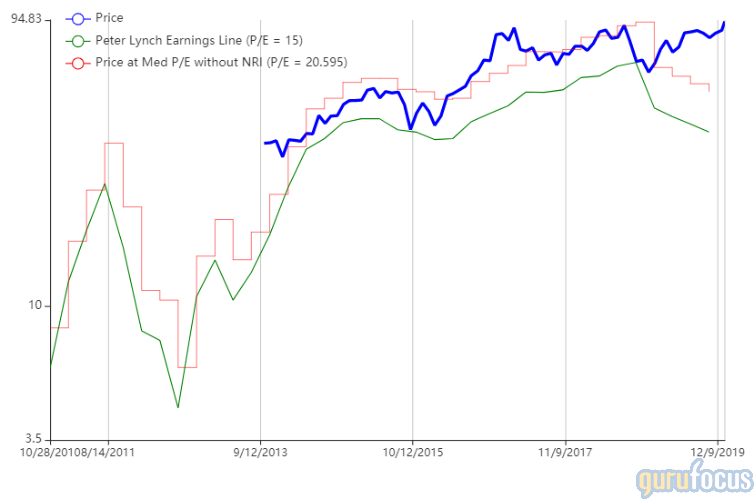

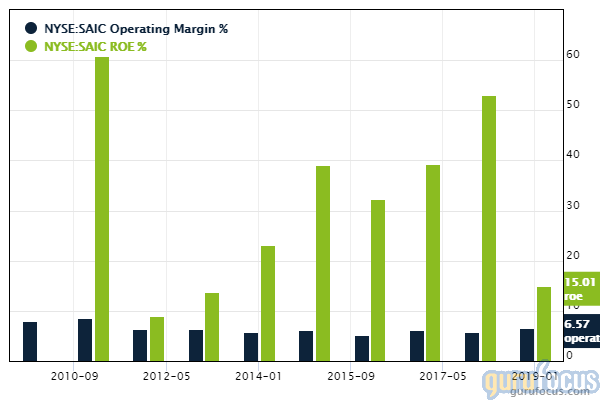

Science Applications International

The fund purchased 36,863 shares of Science Applications International, giving the position 2.41% equity portfolio weight. Shares averaged $83.73 during the quarter.

The Reston, Virginia-based company provides technical, engineering and enterprise information technology solutions, primarily to the U.S. government. GuruFocus ranks the company's profitability 7 out of 10: Operating margins are expanding approximately 1.50% per year on average over the past five years despite outperforming just around 58% of global competitors. Additionally, its return on equity of 13% outperforms 69.31% of global software companies.

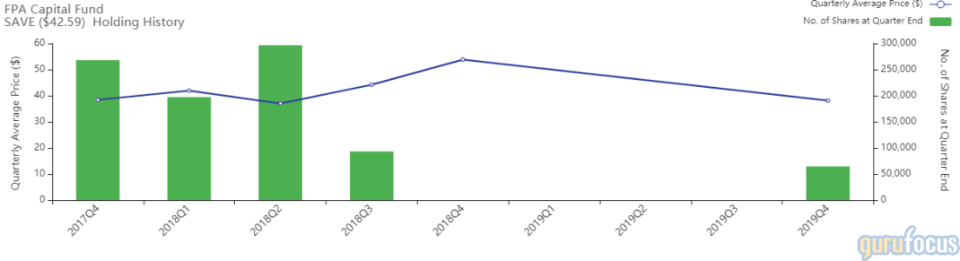

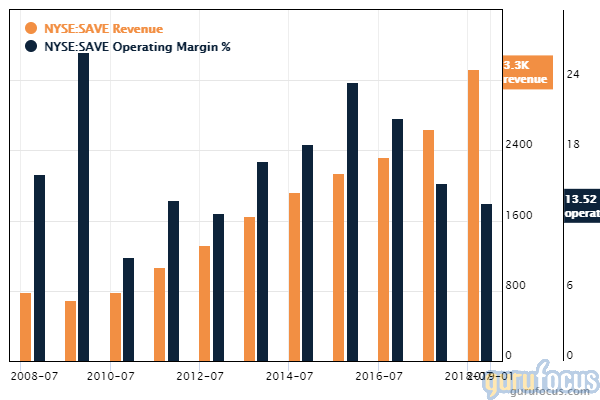

Spirit

The fund purchased 64,518 shares of Spirit Airlines, giving the holding 1.95% equity portfolio weight. Shares averaged $38.12 during the quarter.

The Miramar, Florida-based airline serves the U.S., the Caribbean and Latin America. GuruFocus ranks Spirit's profitability 8 out of 10 on several positive investing signs, which include operating margins that outperform over 74% of global airlines and a three-year revenue growth rate near a 10-year high of 18% and outperforms over 84.83% of global competitors.

Disclosure: No positions.

Read more here:

Jerome Dodson's Parnassus Fund Buys 2 Stocks in 4th Quarter

Jana Partners Slims Holding in Calloway Golf

Berkshire Bank Holding JPMorgan Rises on Strong 2019 Revenue Growth

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.