How France’s socialist mortgage cap backfired on Macron

Mortgage holders have had a difficult 18 months.

Rising interest rates across the world have pushed up the costs of loans, making it harder for first-time buyers to get on the ladder and stretching the finances of borrowers forced to move on to much higher rates when their loan term ends.

In the UK, the Government faced calls last year to intervene to stop lenders increasing rates further, but to no avail. However, France already had a market intervention in place.

France’s long-standing cap on mortgage rates is designed to protect consumers from rising rates. However, the mechanism has backfired in the past year by making lending unprofitable for banks, causing them to remove products from the market.

The taux d’usure, introduced in 2016, is set by the Bank of France and dictates the maximum annual percentage a lender can charge for a fixed-rate mortgage. It is calculated taking the average rate for the previous three months plus a third of that figure.

When the European Central Bank started raising interest rates the cap couldn’t keep up, so the price at which lenders bought money to lend made it unprofitable to pass on to customers while keeping below the cap.

Fiona Watts, managing director of International Private Finance says: “In September the cap was so low that lending was unprofitable. So banks said we would rather withdraw the products.”

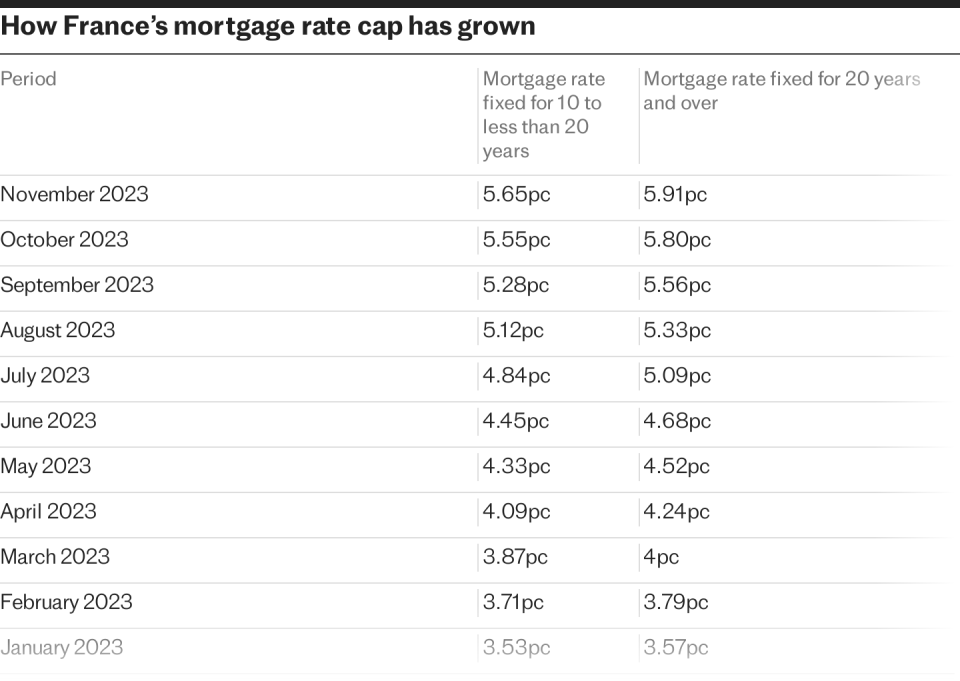

In response, the central bank changed the frequency of the decision in February 2023 to monthly, so the cap is now updated but still using data from the previous quarter. However, the change is currently only in place for a year.

The most recent cap, set in December, for a fixed-rate mortgage with a term of over 20 years was 6.11pc, for loans dated 10 to 20 years it is 5.8pc.

In the final quarter of 2023 the average rate for a fixed 20-year loan was 4.58pc and 4.35pc for those between 10 and 20 years long.

The drop in product availability has resulted in a dramatic fall in the number of mortgage approvals. From August 2022 to August 2023 the volume of new housing loans nearly halved from €18.9bn (£16.24bn) to €9.9bn (£8.51bn) – a drop of 47pc.

House prices have also taken a hit as a result of higher rates. Fixed mortgages in France usually have terms of around 20 years or longer, so locking in a higher rate is more punitive than it would be in the UK where the majority of fixed rates run for two or five years.

Demand has reduced significantly with existing home sales falling 20pc in the year to October 2023 compared to the previous 12 months.

Matthieu Ragon, general manager at French Private Finance, says: “For the most part of 2023 mortgage applications were extremely difficult in France, at one point about 50pc of applications were being turned down.

“It impacted those trying to buy their first home, not because the profile of the client was bad but because the bank couldn’t find a portable solution”.

Long-dated loans have provided some protection from the rapid rise in interest rates over the past year that is helping to insulate house prices.

The length reduces the number of mortgage holders who face a financial shock when refinancing at a much higher rate, an issue around 1.5 million homeowners in the UK will face when their mortgage deal ends this year.

House prices in France fell 1.1pc in the third quarter of 2023, compared to the same period the previous year. In the UK prices fell 6.1pc in the year to September, according to Knight Frank. It was the biggest annual drop since a 13.4pc fall in Q3 of 2009.

As borrowing capacity continues to be stretched, French bank Groupe BPCE expects transaction volumes for existing properties to fall a further 5pc in 2024, with prices falling to a lesser extent.

The bank expects prices to drop by 3pc this year with the number of new mortgages dropping by around 20pc.

Net zero regulations could hit prices further

However, the market could see another shock as net zero regulations threaten to knock down the prices of older housing stock.

There are around 37 million homes in France, nearly a fifth (5.2 million) of which are classified as the least efficient – rated F or G – according to the French government.

As part of the country’s roadmap to net zero by 2050, some 370,000 homes need to be retrofitted each year by 2030 and 700,000 a year after that. But the current rate of retrofits is well shy of this target, believed to be between 50,000 and 100,000 buildings per year.

The French president has already forced those with the country’s most inefficient homes to fork out €800 each for ‘regulatory energy audits’ if they want to sell them. Landlords are also slowly being banned from renting more and more of the country’s least inefficient housing stock.

This, in turn, is having a detrimental impact on mortgage applications. Monica Bisci, partner at financial adviser Enness Global, said in some cases banks are telling buyers of low-rated properties that they need to retrofit them within a certain period as part of their loan agreement – and that if they do not, the bank can call on the loan.

Jason Porter, of the financial adviser Blevins Franks, agreed that lenders across the board – right from standard residential to ultra-prime property – are increasingly likely to look unfavourably on properties with low energy efficiency ratings.

He added: “This gives rise to lower valuations. As a result, you may not be able to borrow as much as you hoped, or you may have to pay a higher interest rate.

“Some lenders will not lend against low efficiency properties, as the new legislation means they will shortly be unmarketable without investment in their energy efficiency, and others will have fixed criteria for the efficiency of building they will finance.”

Currently around 74pc of would-be house buyers consider the energy efficiency rating of a property to be a deciding factor in their choice, according to Groupe BPCE. Just 14pc say it wouldn’t influence their choice.

Small rental properties and individual homes are expected to be the most heavily impacted properties. Within these groups the gap between properties rated F or G and those rated D can be as high as 15pc.

The cost of renovating in France has risen in recent years. Trevor Leggett, founder of Leggett International Real Estate, says they have as much as doubled, from around €1,500 to €3,000 per square metre.

Government grants of up to €70,000 are available to French homeowners, but many families have been excluded from these based on their income.

In Paris, to qualify for a full grant the income thresholds range from €23,500 for a single person to €51,000 for a family of five.

In the rest of France, maximum grants are issued to families earning between €17,000 and €40,000.

British buyers suffer

UK citizens looking to buy property in France are also being impacted by the French mortgage market uncertainty.

As with domestic loans, those for non-residents also got pulled as rates rose leaving fewer options for overseas buyers.

However, mortgage rates began to fall this week raising hopes that products will start to return to the market.

Buying property in France can be tricky from an affordability perspective if you need a mortgage. France has imposed a debt-to-income ratio that means no more than a third of your income – 35pc – can be taken up serving your debt.

This means that with a monthly income of £10,000 a maximum of £3,500 can be spent on debt, including any car financing, student debt or credit cards.

However, banks do not apply the rule in the same way. Some use your gross income to calculate affordability whereas others only use the net amount, further limiting what you can borrow.

“It really favours someone on a high basic salary or good bonuses,” says Watts “It is such a different system to the UK, so a lot of what we do is explaining to clients how different it is managing expectations. Most of my clients are pretty wealthy so they would be able to get a mortgage, so that is wherethe shock comes from. People can’t quite believe it.”

Furthermore, a small minority of banks require international buyers to keep significant sums within the bank as extra security when taking out a loan, says Ragon.

In previous years it was just €50,000 but this has risen in recent times. Some lenders now expect buyers to deposit as much as €200,000 to qualify for a home loan although an amount this high is considered rare, explains Watts.

“The reality is that quite a lot of buyers don’t necessarily need mortgages but use it for liquidity purposes,” says Jack Harris, partner at Knight Frank International Residential Department responsible for the south of France.

“But what is going on in the mortgage market does have an impact on buyer demand and sentiment. However, a UK cash buyer is now very attractive to a seller in France because they are removed from the uncertainty.”

Recommended

Where to buy a beautiful house in France for less than £100,000