Fraser and Neave (SGX:F99) Seems To Use Debt Quite Sensibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Fraser and Neave, Limited (SGX:F99) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Fraser and Neave

How Much Debt Does Fraser and Neave Carry?

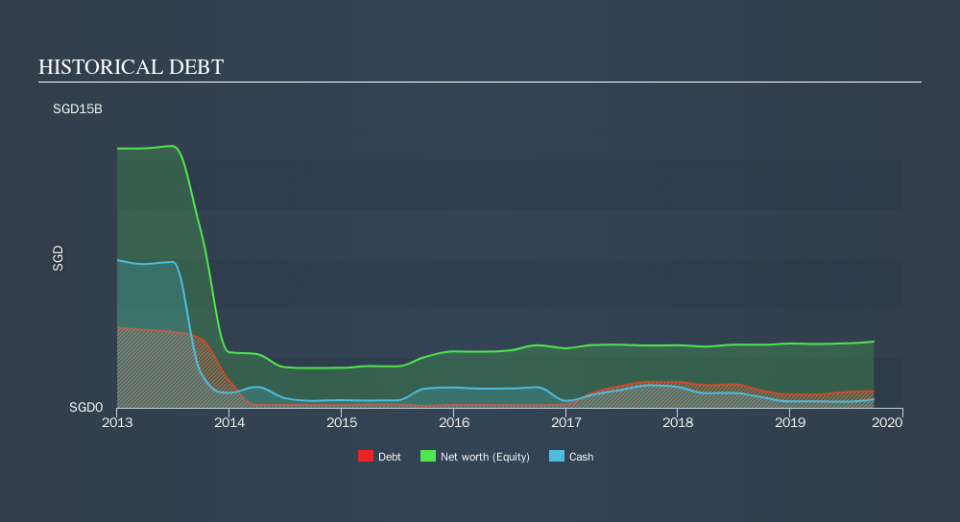

As you can see below, Fraser and Neave had S$829.7m of debt at September 2019, down from S$871.4m a year prior. However, it does have S$420.3m in cash offsetting this, leading to net debt of about S$409.4m.

A Look At Fraser and Neave's Liabilities

The latest balance sheet data shows that Fraser and Neave had liabilities of S$501.6m due within a year, and liabilities of S$885.4m falling due after that. On the other hand, it had cash of S$420.3m and S$352.3m worth of receivables due within a year. So its liabilities total S$614.3m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Fraser and Neave is worth S$2.54b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Fraser and Neave's moderate net debt to EBITDA ratio ( being 1.9), indicates prudence when it comes to debt. And its commanding EBIT of 10.6 times its interest expense, implies the debt load is as light as a peacock feather. Importantly, Fraser and Neave grew its EBIT by 32% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Fraser and Neave will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Fraser and Neave's free cash flow amounted to 24% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Happily, Fraser and Neave's impressive EBIT growth rate implies it has the upper hand on its debt. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that Fraser and Neave can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Fraser and Neave's dividend history, without delay!

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.