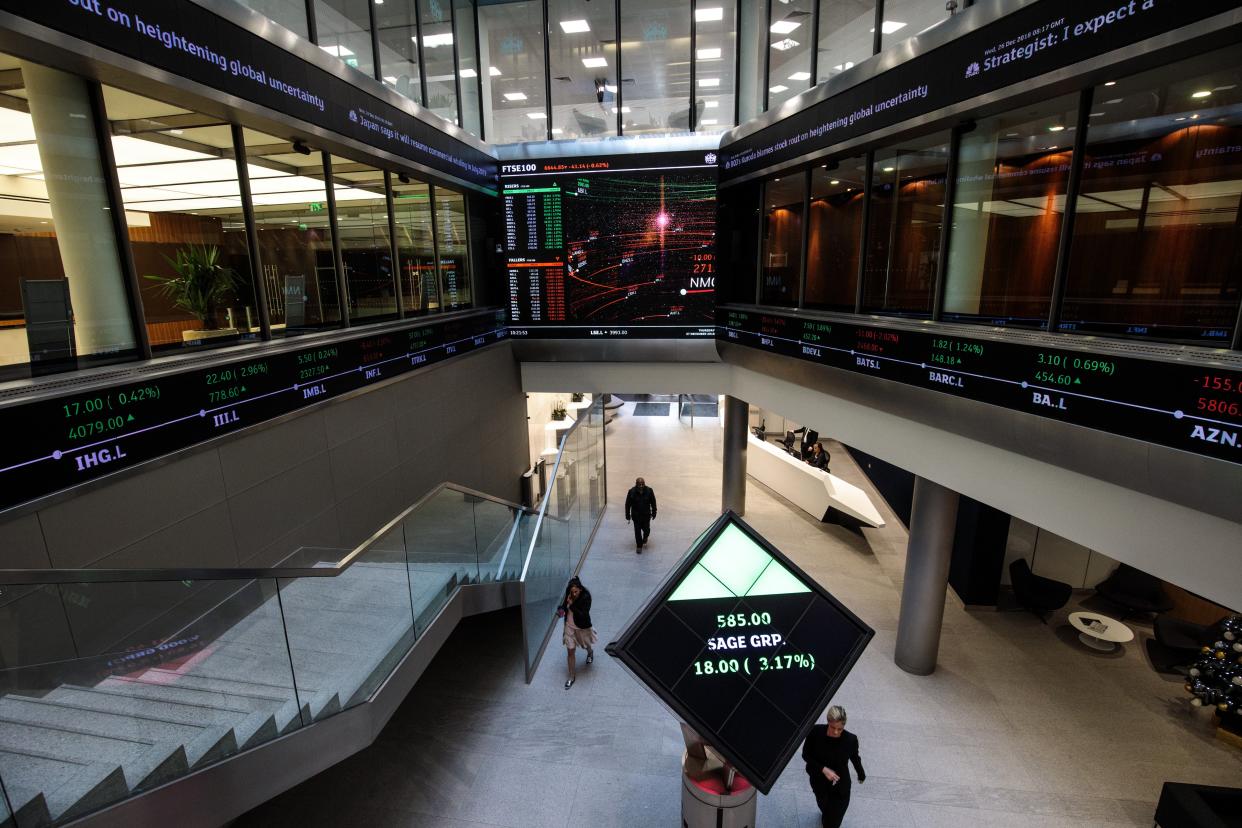

FTSE 100 rises to new pandemic highs, Asian stocks trade mixed ahead of Fed report, Sensex 100 points down

London’s FTSE 100 ended higher on Tuesday maintaining its pandemic highs, helped by gains in consumer staples and healthcare stocks. However, the delay announced in lifting Covid-related restrictions capped profits for several sectors.

The blue-chip index rose 26 points or 0.4 per cent to match where it was in February 2020. Meanwhile, the domestically focused FTSE 250 fell 0.5 per cent.

Dollar-earning consumer staples stocks, including Unilever, Reckitt Benckiser Group, British American Tobacco and Diageo Plc gained between 0.58 per cent and 1.77 per cent, on the weaker pound. While oil majors also rose tracking crude prices.

Travel and leisure stocks fell 0.8 per cent, with Flutter Entertainment Plc and Entain Plc among the top decliners. On Monday Boris Johnson’s government announced a four-week delay in lifting Covid restrictions, citing the spread of Delta variant and buying time to vaccinate more people.

Meanwhile, in the US, Wall Street indices closed lower as investors await a key Federal Reserve decision on interest rates, with data showing stronger inflation and weaker US retail sales. The S&P 500 edged 0.2 per cent lower. The Dow Jones Industrial Average fell 0.3 per cent, and the Nasdaq Composite fell 0.7 per cent.

Stocks in the Asia-Pacific region on Wednesday morning also opened mixed, dragged by uncertainty in global peers and as investors await economic data from China as well.

In Japan, the Nikkei 225 slipped 0.5 per cent by afternoon after trading in red throughout the first part of the session. Elsewhere, mainland Chinese stocks slipped in early trade, and are 0.7 per cent down. Hong Kong’s Hang Seng index fell 0.3 per cent.

South Korea’s Kospi, however, edged 0.5 per cent higher. Australian stocks advanced as the S&P/ASX 200 gained marginally. MSCI’s broadest index of Asia-Pacific shares outside Japan traded 0.9 per cent lower.

Indian indices were trading lower on Wednesday dragged by heavyweights like Reliance and mixed global cues.

Additional reporting by agencies

Read More

China offers glimpse of Tibetan life without the Dalai Lama