'Old-fashioned embezzlement': FTX CEO testifies to Congress; founder Sam Bankman-Fried arrested: recap

WASHINGTON – Congress waded into the complex, mystifying world of cryptocurrency Tuesday with a hearing on FTX, a newfangled company that found an old-fashioned way to lose billions of dollars, according to its CEO.

Federal prosecutors unsealed an eight-count indictment Tuesday against a former CEO, Sam Bankman-Fried, who was arrested in the Bahamas on charges including wire fraud and misusing customer funds. Customers lost an estimated $8 billion and the company has filed for Chapter 11 bankruptcy protection.

The hearing before the House Financial Services Committee explored the new frontier of cryptocurrency for transferring money – and wealth – through the digital realm. The unfamiliar landscape adopted a language of blockchain and crypto wallet.

But the allegations are simple enough. FTX Trading Ltd. assets were routinely comingled with another company, Alameda Research LLC, where the company and Bankman-Fried allegedly appropriated customer funds for their own use, such as buying luxury real estate.

“This is really old-fashioned embezzlement,” said John Ray III, who took over as CEO the day the company filed for bankruptcy on Nov. 11. “This is just taking money from customers and using it for your own purpose.”

Who is testifying? John J. Ray III, who took over as CEO Nov. 11, has spent his 40-year career handling insolvency cases, including managing Enron through its bankruptcy caused by accounting fraud.

FTX lost billions, Ray said: Ray said Tuesday he does not find any statements that the alleged fraud happened by mistake credible, that his team continues to search for customer wallets to recover their money, and that FTX lost at least $7 billion, but the final number remains to be seen.

What happened to FTX? FTX collapsed in early November and filed for bankruptcy when it was unable to pay back customers. The company has said it owes more than 100,000 people, but expects that number to grow to more than 1 million.

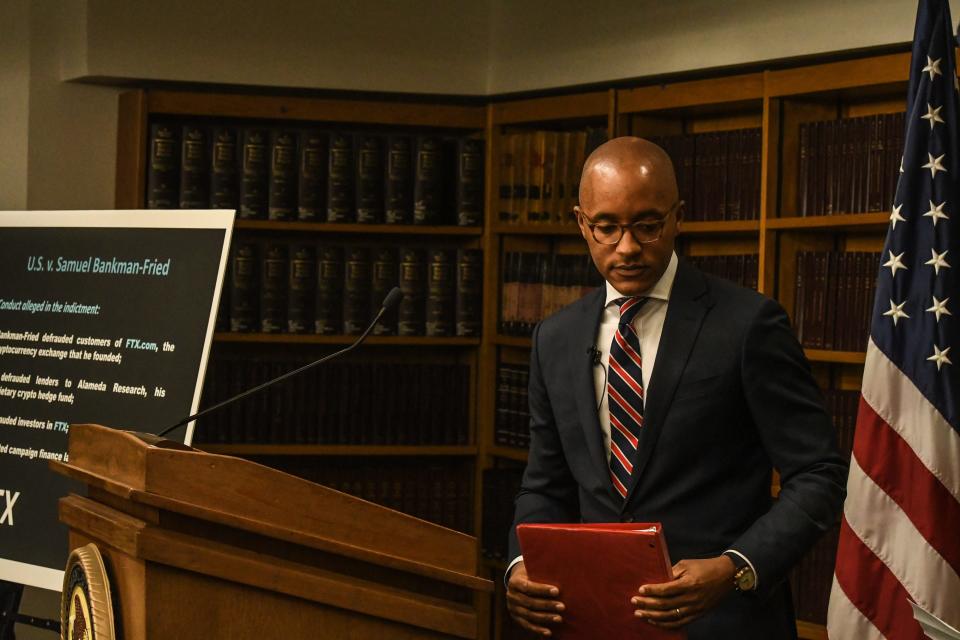

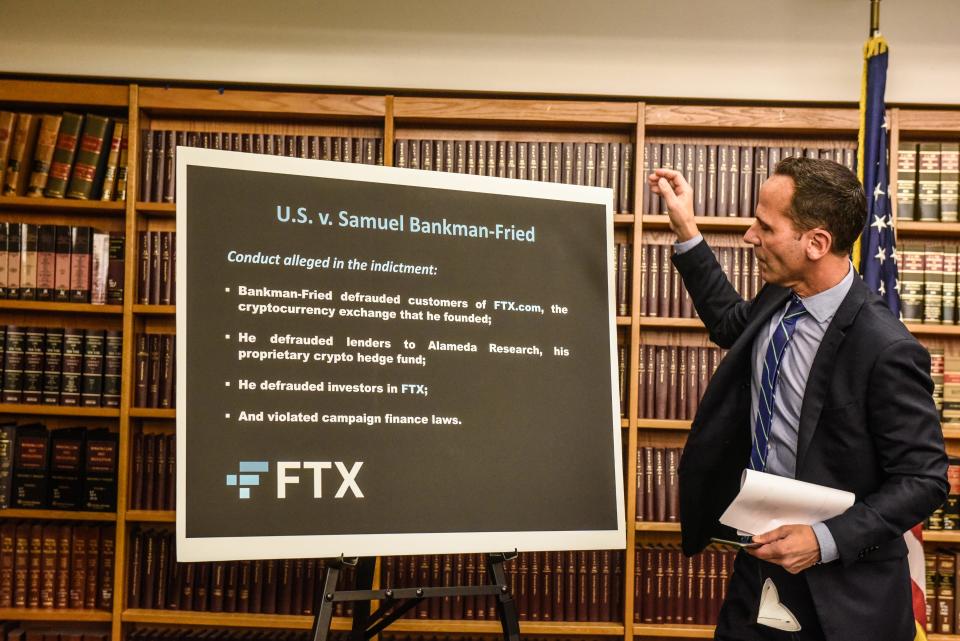

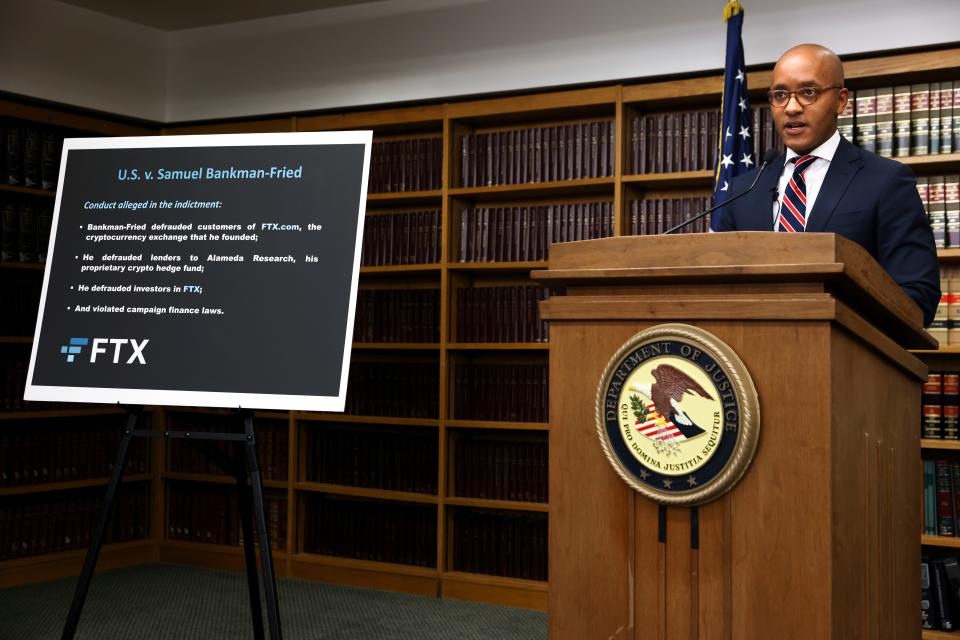

SBF indicted: Federal prosecutors on Tuesday unsealed an eight-count criminal indictment against disgraced exchange founder Sam Bankman-Fried, alleging crimes all the way up to money laundering. The Securities and Exchange Commission and the Commodity Futures Trading Commission also filed civil complaints.

Stay in the conversation on politics: Sign up for the OnPolitics newsletter

CFTC: Bankman-Fried hurt integrity of digital asset market

Gretchen Lowe, acting enforcement division director for the Commodity Futures Trading Commission, said former FTX CEO Sam Bankman-Fried’s alleged crimes hurt the entire world of cryptocurrency by undermining faith in the system.

“The rippling consequences of defendant’s fraud are vast and have done significant damage to the integrity of the evolving digital asset market,” Lowe said.

-- Bart Jansen

Bankman-Fried and campaign contributions

Manhattan U.S. Attorney Damian Williams said Bankman-Fried caused "tens of millions of dollars in illegal campaign contributions to be made to candidates and committees associated with both Democrats and Republicans."

The contributions were "disguised to look like they were coming from wealthy co-conspirators, when in fact, the contributions were funded by Alameda Research, with stolen customer money," Williams said .

The strategy behind the contributions was simple, he added. "All of this dirty money was used in service of Bankman-Fried's desire to buy bipartisan influence and impact the direction of public policy in Washington.

Williams declined to identify any of the candidates and committees.

-- Kevin McCoy

SEC: Bankman-Fried about investor safety ‘bogus’

Gurbir Grewal, SEC director of enforcement, said former FTX CEO Sam Bankman-Fried repeatedly touted to investors his company’s automated risk controls that he claimed protected customer assets, which he said were “safe, segregated and secure.”

“Bankman-Fried’s claims about sophisticated risk controls and other customer protections were simply bogus,” Grewal said.

Grewal accused Bankman-Fried of secretly and improperly diverting FTX customer funds to the hedge fund Alameda Research. The money was used to make venture investments, lavish real-estate investments and large political donations, Grewal said.

“Bankman-Fried’s entire house of cards started to crumble as crypto asset prices plummeted in May 2022 and as Alameda’s lenders demanded repayment on billions of dollars in loans,” Grewal said.

--Bart Jansen

Fraud of historic proportions

Manhattan U.S. Attorney Damian Williams, along with representatives of the FBI, the Securities and Exchange Commission and the Commodity Futures Trading Commission, said the agencies are continuing to investigate other potential suspects who might have worked with Bankman-Fried.

“If you have not reached out to us, I would encourage you to do so,” said Williams.

When asked if investigators are targeting specific suspects, he said: “All I can say is we’re not done.”

Williams also said investigators are pursuing efforts to extradite Bankman-Fried from the Bahamas.

-- Kevin McCoy

FBI: Bankman-Fried preyed on customers

Michael Driscoll, FBI Assistant Director in charge of the New York office, said former FTX CEO Sam Bankman-Fried is charged with diverting customer funds to pay corporate and personal expenses and investments through another company.

“He preyed on his customers, the victims of this case, abusing the trust placed not only in his company, but in himself as the lead of that company,” Driscoll said. “This case is about fraud. Fraud is fraud. It does not matter the complexity.”

-- Bart Jansen

Prosecutor: One of biggest frauds in history

Damian Williams, the U.S. attorney for the Southern District of New York, said the investigation is continuing after the arrest of former FTX CEO Sam Bankman-Fried.

Bankman-Fried was indicted on eight charges, including defrauding customers of FTX cryptocurrency exchange, lenders at Alameda Research hedge fund and investors in FTX, and violating campaign finance laws. Authorities are pursuing other suspects.

“This investigation is very much ongoing and it is moving very quickly,” Williams said.

Losses from the alleged fraud total $8 billion, according to authorities.

“It’s so hard to compare these things, but I think it is fair to say that by anyone’s lights, this is one of the biggest financial frauds in American history,” Williams said.

– Bart Jansen

Previously: FTX founder Sam Bankman-Fried arrested in Bahamas, indicted in New York, prosecutors say

Second part of hearing to be held next year

Ranking member Rep. Patrick McHenry, R-N.C., said in his closing statement that part two of the hearing will be held in 2023.

“We know there will be ongoing conversations in the new year,” he said.

– Rachel Looker

Report: Former billionaire Sam Bankman-Fried says he's down to $100,000 in bank account

Will FTX users get their money back?

The committee asked the Ray if he believes Bankman-Fried was correct in saying FTX users will receive a dollar-on-dollar return of funds at the end of bankruptcy proceedings.

“That’s speculative at this point,” Ray responded.

Ray said his job is to find the assets and get customers their money back as quickly as possible.

“It’s a mining exercise at this point,” he said. “At the end of the day, we're not going to be able to recover all the losses here. Money was spent that we'll never get back.”

– Rachel Looker

What is the FTX scandal?: How the celebrity-endorsed crypto giant collapsed into chaos

What does it mean to ‘commingle funds?’

Commingling refers to mixing funds between two separate parties, according to Cornell University’s Legal Information Institute.

During his testimony, Ray said customer assets from FTX.com were commingled with assets from the Alameda trading platform.

According to the SEC documents, Alameda did not segregate customer funds, but instead mixed them with other assets and used them to fund trading operations and Bankman-Fried's other ventures.

– Rachel Looker

What is a crypto wallet?

The phrase “crypto wallet” has been thrown around like the spending of a drunken sailor after the collapse of FTX, but it’s not a leather billfold.

Because crypto currencies exist in the digital realm, a “wallet” for that currency is a metaphor for how to retrieve your own currency, such as Bitcoin or Ethereum.

The “wallet” basically holds the digital keys to the assets, typically through a phone app or a desktop computer. The keys are long strings of numbers and letters that are unique to the asset and match the asset.

Another distinction is that there are “hot” and “cold” wallets. Hot wallets are connected to the internet and cold wallets aren’t, which protects them from hackers.

– Bart Jansen

Crypto 101: Here are 10 cryptocurrency terms people use every day from blockchain to NFT

CFTC: How the alleged scam worked

The Commodity Futures Trading Commission said Tuesday that FTX characterized itself as “the safest and easiest way to buy and sell crypto.” The financial monitor, which filed a civil lawsuit Tuesday against FTX Trading Ltd, Alameda Research LLC and Samuel Bankman-Fried, the alleged mastermind behind the companies, said the claims belied the real operations.

“To the contrary, FTX customer assets were routinely accepted and held by Alameda and commingled with Alameda’s funds. Alameda, Bankman-Fried, and others also appropriated customer funds for their own operations and activities, including luxury real estate purchases, political contributions, and high-risk, illiquid digital asset industry investments, said the CFTC.

The CFTC also said its lawsuit also alleges that, acting on Bankman-Fried’s instructions, FTX employees created features in the company’s electronic code that “favored Alameda and allowed it to execute transactions even when it did not have sufficient funds available, including an … effectively limitless line of credit that allowed Alameda to withdraw billions of dollars in customer assets from FTX.”

– Kevin McCoy

CEO: FTX is 'virtually void of any internal controls'

When asked what documents Ray has identified with respect to internal controls and governance, Ray responded: There are none.

“The company is virtually void of any internal controls or documentation,” he said.

Ray said he has not seen any resolutions or authorizations approving massive loans taken by the company.

“When Sam Bankman-Freed signs on behalf of the company, and then he signs his own loan, that should tell you a lot right there,” Ray said.

– Rachel Looker

FTX CEO: Cyber experts, law enforcement tracking theft of assets

FTX CEO John Ray told lawmakers the company is relying on financial experts to track where assets have gone rather than relying on the former CEO, Sam Bankman-Fried.

Rep. Sean Casten, D-Ill., asked about a Nov. 12 hack of the company that resulted in the theft of $477 million in tokens. Bankman-Fried gave an interview Nov. 29 saying he had narrowed the suspects to eight.

“We’re relying on forensic and cyber security experts who are tracking the crypto,” Ray said. “You can ultimately find where the crypto ends up. We’ve got law enforcement involved. So we’re tracking it. We’ve got all the help we need on that front.”

– Bart Jansen

What is the FTX scandal?: How the celebrity-endorsed crypto giant collapsed into chaos

CFTC court complaint alleges more than $8B in FTX customer losses

Customers of FTX lost more than $8 billion in deposits from the alleged scam engineered by Samuel Bankman-Fried and others, the Commodity Futures Trading Commission alleged in the civil lawsuit the financial monitor filed on Tuesday.

The complaint named Bankman-Fried, FTX Trading Ltd. and Alameda Research LLC, two of his companies. It accuses all three defendants of fraud and material misrepresentations involving the sale of digital commodities in interstate commerce. CFTC chairman issued a statement warning that “digital commodity asset markets continue to present risks for investors dur to the lack of basic protections.”

As the defendants touted FTX.com as a “model digital commodity asset platform,” they “were committing fraud to the detriment of U.S. investors and to the credibility of the digital asset markets,” said Gretchen Lowe, acting director of CFTC Enforcement.

– Kevin McCoy

Statement from Mark S. Cohen – Counsel to Sam Bankman-Fried

“Mr. Bankman-Fried is reviewing the charges with his legal team and considering all of his legal options.”

– Erin Mansfield

FTX CEO: FTX was ‘uniquely positioned to fail’

Ray said FTX’s wallets, where crypto assets are stored, were vulnerable to hacking. He said the way the company stored passwords, allowed multiple users to set up accounts, store keys in non-centralized locations and a lack of discipline for storage of wallets made it challenging to have a complete company inventory.

“This company was uniquely positioned to fail,” Ray said.

– Rachel Looker

CEO: FTX recovered $1B after bankruptcy

FTX CEO John Ray told lawmakers the company had recovered $1 billion after losing an estimated $7 billion.

“We’ve recovered over $1 billion in crypto assets,” Ray said of “coins of various nature” and securing bank accounts that had been frozen with new authorized users. “Our main goal is to secure the cash and secure the crypto assets.”

Rep. Roger Williams, R-Texas, asked what role Sam Bankman-Fried is playing at the company today.

“The role he’s currently playing: zero,” Ray said.

– Bart Jansen

FTX CEO points to “unlimited ability” to take customer funds

Rep. Michael San Nicholas, D-Guam, asked Ray to pinpoint a “singular cause” or “single trigger point” that led to the collapse of FTX.

“It’s just the unlimited ability of those in control positions to borrow customer funds or take customer funds and then deploy them for their own use,” John J. Ray said.

“That use involved margin trading, which is inherently risky, and of course they spent enormous amounts of money beyond that. It’s really the misuse of funds, and it’s as simple as that.”

Ray said the company has lost “in excess of $7 billion.”

– Erin Mansfield

Ray: FTX example of ‘old-fashioned embezzlement’

Ray dubbed the acts of FTX as “plain old” embezzlement. He said it is only sophisticated in the way that FTX was able to hide it from people in front of their eyes.

“This is really old-fashioned embezzlement,” Ray said. “This is just taking money from customers and using it for your own purpose.”

– Rachel Looker

Report: Former billionaire Sam Bankman-Fried says he's down to $100,000 in bank account

Think like a federal prosecutor?

Some members of the House committee asked John J. Ray III, the new chief executive of FTX, whether money laundering might have occurred before the company’s abrupt collapse.

“There’s a lot more questions than answers, and it certainly is highly irregular and that’s certainly what’s gotten out attention,” said Ray.

The criminal indictment unsealed Tuesday against disgraced FTX executive Samuel Bankman-Fried specifically charges him with conspiracy to commit money laundering.

– Kevin McCoy

Ray: ‘I don’t trust a single piece of paper in this organization’

When Rep. Andy Barr, R-Ky., asked Ray to elaborate on why he does not believe audited FTX financial statements are reliable, Ray emphasized the $8 billion in customer money lost.

“By definition, I don’t trust a single piece of paper in this organization,” he said.

– Rachel Looker

Ray: 'very few' rules at FTX

When asked about FTX loaning out customer assets, Ray highlighted the lack of corporate controls and lack an independent board.

“The owners of the business, the senior management, had virtual control of the accounts via the silos and could move money or assets around as they desired undetected by customers,” Ray said.

“To the extent there were rules, and there were very few, obviously they were made to be broken,” he said.

– Rachel Looker

FTX CEO: 'Every day we are out looking for wallets'

John J. Ray told Rep. Joyce Beatty, D-Ohio, that his team continues to look for customer money in wallets and get access to those wallets.

“We are securing our assets every day,” Ray said. “Every day we are out looking for wallets and keys to those wallets to maximize the recovery of value, so that’s an ongoing process. We’ve secured all the cash in the bank accounts to the extent that we can at this point.”

He said finding out how many users have lost money and when they’ll get that money back, is “a question of months.”

– Erin Mansfield

Ray: Investigation may look into Bankman-Fried's parents

Rep. Bill Huizenga, R-Mich., asked Ray if there was any evidence of Bankman-Fried's parents’ involvement with the FTX collapse. Huizenga referenced a meeting he had in his office with Bankman-Fried in 2020 and in which his father attended.

“We're investigating that as well as any other players,” Ray said.

– Rachel Looker

Congressman: Change the name of crypto to 'creepy dough'

Rep. Emanuel Cleaver, D-Missouri, joked with John J. Ray that Congress should change the term “cryptocurrency” to “creepy dough currency.”

“I just want to know whether you’d support changing it to ‘creepy dough,’” Cleaver asked.

Ray said he would leave that skill set to Congress.

– Erin Mansfield

The future of crypto: After fall of bitcoin prices, is cryptocurrency a good investment?

Ray: ‘More questions than answers’

The committee asked Ray if it could be possible that money laundering was occurring within FTX.

“There’s a lot more questions than answers and it certainly is highly irregular and that’s certainly what’s gotten out attention,” Ray said.

– Rachel Looker

CFTC files court complaint

A separate civil lawsuit filed Tuesday by the Commodity Futures Trading Commission said daily trading volume on FTC.com was more than $20 billion, and the company had amassed a $32 billion valuation. The company had paid sponsorships, including naming rights to a Miami sports arena, celebrity endorsements and a 2022 Super Bowl commercial that characterized FTX as “the safest and easiest way to buy and sell crypto.”

Belying that image, FTX collapsed in November, and its customers and the world “discovered that FTX, through its sister-company Alameda, had been surreptitiously siphoning off customer funds for its own use—and over $8 billion in customer deposits were now missing,” the CFTC court complaint alleges.

"At Bankman-Fried’s direction, FTX executives created features in the underlying code for FTX that allowed Alameda to maintain an essentially unlimited line of credit on FTX,” the court complaint alleges. “FTX Trading executives also created other exceptions to FTX’s standard processes that allowed Alameda to have an unfair advantage when transacting on the platform, including quicker execution times.”

– Kevin McCoy

Accountants looking at whether IRS forms properly filed

Accountants from the firm Ernst & Young are looking into whether FTX properly filled out forms such as tax returns filed with the Internal Revenue Service, CEO John J. Ray told Rep. Pete Sessions, R-Texas.

“They are taking a comprehensive review,” Ray said. “They’re going backwards and starting with the earlier years. We’re reviewing the return that was filed in 2020, 2021, and of course they’re looking at all of the transactions within 2022, so that review is ongoing.”

– Erin Mansfield

Previously: Report: Former billionaire Sam Bankman-Fried says he's down to $100,000 in bank account

Rep: Cleaver: Bankman-Fried's testimony ‘disrespectful’

Rep. Emanuel Cleaver, D-Mo., referenced Bankman-Fried's testimony, calling it “so disrespectful” and a “mess.”

“There's not a person up here who would like to show this to their children,” he said.

Cleaver began to read one specific line from Bankman-Fried's testimony, but said he can’t read it publicly.

“It makes two words. Absolutely insulting,” Cleaver said.

– Rachel Looker

Congressman: 'We have to send a message' to bad actors

Rep. Al Green, D-Texas, questioned whether Sam Bankman-Fried could have harmed so many people by accident, saying that he thinks there must have been “malfeasance” at play that should not happen again.

“They just don’t emanate from ignorance and stupidity,” Green said of FTX’s actions, “and a lot of people have been hurt.

“And aside from the civil actions, I think that we have to send a message to the others who would take advantage of people that this is not going to be tolerated,” he said.

– Erin Mansfield

Ray: FTX unprecedented in lack of documentation

When asked how his experience handling other bankruptcies compares to the FTX situation, Ray said FTX is unprecedented in terms of lack of documentation.

Ray said even the most failed companies had a roadmap as to what happened.

“We're dealing with literally a paperless bankruptcy in terms of how they created this company,” he said. “It makes it very difficult to trace and track assets and particularly, as I've said, in the crypto world.”

– Rachel Looker

Ray: Bankman-Fried calling fund transfers 'mistake’ not credible

Ray said he doesn’t find statements made by Bankman-Fried that FTX customer funds transferred to Alameda was done by mistake.

“I don't find any such statements to be credible,” Ray said.

– Rachel Looker

What is the FTX scandal?: How the celebrity-endorsed crypto giant collapsed into chaos

More indictment details

One part of the alleged conspiracy allegedly involved an effort in which Bankman-Fried and others made illegal campaign contributions to candidates for federal office, joint fundraising committees and independent expenditure committees while using the names of other persons as the contributors, the indictment charges.

The indictment also accuses Bankman-Fried and other conspirators of making illegal contributions from corporations while disguising the actual source under the names of other people. The indictment seeks forfeiture of all gains from the alleged conspiracy.

– Kevin McCoy

Ray says FTX employees communicated over Slack, used Quickbooks

Ray said the FTX group is unusual compared to other bankruptcies he handled because FTX had no record keeping.

He said employees communicated invoices and expenses via Slack and the multi-billion dollar company used Quickbooks, an accounting software package.

“We had one person really controlling this," he said, referencing Bankman-Fried. "No independent board-- that's highly unusual for the size company this is and it's made all more complex because we're not dealing with widgets or something that's tangible, we're dealing with crypto.”

– Rachel Looker

In case you missed it: FTX founder Sam Bankman-Fried arrested in Bahamas, indicted in New York, prosecutors say

Rep. Patrick McHenry criticizes SEC chief

Rep. Patrick McHenry, R-N.C., called for regulations that spell out “clear rules of the road” for the cryptocurrency industry, and criticized the performance of Gary Gensler, the chairman of the Securities and Exchange Commission.

“We know the Securities and Exchange Commission chair Gensler’s regulation by enforcement approach is not going to stop bad actors,” McHenry said. “Next year, I look forward to hearing from Mr. Gensler early and often. And we’ll hear from him and how we can provide clarity on the application of our security platforms to trading platforms, which he has failed to do.”

McHenry is the ranking member of the House Financial Services Committee and is expected to become chair at the beginning of 2023.

– Erin Mansfield

Ray: Bankman-Fried's loans undocumented

Ray said Bankman-Fried received numerous loans – some documented by individual promissory notes, others with no description of the purpose. In one case, Bankman-Fried received a $1 billion loan which he claimed he did not know the terms of the repayment, Chair of the House Financial Services Committee Rep. Maxine Waters, D-Calif., said.

Ray said in one instance, Bankman-Fried signed a loan as both the issuer and recipient.

– Rachel Looker

FTX CEO: Senior managers had access to customer assets

John J. Ray III, the CEO of FTX seeking to recover customer funds as he guides the company through bankruptcy, detailed at the House hearing Tuesday the lack of security that the firm had for controlling customer money.

Ray said the company’s computer infrastructure gave senior managers access to “systems that stored customer assets, without security controls to prevent them from redirecting those assets.”

He also said the company stored “certain private keys to access hundreds of millions of dollars in crypto assets without effective security controls or encryption.”

– Erin Mansfield

Sam Bankman-Fried indicted on 8 criminal counts, including conspiracy to commit wire fraud and violating campaign finance laws

Federal prosecutors in the Southern District of New York on Tuesday unsealed an eight-count criminal indictment that accuses Bankman-Fried of conspiracy to commit wire fraud on customers and lenders, as well as conspiracy to commit commodities fraud and securities fraud.

The indictment also charges him with a money laundering conspiracy and a conspiracy to defraud the U.S. government and violate campaign finance laws with contributions that exceeded giving limits.

– Kevin McCoy

SBF schemed with others, indictment says

The criminal indictment alleges Sam Bankman-Fried schemed with others from at least 2019 through November 2022.

He and several people not identified in the indictment allegedly agreed to defraud customers of FTX.com by misappropriating their deposits and using those funds to pay expenses and debts of Alameda Research, Bankman-Fried's proprietary crypto hedge fund.

The indictment also accuses Bankman-Fried of providing misleading information to lenders about the true financial condition of Alameda Research.

– Kevin McCoy

SEC alleges Bankman-Fried ran 'massive years-long fraud'

Instead of running a secure crypto trading platform, Samuel Bankman-Fried "engaged in a scheme to defraud equity investors" from at least May 2019 until November 2022, the Securities and Exchange Commission alleges in a civil complaint filed Tuesday in the federal court for the Southern District of New York.

He raised more than $1.8 billion from investors who believed his FTX Trading Ltd. platform had appropriate controls and risk management measures, the SEC said.

"Unbeknownst to those investors (and to FTX’s trading customers), Bankman-Fried was orchestrating a massive, years-long fraud, diverting billions of dollars of the trading platform’s customer funds for his own personal benefit and to help grow his crypto empire," the complaint alleges.

– Kevin McCoy

SBF spent investors' money on 'lavish real estate', political donations, SEC says

Investors in the U.S. and worldwide sent billions of dollars to Bankman-Fried's FTX platform with the belief that their assets would be secure.

"But from the start, Bankman-Fried improperly diverted customer assets to his privately-held crypto hedge fund, Alameda Research LLC, and then used those customer funds to make undisclosed venture investments, lavish real estate purchases, and large political donations," the SEC complaint alleges.

– Kevin McCoy

Sam Bankman-Fried's 'house of cards'

Federal prosecutors in Manhattan are expected to file a parallel criminal action against Bankman-Fried later on Tuesday.

"We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto," SEC Chair Gary Gensler said in a statement issued with the agency's complaint. "The alleged fraud committed by Mr. Bankman-Fried is a clarion call to crypto platforms that they need to come into compliance with our laws."

– Kevin McCoy

SEC: Alleged scheme unraveled when crypto values crashed and lenders wanted money back

The SEC court complaint said the alleged scheme began crumbling in May 2022, when cryptocurrency values plummeted.

The plunge prompted lenders to Bankman-Fried's privately-held crypto hedge fund, Alameda Research LLC, sought repayment on billions of dollars of loans. Alameda had already received billions of dollars in FTX investor assets by that point, but nonetheless was unable to meet the repayment demands, the court complaint said.

Trying to stave off a collapse, "Bankman-Fried directed FTX to divert billions more in customer assets to Alameda to ensure that Alameda maintained its lending relationships, and that money could continue to flow in from lenders and other investors," the SEC court complaint alleged.

SBF made 'misleading' statements to investors, SEC says

Bankman-Fried continued the shifting of investor assets during the summer of 2022 even as it became increasingly clear that FTX and Alameda would not be able to fully repay investors and lenders, the SEC complaint said.

"He directed hundreds of millions more in FTX customer funds to Alameda, which he then used for additional venture investments and for 'loans' to himself and other FTX executives," the court complaint alleged. "All the while, he continued to make misleading statements to investors about FTX’s financial condition and risk management."

– Kevin McCoy

SBF built web of more than 100 companies, SEC says

Sam Bankman-Fried, assisted by a few associates, built an interconnected web of companies that ultimately comprised more than 100 different entities, the SEC court complaint said.

The web had Bankman-Fried at its top, and Alameda Research, his cryptocurrency hedge fund, at its center. In multiple public statements, he branded himself and his companies as "honest stewards of crypto," the court complaint said. But the reality was different.

"From the start, contrary to what FTX investors and trading customers were told, Bankman-Fried continually diverted FTX customer funds to Alameda and then used those funds to continue to grow his empire, using billions of dollars to make undisclosed private venture investments, political contributions, and real estate purchases," the SEC court complaint alleges.

– Kevin McCoy

Who is Sam Bankman-Fried, former FTX CEO?

Bankman-Fried, the 30-year-old former billionaire turned political donor who started FTX, is listed on the committee's website as a witness. He was scheduled to testify before Congress for the first time since the collapse of FTX, but canceled after being arrested in the Bahamas Monday night.

FTX attracted average people, promised safety, expert says

FTX attracted average people who wanted to invest in cryptocurrency but didn’t want to deal with the complex processes that often comes with buying cryptocurrency, said Yesha Yadav, a law professor at Vanderbilt University in Tennessee.

A decade ago, Yadav said, cryptocurrency traders would need to download specific software and then find someone willing to sell their cryptocurrency. On an exchange like FTX, a user would place an order and essentially be given an IOU for the crypto they bought, she said.

“From the user experience, that’s awesome,” she said. On top of that, she said, “The reason it was so well regarded was because it promised safety. It promised consumer protection it promised cutting-edge products without some of the kind of riskier aspects of crypto attaching to it.”

– Erin Mansfield

Who is new FTX CEO John J. Ray?

John J. Ray, who replaced Bankman-Fried, is scheduled to testify. Ray previously oversaw Enron during its bankruptcy and is performing a similar service for FTX, including responding to inquiries from the Department of Justice and Securities Exchange Commission.

He told a federal bankruptcy court in November the company "did not keep appropriate books and records," and used software "to conceal the misuse of customer funds."

He wrote in the same filing, "Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here."

Stay in the conversation on politics: Sign up for the OnPolitics newsletter

More: Sam Bankman-Fried, former CEO of FTX crypto exchange, says he will testify before Congress

What is FTX?

FTX was a tool that investors all over the world used to buy cryptocurrency and other financial instruments. They could also store their cryptocurrencies in digital wallets, similar to using a bank. The company promised customers not to use their money for trading, but did.

The House Committee on Financial Services has looked at major fraud cases

The House Committee on Financial Services oversees a broad range of topics, including banking, insurance, securities, and housing. The leaders of the panel are outgoing chair Rep. Maxine Waters, D-Calif., and the expected incoming chair Rep. Patrick McHenry, R-N.C.

The committee held hearings on the impact of the accounting fraud scandal at Enron on financial markets, and how financial regulation could be improved in light of Bernie Madoff's Ponzi scheme.

Sam Bankman-Fried has been on a media tour about FTX

Since stepping down from his post in November, Bankman-Fried has appeared in interviews with news organizations like the New York Times and Wall Street Journal, expressing regret over mismanagement of the company but denying any intentional wrongdoing.

"I had a duty to all of our stakeholders, to our customers, our stakeholders and to the regulators and the world to do right by them, to make sure the right things happened at the company. Clearly I didn't do a good job at that. Clearly I made a lot of mistakes that are things I would give anything to be able to do over again.

"I didn't ever try to commit fraud on anyone," Bankman-Fried, who goes by SBF, told the New York Times. "I was excited about the prospects of FTX a month ago. I saw it as a thriving, growing business. I was shocked by what happened this month, and reconstructing it, there were some things I wish I had done differently."

Bankman-Fried: ‘I basically have nothing left’

Bankman-Fried told Good Morning America’s George Stephanopoulos that he is down to $100,00 in his bank account – a significant difference from the estimated $20 billion he said he had over the summer.

“To my knowledge, I basically have nothing left,” he said. “Basically everything I had was invested in the business.”

The former FTX CEO said he took out a $1 billion loan to reinvest into the company, not for consumption. He described the loss as “a really humbling fall in a lot of ways.”

– Erin Mansfield

This article originally appeared on USA TODAY: FTX-Congress recap: Sam Bankman-Fried indicted as CEO testifies