Future tax hikes? 'If we don't fix growth paying for itself, we will be in same situation'

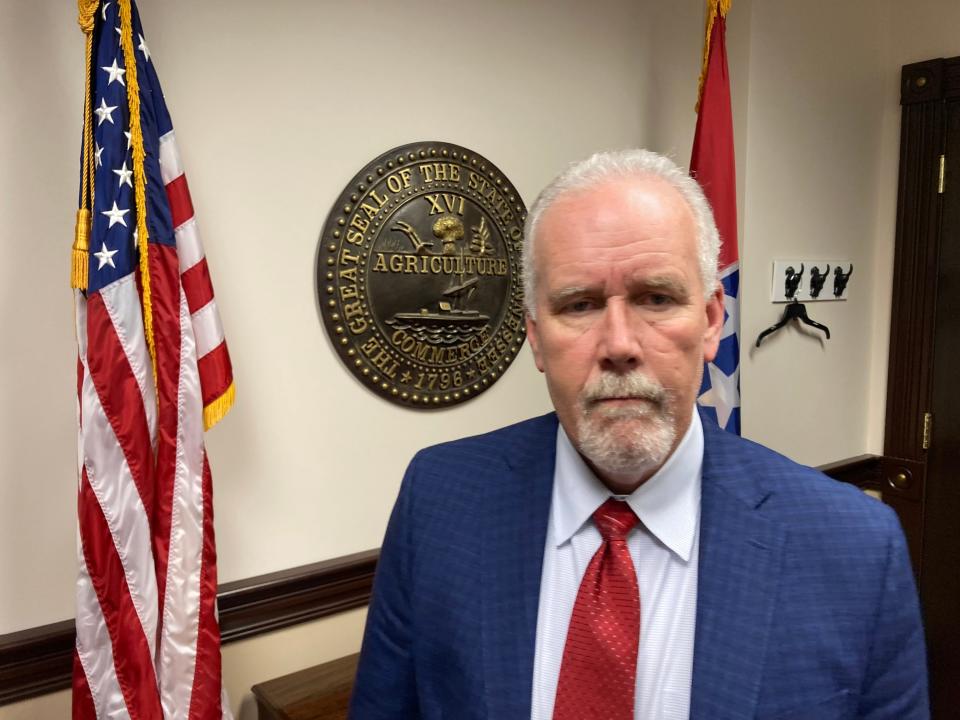

Rutherford County's 16.1% property tax hike will not prevent future deficits to fund growth needs, Mayor Joe Carr suggested.

"We will be here again in four years if this county doesn't understand that growth doesn't pay for itself," said Carr, a first-year Republican mayor who began his four-year term September 2022 with a previously approved $64 million budget deficit. "If we don't fix growth paying for itself, we will be in same situation."

Although faced with opposition from home builders and realtors, the mayor wants state lawmakers to allow the Rutherford County Commission to adopt impact fees on homes and other developments like the Murfreesboro City Council recently did to generate revenues for schools, roads, parks and public safety.

"Property taxes won't pay for the expansion of those services," said Carr, adding that Rutherford County Schools typically need a new campus each year after adding 1,000 to 1,500 students annually.

Carr's recommended 16.1% tax hike approved by the majority of the county commission is the seventh increase this century, records show. The recent property tax hike topped the previous high 11.6% increase adopted more than two decades ago in the 2002-03 fiscal year when Democrat Nancy Allen began her third and final four-year term as mayor.

Carr won his seat August 2022 against three independents: runner-up Randy Allen, Royce Olen Johnson and Norman Hanks. Carr also captured the Republican primary May 2022 against runner-up Rhonda Allen, a former county commissioner, and Bill Ketron, the previous county mayor.

'You got to pay the bills': County commission adopts 16% property tax hike

Mayor Joe Carr seeks new state law on growth taxes

The county commission the past decade has followed a pattern of raising property taxes every four years after incumbents got past an election years in 2014, 2018 and 2022.

The tax hikes have helped the county pay for raises to recruit and retain public employees. The increased taxes also help fund projects to keep pace with growth, especially for education, such as $156.3 million this year to expand and renovate overcrowded Riverdale, Smyrna and Oakland high schools.

The increased property taxes also have helped the commission rebuild rainy day reserves needed to borrow money at lower interest rates to fund projects. The reserves cover emergency costs, as well, for overtime pay for county workers and other expenses, such as the response to the April 1 tornado in Readyville community on the far eastside of county.

In addition to tax hikes, the commission has had a pattern of approving annual budgets with deficits that rely on those rainy-day reserves to fund what's not covered by estimated revenues.

New elected officials: 21-member Rutherford County Commission will see new faces with 9 elected officials

The county's current estimated budget deficit following the 16.1% tax hike dropped to $7.5 million, which is the lowest since being at $2.5 million in 2009-10 fiscal year. The $2.5 million deficit came after back-to-back tax hikes of 4.9% in 2007-08 and 6.8% in 2008-09 to help fund government and school operations during the Great Recession while former Mayor Ernest Burgess was serving in his first of three four-year terms.

County officials such as Carr have sought to increase revenues from growth to ease the burden on property taxpayers.

"If we don't get that relief from the Tennessee General Assembly, we'll be back here in four years," Carr said. "That's the reason for the deficits."

Carr previously served for six years as a Republican state representative for District 48 areas that include his home farm in Rutherford County's Lascassas community that's northeast of Murfreesboro.

Paying for growth: Rutherford County wants state law to stop 'burden of paying for new development'

County must wait until 2025-26 to increase taxes on new housing unless law changes

State Rep. Robert Stevens, R-Smyrna, said Rutherford's seven lawmakers serving in the Tennessee legislature understand the concerns presented regarding growth and want to work with county leaders to benefit Rutherford County citizens.

"Discussions with stakeholders are already taking place and will continue into the fall," said Stevens, a former 12-year member of the county commission. "Hopefully everyone can work together to develop a unified strategy and go into next year's legislative session with consensus already established. Several ideas are being circulated that have considerable potential. The key for any legislation to pass in this area will be to have agreement on the front end and eliminate the element of surprise."

Stevens suggested that lawmakers will need more time than this past legislative session to examine changes to the County Powers Relief Act adopted in 2006. The law permits counties to establish a county school facilities tax that charges $1 per square foot on residential construction to help pay for campus projects. This tax can increase 10% every four years.

The Rutherford County Commission decided to adopt the school facilities tax in 2021-22, so the soonest this can increase would be 2025-26 unless the law changes.

The commissioners in late March were unsuccessful in asking state lawmakers to allow the majority of county voters in a 2023 referendum to decide whether to charge an additional $5,000 per new home or apartment.

The proposed $5,000 fee per residential dwelling combined with the $1 per square foot collected now on new housing averaging 2,400 square feet would bring in $7,400 per home, which would more than triple the $2,400 at this time, Mayor Carr said.

The county's existing school facilities tax collects less than Murfreesboro's new impact fees charging $1.50 per square foot on new homes this year. The city's square foot impact fees on houses will go up to $2 by July 2024 and $2.50 by July 2025.

The county proposal also would have given the 21-member county commission authority to increase or decrease the $5,000 tax per new house or apartment through a two-thirds majority vote.

Tax issues: 7 TN lawmakers annoy Mayor Carr with letter saying his proposed property tax hike unneeded

Home builders oppose recent proposed tax on new housing

Home builders such as Chris Jensen say they're worried about housing costs going up with impact fees or the county's unsuccessful March proposal to charge $5,000 more per residential lot if a referendum passed.

"Even if we double it, it does not solve the county’s problem," Jensen said. "The consumer ends up paying it, and it just makes housing more expensive."

Jensen is the owner of Jensen Quality Homes that was founded by his late father, Steve Jensen. Although the custom-home-building business has an office in downtown Murfreesboro, Jensen said he commutes from Manchester because he could afford the home he wanted in that Coffee County community that's adjacent to Rutherford County and farther south from Nashville.

"There are a lot of people in Rutherford County that need to buy homes, and they can’t afford them," said Jensen, who's also president of the Home Builders Association of Central Tennessee. "Most people moving into the area aren't buying the starter homes. We don’t have affordable homes anymore."

There’s a shortage on houses, Jensen said.

The home builders association contends the county's budget issues need a multifaceted approach. Jensen said.

"We’re actively trying to work toward ideas and solutions," Jensen said. "The association is not against responsible growth and changes that are needed."

Impact fee options divides council: 'We're going to be a city of have and have nots'

Real estate association also opposes county's proposed tax on housing

The Middle Tennessee Association of Realtors President Scott Abernathy said his organization also opposed the Rutherford County Commission proposal for an additional $5,000 tax on each new home because this approach was blaming only new housing on the county's budget issues.

Many of the people buying new homes live in Rutherford County, Abernathy said.

The insistence on growth paying for schools is unreasonable, said Abernathy, adding that there's other ways for the county to expand the tax base.

"We also have to think about affordable housing," Abernathy said.

Houses prices continue to rise: Rutherford County homebuyers face challenge in quest for affordable housing

Reach reporter Scott Broden with news tips or questions by emailing him at sbroden@dnj.com. Follow him on Twitter @ScottBroden. To support his work with The Daily News Journal, sign up for a digital subscription.

Rutherford County property tax hikes this century

2002-03: 11.6%

2007-08: 4.9%

2008-09: 6.8%

2013-14: 4.1%

2015-16: 7.8%

2019-20: 5.7%

2023-24: 16.1%

Source: Rutherford County government

This article originally appeared on Murfreesboro Daily News Journal: Mayor Joe Carr expects future tax hikes unless growth pays for itself